Blockchain: A Graph Primer

This post is an abridged version of our manuscript, which contains an additional section on Blockchain analysis. See the full version in PDF here.

Bitcoin and its underlying technology Blockchain have become popular in recent years. Designed to facilitate a secure distributed platform without central authorities, Blockchain is heralded as a paradigm that will be as powerful as Big Data, Cloud Computing and Machine learning.

Blockchain incorporates novel ideas from various fields such as public key encryption and distributed systems. As such, a reader often comes across resources that explain the Blockchain technology from a certain perspective only, leaving the reader with more questions than before.

We will offer a holistic view . Starting with its brief history, we will give the building blocks of Blockchain, and explain their interactions. We devote Section 4 to the future of Blockchain and explain how extensions like Smart Contracts and De-centralized Autonomous Organizations will function.

Without assuming any reader expertise, our aim is to provide a concise but complete description of the Blockchain technology

1. BLOCKCHAIN

In simple terms, Blockchain is a distributed database that is secure by design. It was proposed by the unknown author Satoshi Nakamoto in 2008 [37]. Blockchain consists of blocks of transactions that can be verified and confirmed without a central authority. The technology has been popularized through its use in the digital currency Bitcoin, where each transaction is financial by nature.

As the origins of Blockchain start with Bitcoin, it is easy to confound the two. Mostly people refer to Bitcoin and Blockchain interchangeably.

It started with Bitcoin, but found usage in many new areas (See Section 3 by Mattila [31]). Companies have created Blockchain applications ranging from monitors that track diamonds, to networks that distribute food products in the globe. Recent years have seen Blockchain based commercial products from established tech companies such as Hyperledger Fabric [24] of IBM. This increasing interest has been fueled further by another popular Blockchain application: Ethereum.

In some aspects (e.g., asset transactions) new Blockchain applications differ from Bitcoin; we will outline these in Section 4. Nevertheless, from a graph perspective these differences are minor; Bitcoin transactions offer very good examples to explain how Blockchain works. Similarly, companies that track and analyze financial transactions on the Bitcoin network use the term Blockchain analysis to refer to their research efforts.

Another benefit of using Bitcoin is due to its long history. Bitcoin has been used worldwide by thousands of users since 2011, and its usage has both shown the utility of Blockchain, and highlighted its shortcomings in real life (e.g., delays in transactions).

As in the case of creating blocks of transactions, the core ideas behind Blockchain directly shape creation and maintenance of nodes and edges in graphs, and we will explain these ideas thoroughly. Blockchain lends itself easily to graph analysis; public addresses are linked with transactions, and transferred amounts correspond to weighted edges. In addition to the behavior imposed by the Blockchain core, some user practices change how Blockchain graphs are updated in time. An example of this is the common practice of moving remaining amounts of assets into new addresses at the end of each transaction.

Our aim is to provide a concise but complete summary of Blockchain for graph mining researchers. This post will cover core aspects and user practices in Blockchain and explain how they affect research efforts.

Some other aspects that we do not cover in this manuscript are privacy [14], and usage of digital currencies in Blockchain [47]. When needed, we will provide references for them throughout the manuscript.

We will start with a brief history of Blockchain, next.

2. A BRIEF HISTORY

Ian Grigg [21]

Bitcoin represents the culmination of efforts from many people and organizations to create an online digital currency. Notable currencies from early times are ecash from Chaum and b-money from Dai. Up to the seminal Bitcoin paper by Nakamoto [37], multiple times digital currencies seemed to have finally succeeded in creating a viable payment method [21]. Hindered by laws and regulations but mostly due to technical shortcomings, non of these currencies took root. Each failure, however, allowed digital enthusiasts to learn from the experience, and propose a new building block towards a viable currency.

From the beginning, digital currencies ran into several fundamental problems. A major hurdle was the need for a central authority to keep track of digital payments among users. Companies that invented digital currencies proposed to be the central authorities themselves. In a sense, rather than eliminating financial institutions, currencies tried to replace them. This approach never gained traction.

An alternative to the central authority approach was to use a distributed, public ledger to track user balances; every user stores account balances of all users. Although it sounds nice in theory, this solution is unfeasible because information about transactions cannot be digitally transmitted in fast and reliable ways. The networks are faulty and malicious users try to benefit from lying about balances. In fact, the problems with this approach, known as the Byzantine General’s Problem, has been a well studied topic in distributed systems [28].

While the central authority problem was still an issue, in the unrelated spam detection domain a solution, called HashCash, was developed for a very different purpose [4]. Email providers had the problem of receiving too many spam emails. Even though emails can be analyzed and marked as spam, this wasted system resources. Researchers were searching for ways to check emails for spam without using too much resource.

HashCash proposed an agreement between email senders and email providers. Email senders were tasked to do a computation for each email and append a proof of the computation to the email. The computation itself is designed to be time consuming, whereas checking the proof is easy. The email provider accepts incoming emails with valid proofs, and may discard all others without analyzing them. This scheme is called a Proof-of-Work. Note that an email sender can still create a spam email, compute its proof and send it. However, Proof-of-Work makes it too difficult to send too many such emails.

