Revolutionizing Business Finances: How Crypto Payments Drive Cost Savings for Entrepreneurs

Explore how entrepreneurs can leverage crypto payments to achieve substantial cost savings across various aspects of their business operations.

In the ever-evolving landscape of commerce, entrepreneurs are constantly seeking innovative solutions to optimize their operations and drive cost savings. One such technology that has garnered significant traction in recent years is blockchain.

Beyond its status as a speculative investment, cryptocurrency that operates using blockchain technology as its backbone offers tangible benefits for businesses, particularly in terms of reducing transaction costs and streamlining financial processes. In this article, we will explore how entrepreneurs can leverage crypto payments to achieve substantial cost savings across various aspects of their business operations.

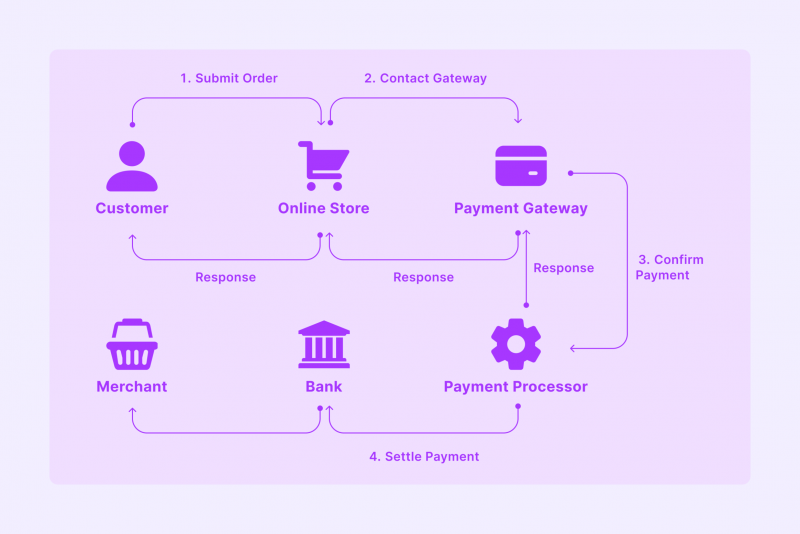

The Traditional Payment Paradigm: A Burden on Entrepreneurs

Traditional payment methods, such as credit cards and bank transfers, often come with a myriad of associated fees and inefficiencies that burden entrepreneurs and eat into their bottom line. These fees can include transaction fees, processing fees, currency conversion fees, and chargeback fees, among others. For businesses operating on tight margins, these costs can add up quickly and significantly impact profitability.

1. Processing Fees:

Online payment gateways charge merchants a percentage of each transaction ranging from 2-4%, along with fixed transaction fees. These fees can vary depending on the gateway provider and the volume of transactions processed, resulting in significant expenses for businesses, especially those operating in e-commerce.

2. Currency Conversion Fees:

For businesses engaged in international trade or catering to a global customer base, currency conversion fees can be a significant pain point. Traditional financial institutions often impose hefty fees and unfavorable exchange rates for converting between different currencies, leading to unnecessary expenses for entrepreneurs.

3. Setup Fees:

Setting up traditional payment processing infrastructure, such as POS terminals or online payment gateways, can incur upfront setup costs. These fees may include hardware costs, software licensing fees, and integration expenses, depending on the complexity of the system.

4. Additional Fees

There may be additional fees that a payment gateway can charge you, such as manually entered card fees, 3D secure authentication, chargebacks, etc. These charges can very easily add up and further increase your fee burden.

