How to pay Salary in Crypto: Payroll in 2021

With crypto’s growing popularity companies from around the globe have started to open up to this form of payment.

With crypto’s growing popularity companies from around the globe have started to open up to this form of payment.

Faster transactions, low transaction fees, secure payments, are just some of the benefits organizations get to enjoy when using crypto as a form of payment.

What’s even better is that since cryptocurrencies are borderless it opens a global pool of workforce for companies, who can now hire talent from across the world without having to worry about complex banking regulations or high cross-border charges.

Whether a company is big or small having crypto as an option of salary payment will surely be advantageous in the long run.

Tax Considerations

One thing that often withholds a large number of organizations from paying their employees in crypto is the underlying legal and tax implications that companies are obligated to follow.

Since crypto is in a legal grey area with no clear set of rules underlined by the government, most companies shy away from using it as a form of payment.

But, crypto legality is ever-evolving with some countries already green lighting its use such as El Salvador, Australia, US, EU.

Plus, there are ways for companies to pay their employees in crypto and still be compliant with laws.

For any type of company looking to pay their employees in crypto here are options:

Payroll Software

Payroll Softwares are specialized solutions that allow companies to manage the entire process of payments of their employees. Such software is extensively used by companies all over the world and helps process payments for millions of employees in their local fiat currency.

What's even better is that these tools take care of tax deductions as well as the legal compliance of the respective country of the particular employee reducing a massive overhead for the employer.

With the mainstream adoption of digital currency, payroll solutions are adapting by adding cryptocurrency to their list of supported currencies.

In addition to managing/tracking the payouts of employees, settling payrolls in crypto comes with a host of advantages for companies, a few of which include:

- Multiple currency support

- Real-time payments

- Reduced/Low transaction fees compared to traditional banks, especially for cross-border payments

- Quicker transactions

Who should use Payroll software?

Large to medium-sized firms with a sizable employee base.

Some of the top payroll software that allows for crypto settlements include:

Deel

Deel is a global payroll and compliance solution that allows companies to onboard global talent effortlessly and put them on a payroll that is compliant with their local laws.

Companies can hire full-time employees or independent contractors and Deel takes care of the rest. Employees even have the option to choose their preferred method of payment, and yes, that includes cryptocurrency.

Supported cryptocurrencies include Bitcoin, Ethereum, and Ripple.

Bitwage

Bitwage is an international payroll solution that allows companies to manage payouts for remote talent from across the globe.

Bitwage is a crypto-focused solution but it supports traditional financing options as well, which means employers and well employees have the option to choose their desired method of payment.

Crypto payments can be made out in Bitcoin, Bitcoin Cash, Ether, DAI, and USDC.

PapayaGlobal

Papaya Global is global payroll and workforce management solution that offers a complete suite of services to its customers, right from hiring, onboarding, managing, and paying them.

Their services span more than 140 countries and provide full compliance and real-time reporting with BI and analytics.

Papaya Global allows for 30% of salary to be paid in cryptocurrency. This allows the company to be compliant with local reporting regulations and tax laws and at the same time regulate the employees' salary allocation.

Crypto Invoice

Invoicing is one of the most common and versatile transaction documents to exist in commerce. Crypto invoices follow the same premise as traditional invoices but instead of mentioning your bank details, you mention the wallet address of the cryptocurrency you wish to receive your payment in.

Unlike payroll software which is mainly used by employers, crypto invoices are used by employees.

There are few services that provide crypto invoicing solutions, allowing anyone to create and send invoices that settle in cryptocurrency.

Another added benefit of crypto invoices is that they take care of the price volatility of cryptocurrency and provide the payor with the most updated amount to be paid.

Who should use crypto invoices?

Freelancers, consultants, independent contractors, part-time employees

Some of the top crypto invoice solutions include:

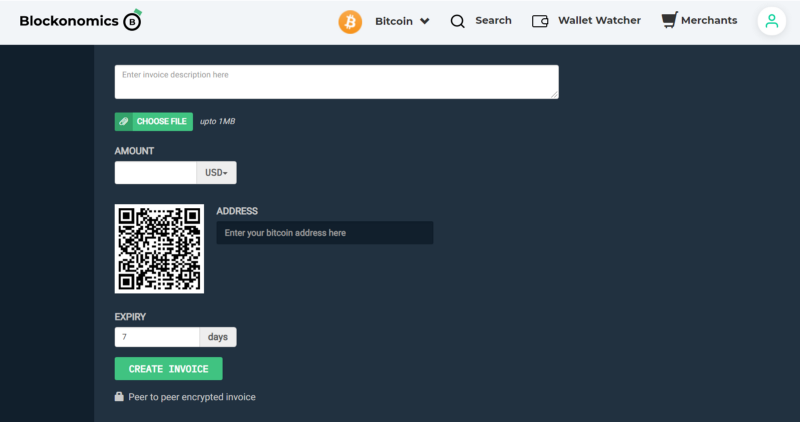

Blockonomics

Blockonomics invoicing is one of the easiest solutions that exist for customers in today's market. It takes merely 2 mins to create a bitcoin invoice and you get a unique shareable link that can be used anywhere online.

Simply plug in your BTC address and the amount, and your invoice is ready, it doesn't get any easier than this.

The bitcoin price is updated in real-time so the payor knows the exact amount to be paid and all payments come directly to your wallet. Another added benefit is that there is no need for sign-up or KYC to use this service, greatly protecting the privacy of the users.

There is no fees involved in using this service.

But this simplicity does come at a price, there is no dedicated portal to manage the invoices nor does it have a service to track payment history.

PaymentX

PaymentX invoicing allows you to create personalized invoices through a dedicated portal. The platform is intuitive and easy to use and you can get started in a matter of minutes.

In addition, you can manage past payments, transaction history and even set up recurring invoices for regular customers.

The platform is still in beta and there are no fees involved in using their services.

Crypto Address

One of the most basic methods to accept crypto payments is simply sharing the receiving address and the amount to the payor.

It has been a fairly common practice in the crypto world to use this method of payment given how nascent the industry is but as it goes mainstream it is not the best way to receive crypto payments.

This method comes with inherent security issues as it requires trust between the two transacting parties. Hence this method is best used only if you trust the other party.

Conclusion

Crypto payments are getting mainstream and the workforce, as well as companies regardless of size are starting to see their presence.

There are options for any type of company looking to pay their employees in crypto [either full or part of their salary].

Payroll software work best for large/medium companies who need to manage a sizable employee base and have options for both fiat and crypto.

Invoices are a great way to charge an employer for the services they hired you for, it works great for freelancers, independent contractors, consultants.

Finally, crypto addresses, though widely used, are not the ideal choice of receiving salary given the inherent security issues, but it is the easiest method. If there is trust between the parties then this method can be used.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()