Nakamoto used Proof-of-Work to hinder block creation for two reasons. First, it makes lying about blocks more difficult; a miner needs to spend considerable power to mine a block. Second, the time it takes to create a new block allows the network to reach a consensus about transactions. Furthermore, each block contains information about the previous block, collating all in an immutable chain. This chain of blocks is called a blockchain.

Bitcoin’s popularity brought a flood of alternative digital currencies. The most famous being LiteCoin, these alt-coins propose modifications to Bitcoin in aspects like block creation frequency and Proof-of-Work. More fundamental changes come from products not related to digital currencies. Ethereum, specifically, was designed to be the “World Computer” to de-centralize and democratize the Internet; a network of thousands of linked computers that are run by volunteers. We will discuss these improvements in Section 4.

3. BUILDING BLOCKS OF BLOCKCHAIN

3.1 Addresses

In its essence, a Blockchain address is a unique string of 26–35 characters created from public keys. Bitcoin uses two kinds of addresses:

• Pay to PubkeyHash address that starts with 1 as in 1Pudc88gyFynBVZccRJeYyEV7ZnjfXnfKn.

• Pay to ScriptHash address that starts with 3 as in 3J4kn4QoYDj95S3fqajUzonFhLyjjfKjP3.

The most common (we may even say the standard) type is the Pay to PubkeyHash, where a single private key is used to spend bitcoins received from a transaction. Pay to ScriptHash functionality was added later to support m-of-n multi signature transactions; at the receiving address bitcoins can be spend only when at least m out of n users use their private keys. In theory, all of n private keys can belong to the same user but stored on different computers, thereby reducing the risk of theft. In practice, keys belong to different users and Pay to ScriptHash is used in creative scenarios such as in wallet sharing, or buying/selling things with increased security.

From a graph perspective, the address type does not change anything; both can be used in transactions as input/output addresses. However Pay to ScriptHash makes initiation of a transaction very interesting, because it allows users to participate in spending decisions. This user behavior can be mined for various applications such as fraud prevention, and marketing.

Each user publishes its address on web forums, mailing lists or other mediums. Holder of the address can manage the assets (in Bitcoin the asset is an amount of the bitcoin currency) acquired by transactions, because only she knows the private key associated with the address. A transaction cannot be initiated without a receiver address, and an error checking code appended to the address prevents typo errors in the address.

A key point to note is this: public keys are easily hashed to create addresses but it is a one way street. It is very difficult to compute the public key of a given address.

3.2 Transaction

A transaction is a transfer of assets between addresses. Bitcoin allows transferring funds from multiple addresses to multiple addresses. In practice, all input addresses belong to the same user, but output addresses might belong to different users. For each input, three data pieces are required: i) Id of the previous transaction that brought the input asset, ii) index number of the output in the previous transaction, ii) amount to be transferred. When a transaction has more than one input, and each input is signed by the associated private key separately. This signature prevents the transaction to be altered and proves that the user has authorized the transfer.

When a transaction sends assets to an address, public key of the receiver address is unknown to the network. Only when the received assets are being spent in the future, the receiver shows its public key, and any user in the network can hash the key to verify that the hash equals the address. This is an additional proof that the assets belong to the receiver.

We specifically want to emphasize two aspects of transactions.

First, in transactions, senders do not specifically indicate a transaction fee; the difference between total inputs and total outputs is considered to be the transaction fee. The fee is sent to the address of the miner who confirms the transaction. Bitcoin transactions can be without fees (i.e., output amount is equal to the input amount), but as we will show in Section 3.3 these fees increase the chance of a transaction to be confirmed in the Bitcoin blockchain. Fees also prevent flooding the network with spam transactions.

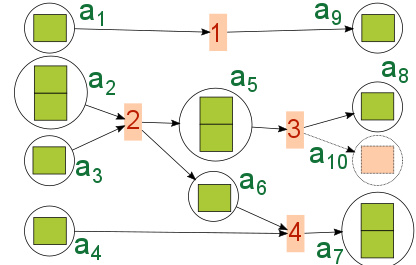

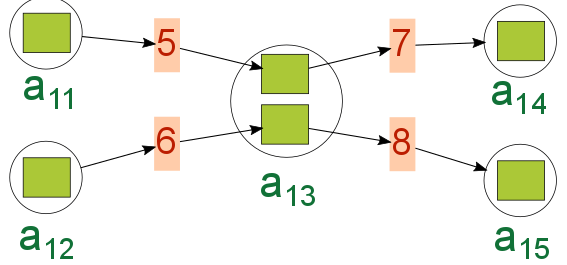

Figure 2a shows four types of transactions. Each green rectangle can be thought of as one Satoshi. A Satoshi is the minimum fraction of a bitcoin, 1 bitcoin = 108 Satoshi. Transaction 1 shows a 1/1 input output transactions. Transactions 2–4 have 2/2, 1/2, 2/1 input/output addresses respectively. When there is more than one input, input source cannot be distinguished. For example, in transaction 4, we cannot know whether the amount in a6 comes from a2 or a3. As we will show in Section 5, these multiple input/output transactions create interesting graphs.