Fiat Payment Processor Fees [A brief case study]

| PayPal | Stripe | 2Checkout | |

|---|---|---|---|

| Transaction Fee | 3.49% | 2.9% | 3.5% |

| Fixed Fee | $0.49 | $0.30 | $0.35 |

| Currency Conversion Fee | 4% | 1% | 5% |

| International Transaction Fee | 1.5% | 1.5% | 2% |

| Additional Fee | - | 0.5% | - |

| TOTAL [Domestic] | 3.49% + $0.49 | 3.4% + $0.30 | 3.5% + $0.35 |

| TOTAL [International] | 8.99% + $0.49 | 5.9% + $0.30 | 10.5% + $0.35 |

| Chargeback Fee | $20 | $15 | $15-$45 |

PayPal

One of the most popular payment gateway, PayPal, is used by users and merchants worldwide to send/receive money as well as process transactions online on websites.

Let's have a look at their fee structure for a normal commercial transaction paid in a foreign currency:

- 3.49%

- International commercial transactions: 1.50%

- Fixed Fees: 0.49 USD (for $ transactions)

- Currency conversion spread: 3-4% + transaction exchange rate (one of the worst in the market)

That's almost 10% of the total transaction amount going to PayPal's pocket just to process a transaction.

The chargeback fee is set at $20 per dispute.

Based on other services offered by PayPal, the fees go even higher in some cases.

Stripe

Another popular payment gateway is Stripe, used by merchants to accept payments. Their checkout is especially popular amongst merchants.

Looking at their fee structure for a normal commercial transaction paid in a foreign currency, merchants can expect to pay the following fee.

- 2.9%

- International commercial transactions: 1.50%

- Fixed Fees: 0.30 USD (for $ transactions)

- Currency conversion: 1%

- Manually entered cards: 0.5%

This comes to about 6% of the total transaction amount, the merchants lose for every transaction that is processed using Stripe.

The chargeback fee is set at $15 per dispute.

There are additional fees based on additional services and payment types.

2Checkout

2Checkout now Verifone, is a major payment gateway in the US and Europe. Used by merchants widely, it offers a host of products for accepting payments.

There fee structure for a normal commercial transaction paid in a foreign currency is as follows:

- 3.5%

- Cross border fees: 2% [exempt for merchants from certain countries]

- Fixed Fees: 0.35 USD (for $ transactions)

- Currency conversion: 2-5% + daily bank exchange rate

Coming to about 10% of the total transaction amount, almost as much as Paypal, if not worse.

The chargeback fee is set at $15 -$45 per dispute, depending on the chargeback rate.

There are additional fees based on additional services and payment types.

