Bitcoin and Ethereum: Two forks one story

On August 1st, Bitcoin (BTC) forked. A new cryptocurrency called Bitcoin Cash (BCH) appeared online when a bunch of Bitcoin miners created their own Blockchain network with updated rules. Interestingly, early in 2016 also Ethereum, currently the second crypto for market capitalisation, forked into Ether (ETH) and Ethereum Classic (ETC), but at the time the split was due to a hack.

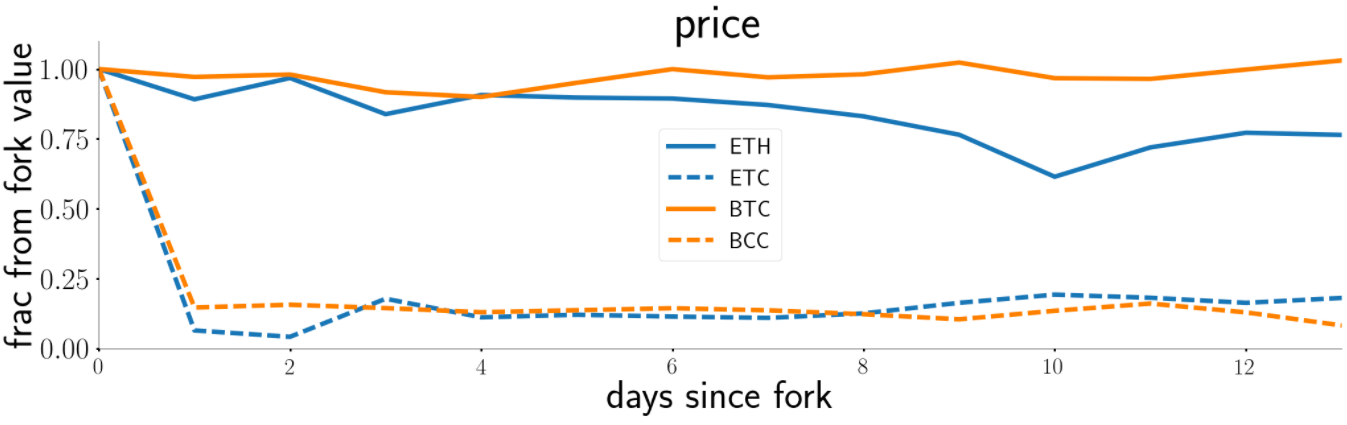

Thus, the two cryptocurrencies forked for entirely different reasons. And what happened next? Abeer ElBahrawy, who does her PhD here at City, and I made a simple figure to find out. As it is clear the fate of the two (four) prices has been pretty similar, at least for the first days, the small daughter of the fork assessing at around 20% of the original price, and the other one not suffering too much.

Just a curiosity? Most probably. But it seems to corroborate that the cryptocurrency market, by definition free from economic fundamentals, often behaves as if it ignored also most of the other underlying facts that could matter (technology, internal history, etc). As we pointed out before, the market has behaved so far as an evolving ecology ruled by “neutral” forces, where no cryptocurrency has shown any strong selective advantage over the other.

In such a scenario, no cryptocurrency can be sure of its fate, and we are guaranteed that more surprises will come.

More info: Bitcoin ecology: Quantifying and modelling the long-term dynamics of the cryptocurrency market arXiv:1705.05334 (2017).

Data from Coin market Cap.

Comments ()