We specifically want to emphasize two aspects of transactions.

Second, an address can receive transfers from multiple transactions, and the outputs of these transactions can be spent separately. However, the community practice is to spend all inputs in a single transaction. For example, in Figure 2b, a13 receives transfers from transactions 5 and 6. a13 then spends two Satoshis in transactions 7 and 8. This is possible because each Satoshi was received in a different transaction. Now consider a5 in Figure 2a. It also receives two Satoshis from transaction 4, but it has to spend both of them at transaction 3. If it only sends 1 Satoshi, the other Satoshi will be taken as the transaction fee, and any unspent amount will be lost. In practice, when a user has to spend a fraction of the received amount, it sends the remaining balance back to its address, or better, creates a new address and sends it there.

Manually creating transactions can be too tedious for ordinary users (See righto.com for details.). Companies have created web sites, called online wallets, that allow users to send, receive and exchange bitcoins without dealing with transaction details.

3.3 Verification and Confirmation

Having covered addresses and transactions, we now turn our attention to how Blockchain, and in particular Bitcoin, makes use of them.

A digital currency, such as Bitcoin, has two main problems to address: payment verification and payment confirmation.

Payment verification means creating a mechanism to verify that 1) the spender has the necessary balance to make a payment, 2) the spender wants to pay the indicated amount. This is similar to verifying that someone wants to pay 50$ with authentic dollar bills. A user presents its public key (to show that the address belongs to her) and signs a signature with its private key (to confirm the amount). The transaction also lists as input a past transaction that brought the amount. For example, in Figure 2b, transaction 8 lists that its input is from the output of transaction 6.

These measures verify that a user has the balance, and wants to make a payment. In the ideal case, in a peer to peer system as soon as an amount is spent, everybody would see the transaction and record the new balances.

Otherwise, the spender can use the same bitcoins to make multiple payments. This issue is known as the Double Spending problem.

In reality, the network is faulty and the news of a transaction may never reach some users. Furthermore, users could be malicious and lie about balances. Due to these problems, users may never reach a consensus about who owns how many bitcoins. Any payment would be a fraud risk. This issue is known as the Byzantine General’s problem [28]. As we mentioned earlier in Section 2, early currencies used central authorities to solve this issue, but their fruitless efforts could only replace banks with companies.

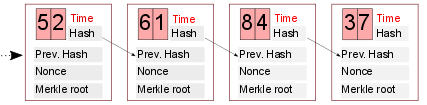

Nakamoto proposed a unique solution to the Double Spending problem. Bitcoin uses a distributed public ledger that contains time-stamped and ID’ed blocks, which in turn contain a number of transactions. Each block carries a piece of information (i.e., block hash) about the previous block, so that users can follow how the blockchain grows in time. Blocks have some constraints: as transferring big blocks among peers would clog the network, Bitcoin limits the block size to 1 MB. As a future improvement, the Segregated Witness concept has been proposed to exclude transaction signatures from blocks so that more transactions can be fit into a block. When a new user joins the network, the whole chain is downloaded from peers and starting from the first block, all blocks and transactions are verified by the user. Because of this, it takes considerable time to be up-to-date with the blockchain.

Block creation is limited to one per ten minutes (this is more a wish than a rule) through a mechanism known as Proof-of-Work. Each block is very difficult to create but easy to confirm once created. Proof-of-Work requires finding a 32 bit number known as the nonce through trial and error. In a sense, it is similar to buying a ticket to win a lottery. Using more computing power increases the probability of finding the number, but does not guarantee it. Currently difficulty is such that it takes around 10^20 attempts to find a valid nonce value. Users who work on finding confirmed blocks are called miners.

Proof-of-Work entails these steps: Each miner receives a list of transactions from its peers that are waiting to be confirmed. The list may be different for each miner. The miner picks a number of them to include in a block. While doing this, it may prefer transactions that pay a higher fee. First, a number of block specific data pieces, such as time of the block, hash of the previous block and a special hash value of contained transactions are concatenated. Then in each trial a different nonce is appended to the end of the string. The SHA-256 hash value of this string is compared against the difficulty. If the hash value is smaller than the difficulty, the user is said to have mined a block.

The difficulty is a globally determined value that is periodically adjusted depending on how long it took to find the last 2016 blocks. In theory, Bitcoin requires that a block must take around 10 minutes, so 2016 blocks must take two weeks. However, depending on how many miners there are, it may take more or less than the predicted 2 weeks. For example, In July 2017 it took 7.63 minutes to find a block in average. See here for the latest values. The new difficulty value is increased or decreased accordingly to approximate 10 minutes per block. The value has actually decreased multiple times so far.