Enter Crypto Payments: A Paradigm Shift in Financial Transactions

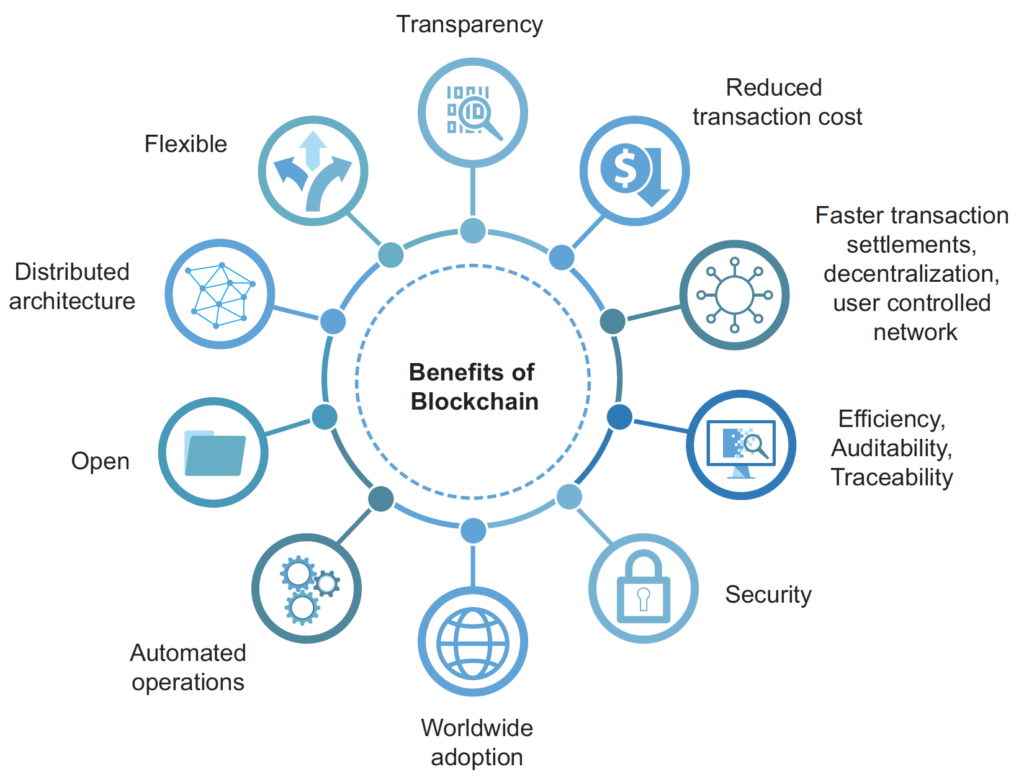

Cryptocurrency payments offer a compelling alternative to traditional payment methods, promising lower costs, faster transactions, and greater security. By leveraging blockchain technology, entrepreneurs can bypass intermediaries, eliminate unnecessary fees, and gain more control over their financial transactions.

1. Minimal Transaction Fees:

Cryptocurrency transactions typically involve minimal or even zero transaction fees, particularly for peer-to-peer transactions conducted on decentralized networks. Unlike traditional payment methods that rely on centralized intermediaries to validate transactions and enforce fees, cryptocurrencies operate on decentralized networks, where transaction fees are negligible.

The only fee you would have to pay is the transaction fee to confirm the transaction on the blockchain. These fees vary based on the blockchain used by the cryptocurrency, it can range anything from a few cents to a few dollars.

If you are using a crypto payment gateway for your business, you will also need to consider payment gateway fees. However, this fee is significantly less compared to fiat gateways, ranging from 0%-1% per transaction.

2. Direct Peer-to-Peer Transactions:

Cryptocurrency payments enable direct peer-to-peer transactions between parties, without the need for intermediaries such as banks or payment processors.

This direct transfer of value eliminates the associated fees and delays imposed by third-party intermediaries, resulting in faster and more cost-effective transactions for businesses.

3. Global Accessibility:

Cryptocurrency payments transcend geographical boundaries, enabling businesses to accept payments from customers anywhere in the world without incurring additional fees or facing currency exchange complications.

This global accessibility opens up new markets and revenue opportunities for entrepreneurs, empowering them to expand their customer base beyond traditional borders.

4. Enhanced Security:

Blockchain technology, the underlying technology behind cryptocurrencies, offers enhanced security features compared to traditional payment systems.

Cryptocurrency transactions are cryptographically secured and recorded on a distributed ledger, making them tamper-proof and resistant to fraud. By embracing cryptocurrency payments, businesses can mitigate the risk of fraud, chargebacks, and identity theft, thereby reducing associated costs and liabilities.

Learn more on how to accept cryptocurrency payments on your website.

Real-World Examples of Cost Savings with Crypto Payments

To illustrate the tangible benefits of adopting cryptocurrency payments, let's consider a few real-world examples of how entrepreneurs have successfully leveraged crypto to drive cost savings in their businesses.

Case Study 1: E-commerce Retailer

An e-commerce retailer specializing in electronics and gadgets decided to integrate cryptocurrency payments into their online store. By offering Bitcoin and other cryptocurrencies as payment options, the retailer was able to attract tech-savvy customers and reduce transaction fees compared to traditional payment methods.