Once a miner finds a block b, she sends b to its peers in the network, and hopes that this is included in the chain. As the information about b propagates in the network, users update their chains and set b as the latest block. Once notified about this new block, miners stop their ongoing computations. If changed, they update the difficulty, and remove transactions that are already included in b. Furthermore, miners change the hash of previous block with hash of b, and resume their mining efforts.

The first block of the chain, known as the Genesis block, was mined by Nakamoto. Miner or not, a user in the system considers the longest chain as the valid Blockchain.

In some cases, news about a block’s discovery may reach some users late. Meanwhile another miner may come up with a new block. In this case, users receive two alternative blocks that fork from a previous block. In the main block chain these forks get into a race. As miners choose one block to build on, the fork that is shown to require “the most effort” becomes the main chain. If the difficulty is the same at both forks, the longest chain has the most effort. Although the last block may change, longer forks are not very common [29] . The longest fork was created due to a version mistake of the Bitcoin protocol, but was solved after 24 blocks.

Figure 3 shows how blocks can be created from the transactions that we gave in Figure 1. Initially assume that the latest block is block 5–2 (i.e., Chain …, 5–2). Assume that after the block 5–2 is appended to the blockchain , block 6–1 and 8–4 are mined at the same time. At this point, users and miners can choose any fork, and continue their efforts. While miner a builds on Chain …, 5–2, 6–1, miner b searches for a new block on Chain …, 5–2, 8–4. After all, both chains are the same length and choosing one over another is a kind of gambit. Next, miner a also mines block 8–4, so the fork becomes Chain …, 5–2, 6–1, 8–4. Note from Figure 1 that blocks 6–1 and 8–4 contain different transactions, so they can be mined one after another. At this point, other miners in the system see that there are two forks and Chain …, 5–2, 6–1, 8–4 is the longest. They choose to build on this longer chain, otherwise they risk their resources to be wasted on the shorter chain. Once the network miners start building on Chain …, 5–2, 6–1, 8–4, the chances of miner b mining a longer fork gets even slimmer. There is no rule that stops miner b from continuing to work with its fork. Blockchain assumes that this effort will be futile because rest of the network will create a chain that is much longer than that of miner b.

A transaction is tentatively considered confirmed when it appears in a block. In practice a transaction is considered secure after six confirmations, i.e., six blocks.

With Proof-of-Work, Bitcoin developers ensure that deliberately creating a fork to eventually replace the main block chain becomes very expensive; a malicious user must mine new blocks faster than all other miners in the network combined. This means that the malicious miner must hold at least 51% of all mining resources, which is not probable. In eclipse attacks, a single user may be scammed by taking over all of its peers in the network. The isolated user can be fed a different fork for scam purposes.

Although transactions are secured by the mechanisms we mentioned so far, malicious users have found multiple ways to scam wallets and users (See an excellent survey on all scams in [14]). A very simple case involves transaction malleability to scam Bitcoin exchange websites. The scam works as follows: although transactions cannot be modified, transaction ids are not protected i.e., they are malleable. A user opens a wallet on an bitcoin exchange, and buys bitcoins. The user orders the wallet to send bitcoins to an address. As soon as the exchange publishes the transaction to send the users’ bitcoin, the user herself captures the transaction, modifies the id and re-sends it to the network. Now, the network contains two copies of the same transaction. If a miner includes the fake transaction in a block, the real transaction will be rejected by all miners, because these bitcoins are already spent.

The exchange sees that the transaction was never included in a block, and may refund the malicious user. By repeating this attack many times, attackers caused denial of service attacks on the blockchain network in 2014. Malleability attacks are a nuisance more than a grave threat; they force users to track individual transaction outputs, which number in billions. This puts stress on the whole network.

In transactions, we briefly mentioned that miners who confirm blocks receive transaction fees. Transactions themselves do not have to pay fees, miners can put non-paying transactions in a block as well. However setting aside a fee increases the chances of being picked up. In fact, as Bitcoin receives more transactions, waiting queues have become longer. For the future, a possible remedy is to increase the block size from 1MB, so that blocks can contain more transactions. Similarly, 10 minute rule can be eased, and the Segregated Witness allows squeezing more transactions in a block.

In addition to transaction fees, the Bitcoin protocol creates a mining reward for each mined block. This reward transaction is known as the coinbase transaction, and is usually the first transaction in a block. In early days when Nakamoto was doing all the mining himself, a coinbase transaction was even the only transaction in a block.

Starting with 50 coins for each block and halving every 210K blocks, the total number of created bitcoins will pass 19M in 2022. This geometric series of rewards converges to a maximum of 21 million bitcoins 5. Eventually when rewards become very small, it is expected that transaction fees will provide a sufficient incentive for miners.

4 CHANGES AND IMPROVEMENTS IN BLOCKCHAIN

As Bitcoin became popular, its limitations also became more visible. New generation blockchains learned from these limitations and improved over Bitcoin. Many others adopted the underlying Blockchain concepts for various use cases. Results range from minor tweaks to revolutionary ideas. In this section we will go over the most important ones.

4.1 Assets over cryptocurrency

Bitcoin uses transactions to transfer an asset: the bitcoin currency. A transaction consists of addresses, hash of the asset and a few other data pieces such as time. The key point is that the asset is represented by its hash value. This also implies that any hashable digital asset could appear in transactions. Law documents, contracts, agreements, wills and many other types of assets can be stored in the Blockchain. These asset based blockchains, however, would still need to use a currency to facilitate block mining. For example, although the Ethereum blockchain is not a digital currency, it uses a currency named ether. Beyond digitized assets, some companies also give ids to physical objects such as diamonds and use Blockchain to track their movements in time (See Section 3.4 of [31] for examples). From a graph perspective, proliferation of exchanged assets will create a network that is best described by multilayer networks [9], where the same set of nodes are connected by edges of different natures. An example is the districts of a city being connected by bus, electricity and subway edges. On blockchain, edges will be exchanges of various assets. On a worldwide blockchain, this multilayer network will contain invaluable data about how assets move, change hands and increase/reduce the demand of each other.

4.2 Smart contracts

A new blockchain, Ethereum, has been created to implement not only transactions, but contracts which contain transactions with conditions and rules. Those so called smart contracts are written in proprietary coding languages and put to a network address by everyone to see and analyze. An analogy is the MYSQL snippets stored on a database. A contract clearly defines the functions that can be used, and is guaranteed to work in the way it is specified.

A simple example is an exchange service of assets A and B. The order of transactions is as follows:

(1) Alice writes a contract with three functions: deposit, draw and exchange, and puts this to an address. Exchange indicates that 1B = 5A and it rejects asset fractions. Alice signs the contract with her private key.

(2) Alice deposits 100 As to the contract’s address. This transaction is recorded in the Blockchain.

(3) Bob has Bs and wants to exchange them for As. Bob sends 20 Bs to the contract’s address.

(4) The contract automatically accepts 20 Bs and sends 100 As to Bob’s address.

(5) Alice uses the draw function and receives 20 Bs from the contract.

Although Alice wrote the contract, the contract does not require any involvement from Alice before sending Bs to Bob. Even if Alice is malicious, she cannot intervene, take Bob’s Bs and disappear. In reality, contracts are more complex, and there have been misuses. Formal verification of contracts to make sure that they work as intended is a developing research field [6].

4.3 Decentralized Autonomous Organizations

Adam Hayes [23]

Ethereum’s Smart Contracts made it possible to create a system where actors get into contracts with each other while matters, decisions and results of decisions can be recorded on the blockchain for everyone to see.

This inspired the community to advocate for a future where Ethereum can be used to create an online democracy. This utopic future is discussed under the term Decentralized Autonomous Organizations (DAO).

The first attempt to create such a future was the DAO project, which aimed to create an online investor fund. Joining members could vote on decisions to invest, and earn money through their investments. Due to a hacking incident, the DAO became a traumatic experience that lost $50M and led Ethereum to split into two. We will mention this story in Section 4.4.

The DAO project left a bitter taste in the community and hindered development of new DAOs. Without a very successful example, there is not yet a consensus about what a DAO is and how it should make use of humans, robots, contracts and incentives. Some argue that other than creating contracts and putting them online, and occasionally providing services to DAO (and getting paid), humans should not be involved. Others use a few humans as curators that will manually filter incoming proposals to the DAO before a vote. We may add that even the term DAO is used in different meanings. However, considering that the blockchain itself does not require consensus, a consensus on DAO terms may be asking for too much.

Instead, a few influential developers have opined on what should be the common points of all DAOs. For example, the creator of Ethereum mentions three points [12].

(1) DAO is an entity that lives on the internet and exists autonomously.

(2) DAO heavily relies on hiring individuals to perform certain tasks that the automaton itself cannot do.

(3) DAO contains some kind of internal property that is valuable in some way, and it has the ability to use that property as a mechanism for rewarding certain activities.

Opinions differ on how DAOs should function, but not on how influential they will be. Consider this example from Hayes [23]. A DAO acquires a car, and puts its contract on Ethereum. The DAO investors can vote (without management) to send the car to work at the Dallas Fort Worth Airport. Riders pay the car on the blockchain, and the car pays its investors dividends from what is left after gas, tax, maintenance and insurance fees. This DAO can buy new cars, decide on their working sites and even connect them to plan routes together. All of this is already possible through Ethereum.

4.4 Fork Issues

A short reading quickly reveals that most Blockchain technologies are forks of each other (See here for a map). Blockchain uses soft forks to continue on the same main chain while changing a few aspects of the underlying technology. These are considered improvements or extensions. A soft fork is backward compatible, and reflects community consensus on how the network should evolve. Hard forks, on the other hand, creates a split in the main chain: two versions of the main chain are maintained by different groups of people. In a sense, it creates a new currency, technology or community. The most famous hard fork happened in the Ethereum project in 2016 due to the DAO hacking.