A breakdown of annual numbers when using fiat gateways:

- Sales [average]: $500,000

- Payment Gateway Fees: $35,000 [50% domestic and 50% international]

- Revenue after gateway fees: $465,000

After switching to crypto payments, the merchant now saves thousands of dollars annually:

- Sales [average]: $500,000

- Payment Gateway Fees: $5,000

- Revenue after gateway fees: $495,000

With lower overhead costs and increased customer satisfaction, the retailer experienced a significant boost in profitability and reinvested the savings into expanding their product offerings and marketing initiatives.

Case Study 2: Freelance Services Platform

A freelance services platform implemented cryptocurrency payments to facilitate transactions between freelancers and clients worldwide. By leveraging blockchain technology, the platform eliminated the need for traditional payment intermediaries, resulting in lower processing fees and faster payment settlements for freelancers.

Additionally, the transparent and immutable nature of blockchain transactions reduced disputes and chargebacks, further enhancing cost savings for the platform and its users.

Overcoming Challenges and Embracing Opportunities

While the benefits of cryptocurrency payments for entrepreneurs are clear, there are certain challenges and considerations to navigate along the way.

Regulatory Compliance:

Entrepreneurs must stay abreast of regulatory developments and compliance requirements related to cryptocurrency payments, which can vary significantly across jurisdictions.

By adhering to regulatory guidelines and implementing robust compliance measures, businesses can mitigate legal and financial risks associated with crypto transactions.

Volatility Management:

Cryptocurrency markets are known for their inherent volatility, with prices subject to fluctuations based on market demand and investor sentiment.

To manage exposure to price volatility, businesses can explore strategies such as instant conversion to fiat currency or hedging mechanisms to protect against adverse price movements.

Education and Adoption:

Widespread adoption of cryptocurrency payments requires education and awareness among consumers and businesses alike.

Entrepreneurs can play a crucial role in driving adoption by educating their customers about the benefits of crypto payments and offering incentives or discounts for using cryptocurrencies as a payment method.

Conclusion: Embracing the Future of Finance with Crypto Payments

In conclusion, cryptocurrency payments offer a transformative opportunity for entrepreneurs to drive cost savings, enhance efficiency, and unlock new growth opportunities in their businesses.

By embracing the benefits of blockchain technology and decentralization, entrepreneurs can streamline financial transactions, reduce overhead costs, and gain a competitive edge in the global marketplace.

While challenges may exist, proactive planning, strategic implementation, and ongoing innovation will position entrepreneurs for success in the digital economy of tomorrow. As the adoption of cryptocurrency payments continues to accelerate, entrepreneurs who embrace this paradigm shift stand to reap the rewards of a more efficient, transparent, and inclusive financial ecosystem.

FAQ's

Are cryptocurrency payments widely accepted by customers and businesses?

While cryptocurrency adoption is growing, it's not yet universally accepted by all. However, many online retailers, service providers, and even some brick-and-mortar stores now offer cryptocurrency payment options as the user base of crypto is increasing worldwide.

Do customers need specialized knowledge or tools to make cryptocurrency payments?

Customers typically need a cryptocurrency wallet and some basic knowledge of how to use it to make payments. However, many cryptocurrency payment processors offer user-friendly interfaces that make the process relatively straightforward.

Additionally, businesses can provide guidelines in the form of articles and videos to their customers.

Are there any risks associated with accepting cryptocurrency payments?

While cryptocurrency transactions offer enhanced security features, there are still risks to consider, such as price volatility, regulatory uncertainty, and potential security vulnerabilities.

However, with proper risk management strategies in place, these risks can be mitigated.

How quickly can businesses access funds from cryptocurrency transactions?

Cryptocurrency transactions typically settle much faster than traditional bank transfers, often within minutes or hours, depending on the blockchain network's speed. This enables businesses to access funds more quickly and improve cash flow.

Can businesses offer discounts or incentives for customers who pay with cryptocurrency?

Yes, businesses have the flexibility to offer discounts or incentives to customers who choose to pay with cryptocurrency. This can be an effective way to encourage adoption and reward customers for using a payment method that benefits both parties.

Comments ()