A hacker stole $50M from the DAO project which had raised $150M from the community for a proof-of-concept investor fund. The DAO was hacked because of coding mistakes that allowed multiple refunds for the same investment. Hackers drained DAO while the community was watching the theft in real-time, helplessly. Many developers wanted to roll back the transactions to forfeit the stolen amount. Disagreeing users rejected the roll back, and sticked to the existing blockchain. This created two versions: Ethereum and Ethereum Classic. This fork started a discussion on how Ethereum should be governed. The Code is law proponents claim that any behavior that conforms to the Blockchain protocols should be accepted; a theft, once happened, cannot be punished by rolling back transactions. For legal aspects, see the article by Abegg [1].

In August 2017, Bitcoin faced a hard fork of its own due to the Segregated Witness extension. Bitcoin split into two chains: Bitcoin and Bitcoin cash.

4.5 Tokens

Some blockchains, such as, Ethereum, encourages developers to create applications that use itoffer services. These applications are allowed to develop their own named assets, called tokens. Tokens are offered by the company and bought by investors using the blockchain currency. So why tokens, instead of just using the system currency?

Mainly because tokens can be used in creative ways. For example, a new service can sell its tokens to raise seed money. These initial coin offerings (ICO) have been very popular on the Ethereum blockchain. For token types and legal issues see [11].

4.6 Scalability Issues on Blockchain

Bitcoin expects a block to be mined every 10 minutes. It also imposes a block size of 1 MB, thereby limiting how many transactions can be processed in 24 hours. As a result, Bitcoin processes 7 transactions per second only. The payment method VISA, on the other hand, processes 2000 transactions per second, in average (See the bitcoin wiki for more details [8]).

Size and speed limitations have been eased in some other coins; LiteCoin, for example, mines blocks every 2.5 minutes. The Bitcoin community has been discussing ways to increase the number of transactions. A solution was adopted in 2017 with the Segregated Witness (SegWit) extension. Segregated Witness removes signatures from the block, which reduces block size by 60%. Further improvements would require increasing the block size itself, which is still debated in the community. See the bitcoin wiki for details [7].

4.7 Hyperledger Fabric

By definition any user can join a blockchain, and all transactions are immutable and public. For corporate settings, this transparency means that rivals can learn company finances and buy/sale relationships. The Hyperledger Project was created to use blockchain in industrial settings. Supported by many organizations, the Hyperledger offers membership services to choose blockchain participants and uses permissioned and even private blockchains. The project is hosted by the Linux Foundation and focuses on the storage, capacity and availability aspects of the blockchain. Hyperledger users are allowed to choose their own consensus and mining approaches.

4.1.7 Proof-of-X

A major criticism of Bitcoin is that while miners are in a race to find the next block, no thought goes into how much power and resource is wasted. In 2014 it was estimated that one bitcoin cost 15.9 gallons of gasoline. It will only get worse as more miners join the race. As Swanson notes, Bitcoin is in reality a “peer-to-peer heat engine” [46].

Proof-of-X is an umbrella term that covers Proof-of-Work alternatives in block mining. Each alternative scheme expects miners to show a proof that they have done enough work or spent enough wealth before creating the block. In Proof-of-Work the work is the mining computations and proof is the hash value (see Section 3).

Instead of doing some work, some wealth can be destroyed (as a kind of sacrifice) to mine a block. Proof-of-Stake considers coin age as wealth; 10 coins of 2 years old means a wealth of 10 × 2 = 20. The block whose miner has sacrificed the highest wealth becomes the next block in the chain. Once coins are used as a sacrifice, their age becomes zero. Coins will have to accumulate their wealth again. Proof-of-Burn goes a step further, and indeed sacrifices coins. In the scheme a miner first creates a transaction and sends some coins to a “verifiably unspendable” address. These coins are called burned, but other than the sender, no one in the network is yet aware that the send address is an invalid/unusable one. Some time later, the miner creates a block and shows the proof of burnt coins. The proof is a script that shows how the address was created through erroneous computations. Miner who has burnt the highest number of coins can mine the next block. In this scheme burning coins to collect transaction fees is only viable if transaction fees are high enough.

If miners decide to game the system by supporting every competing fork, Proof-of-Work becomes too expensive due to required computations. Other schemes are not as effective against miner malice. Consider the case with two competing forks in the blockchain. In Stake or Burn based proofs miners can create blocks for each fork by using the same (burned or aged) coins. Eventually one of the forks will be the longest and become the main chain. Regardless of which one is chosen, the miner’s block will have taken its place in the chain, and the miner will reap fees. For an extensive survey on Proof-of-X schemes, see Section 6 of [47].

REFERENCES

[1] Lukas Abegg. 2016. Code is Law? Not Quite Yet. Online. (2016).

[2] Elli Androulaki, Ghassan O Karame, Marc Roeschlin, Tobias Scherer, and Srdjan Capkun. 2013. Evaluating user privacy in bitcoin. In International Conference on Financial Cryptography and Data Security. Springer, 34–51.

[3] Malik Khurram Awan and Agostino Cortesi. 2017. Blockchain Transaction Analysis Using Dominant Sets. In IFIP International Conference on Computer Information Systems and Industrial Management. Springer, 229–239.

[4] Adam Back et al. 2002. Hashcash-a denial of service counter-measure. (2002).

[5] Annika Baumann, Benjamin Fabian, and Matthias Lischke. 2014. Exploring the Bitcoin Network.. In WEBIST (1). 369–374.

[6] Karthikeyan Bhargavan, Antoine Delignat-Lavaud, Cédric Fournet, Anitha Gollamudi, Georges Gonthier, Nadim Kobeissi, Natalia Kulatova, Aseem Rastogi, Thomas Sibut-Pinote, Nikhil Swamy, et al. 2016. Formal verification of smart contracts: Short paper. In Proceedings of the 2016 ACM Workshop on Programming Languages and Analysis for Security. ACM, 91–96.

[7] Bitcoin. 2016. Block size limit controversy. Online. (2016).

[8] Bitcoin. 2016. Scalability. Online. (2016).

[9] Stefano Boccaletti, Ginestra Bianconi, Regino Criado, Charo I Del Genio, Jesús Gómez-Gardenes, Miguel Romance, Irene Sendina-Nadal, Zhen Wang, and Massimiliano Zanin. 2014. The structure and dynamics of multilayer networks. Physics Reports 544, 1 (2014), 1–122.

[10] Shaileshh Bojja Venkatakrishnan, Giulia Fanti, and Pramod Viswanath. 2017. Dandelion: Redesigning the Bitcoin Network for Anonymity. Proceedings of the ACM on Measurement and Analysis of Computing Systems 1, 1 (2017), 22.

[11] Demian Brener. 2016. On Tokens and Crowdsales: How Startups Are Using Blockchain to Raise Capital. Online. (2016).

[12] Vitalik Buterin. 2014. DAOs, DACs, DAs and More: An Incomplete Terminology Guide. Online. (2014).

[13] Konstantinos Christidis and Michael Devetsikiotis. 2016. Blockchains and smart contracts for the internet of things. IEEE Access 4 (2016), 2292–2303.

[14] Mauro Conti, Chhagan Lal, Sushmita Ruj, et al. 2017. A Survey on Security and Privacy Issues of Bitcoin. arXiv preprint arXiv:1706.00916 (2017).

[15] Giuseppe Di Battista, Valentino Di Donato, Maurizio Patrignani, Maurizio Pizzonia, Vincenzo Roselli, and Roberto Tamassia. 2015. Bitconeview: visualization of flows in the bitcoin transaction graph. In Visualization for Cyber Security (VizSec), 2015 IEEE Symposium on. IEEE, 1–8.

[16] Joan Antoni Donet Donet, Cristina Pérez-Sola, and Jordi Herrera-Joancomartí. 2014. The bitcoin P2P network. In International Conference on Financial Cryptography and Data Security. Springer, 87–102.

[17] Sebastian Feld, Mirco Schönfeld, and Martin Werner. 2014. Analyzing the Deployment of Bitcoin’s P2P Network under an AS-level Perspective. Procedia Computer Science 32 (2014), 1121–1126.

[18] Erwin Filtz, Axel Polleres, Roman Karl, and Bernhard Haslhofer. 2017. Evolution of the Bitcoin Address Graph. (2017).

[19] Michael Fleder, Michael S Kester, and Sudeep Pillai. 2015. Bitcoin transaction graph analysis. arXiv preprint arXiv:1502.01657 (2015).

[20] Alex Greaves and Benjamin Au. 2015. Using the Bitcoin Transaction Graph to Predict the Price of Bitcoin. (2015).

[21] Ken Griffith. 2014. A quick history of cryptocurrencies BBTC-Before Bitcoin. Bitcoin Magazine. April 16 (2014).

[22] Bernhard Haslhofer, Roman Karl, and Erwin Filtz. 2016. O Bitcoin Where Art Thou? Insight into Large-Scale Transaction Graphs.. In SEMANTiCS (Posters, Demos, SuCCESS).

[23] Adam Hayes. 2016. Decentralized Autonomous Organizations: IoT Today. Online. (2016).

[24] IBM. 2017. Hyperledger. Online. (2017).

[25] Dániel Kondor, István Csabai, János Szüle, Márton Pósfai, and Gábor Vattay. 2014. Inferring the interplay between network structure and market effects in Bitcoin. New Journal of Physics 16, 12 (2014), 125003.

[26] Dániel Kondor, Márton Pósfai, István Csabai, and Gábor Vattay. 2014. Do the rich get richer? An empirical analysis of the Bitcoin transaction network. PloS one 9, 2 (2014), e86197.

[27] Philip Koshy, Diana Koshy, and Patrick McDaniel. 2014. An analysis of anonymity in bitcoin using p2p network traffic. In International Conference on Financial Cryptography and Data Security. Springer, 469–485.

[28] Leslie Lamport, Robert Shostak, and Marshall Pease. 1982. The Byzantine generals problem. ACM Transactions on Programming Languages and Systems (TOPLAS) 4, 3 (1982), 382–401.

[29] Matthias Lischke and Benjamin Fabian. 2016. Analyzing the bitcoin network: The first four years. Future Internet 8, 1 (2016), 7. , Vol. 1, №1, Article 1. Publication date: August 2017. 1:16 • Cuneyt Gurcan Akcora, Yulia R. Gel, and Murat Kantarcioglu

[30] Damiano Di Francesco Maesa, Andrea Marino, and Laura Ricci. 2016. Uncovering the Bitcoin Blockchain: An Analysis of the Full Users Graph. In Data Science and Advanced Analytics (DSAA), 2016 IEEE International Conference on. IEEE, 537–546.

[31] Juri Mattila et al. 2016. The Blockchain Phenomenon–The Disruptive Potential of Distributed Consensus Architectures. Technical Report. The Research Institute of the Finnish Economy.

[32] Greg Maxwell. 2013. CoinJoin: Bitcoin privacy for the real world. In Post on Bitcoin Forum.

[33] Dan McGinn, David Birch, David Akroyd, Miguel Molina-Solana, Yike Guo, and William J Knottenbelt. 2016. Visualizing dynamic Bitcoin transaction patterns. Big data 4, 2 (2016), 109–119.

[34] Sarah Meiklejohn, Marjori Pomarole, Grant Jordan, Kirill Levchenko, Damon McCoy, Geoffrey M Voelker, and Stefan Savage. 2013. A fistful of bitcoins: characterizing payments among men with no names. In Proceedings of the 2013 conference on Internet measurement conference. ACM, 127–140.

[35] Andrew Miller, James Litton, Andrew Pachulski, Neal Gupta, Dave Levin, Neil Spring, and Bobby Bhattacharjee. 2015. Discovering bitcoinâĂŹs public topology and influential nodes. et al. (2015).

[36] Malte Moser, Rainer Bohme, and Dominic Breuker. 2013. An inquiry into money laundering tools in the Bitcoin ecosystem. In eCrime Researchers Summit (eCRS), 2013. IEEE, 1–14.

[37] Satoshi Nakamoto. 2008. Bitcoin: A peer-to-peer electronic cash system. (2008).

[38] Micha Ober, Stefan Katzenbeisser, and Kay Hamacher. 2013. Structure and anonymity of the bitcoin transaction graph. Future internet 5, 2 (2013), 237–250.

[39] Marc Santamaria Ortega. 2013. The bitcoin transaction graph anonymity. Maste’s thesis, Universitat Oberta de Catalunya (2013).

[40] Stephen L Reed. 2014. Bitcoin cooperative proof-of-stake. arXiv preprint arXiv:1405.5741 (2014).

[41] Fergal Reid and Martin Harrigan. 2013. An analysis of anonymity in the bitcoin system. In Security and privacy in social networks. Springer, 197–223.

[42] Dorit Ron and Adi Shamir. 2013. Quantitative analysis of the full bitcoin transaction graph. In International Conference on Financial Cryptography and Data Security. Springer, 6–24.

[43] Tim Ruffing, Pedro Moreno-Sanchez, and Aniket Kate. 2014. CoinShuffle: Practical decentralized coin mixing for Bitcoin. In European Symposium on Research in Computer Security. Springer, 345–364.

[44] Mariano Sorgente and Cristian Cibils. 2014. The Reaction of a Network: Exploring the Relationship between the Bitcoin Network Structure and the Bitcoin Price. (2014).

[45] Michele Spagnuolo, Federico Maggi, and Stefano Zanero. 2014. Bitiodine: Extracting intelligence from the bitcoin network. In International Conference on Financial Cryptography and Data Security. Springer, 457–468.

[46] Tim Swanson. 2014. Learning from Bitcoin’s past to improve its future. (2014).

[47] Florian Tschorsch and Björn Scheuermann. 2016. Bitcoin and beyond: A technical survey on decentralized digital currencies. IEEE Communications Surveys & Tutorials 18, 3 (2016), 2084–2123.

[48] M Walport. 2016. Distributed Ledger Technology: Beyond Blockchain. UK Government Office for Science. Technical Report. Tech. Rep.

[49] Steve Y Yang and Jinhyoung Kim. 2015. Bitcoin Market Return and Volatility Forecasting Using Transaction Network Flow Properties. In Computational Intelligence, 2015 IEEE Symposium Series on. IEEE, 1778–1785.

Comments ()