How to Accept Cryptocurrency Payments for Your Online Store

Embarking on the journey of accepting cryptocurrency payments for your online store is a strategic move that aligns your business with the evolving landscape of digital finance. As the world transitions towards decentralized and secure financial solutions, integrating cryptocurrencies can position your online store at the forefront of innovation.

In this guide, we will explore the practical steps and considerations to seamlessly incorporate cryptocurrency transactions, tapping into a global market and enhancing the overall resilience and efficiency of your e-commerce venture. Let's delve into the future of online payments together.

Table of Contents:

- What is Cryptocurrency?

- Bitcoin vs Credit Card Payments

- What do you need to accept Crypto Payments?

- How To Accept Bitcoin Payments in 3 Steps

- Offer In-person Crypto Payments

- Understand Cryptocurrency Regulations

- Best Practices For Integrating Bitcoin Payment Checkout

- Conclusion

- FAQs

What is cryptocurrency?

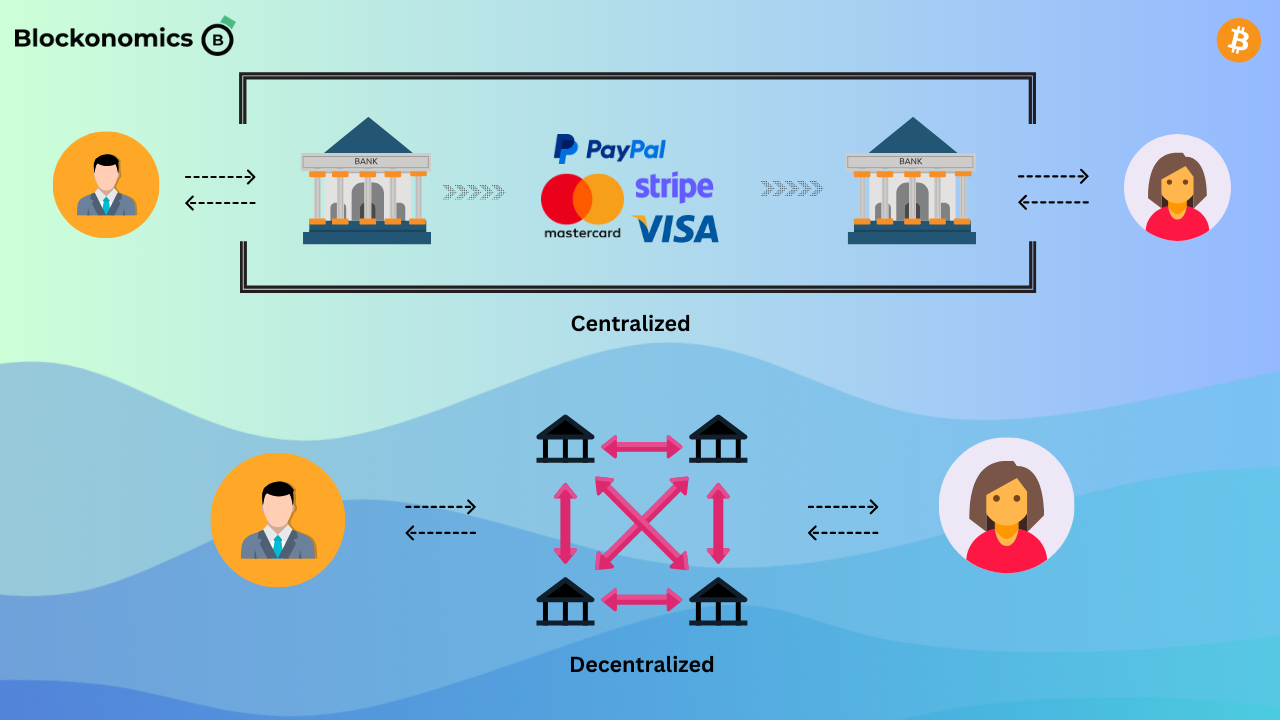

Cryptocurrencies are a form of digital currencies that use cryptography and blockchain technology to securely and safely transfer digital assets between peer to peer and record data on a disturbed ledger which can be accessed by anyone and does not need a central authority to operate. The beauty of cryptocurrency is that it is decentralized and self-governing, which means that no single entity government, or corporate can control its use and manipulate it to their advantage.

Bitcoin is the most widely known cryptocurrency with other popular ones including Ethereum, Solana, Ripple, and USDT. It is important to note that there are thousands of cryptocurrencies currently circulating the market.

Bitcoin vs. Credit Card Payments

The classic battle of the financial titans! Bitcoin vs credit card payments is a debate that has been going on ever since Bitcoin’s inception. Let’s take a look at the pros and cons of each:

Bitcoin:

Pros:

- Decentralization: Bitcoin operates on a decentralized network, meaning any government or institution does not control it.

- Global Transactions: You can send and receive Bitcoin anywhere in the world without the need for currency conversion.

- Lower Transaction Costs: Generally, Bitcoin transactions have lower fees compared to credit card payments, especially for international transfers.

- Safe and Secure: Blockchain is one of the safest methods for transactions currently existing in the finance market.

- Limited Supply: The finite supply of Bitcoin (21 million) can be seen as an advantage, as it may protect against inflation.

- No Chargebacks: Blockchain transactions once confirmed cannot be reversed so canceled. This means as a merchant you don’t have to worry about customers disputing transactions.

Cons:

- Volatility: The value of Bitcoin can be highly volatile, making it a risky store of value.

- Adoption and Acceptance: While increasing, Bitcoin is not universally accepted as a means of payment, limiting its practical use.

- Irreversible Transactions: Bitcoin transactions are irreversible, so if there's a mistake, it's challenging to get your funds back.

Credit Card Payments:

Pros:

- Widespread Acceptance: Credit cards are widely accepted globally, making them convenient for everyday transactions.

- Consumer Protections: Credit cards often come with fraud protection and chargeback options, providing a level of security for consumers.

- Rewards and Benefits: Many credit cards offer rewards programs, cashback, and other perks for users.

- Credit Building: Responsible use of credit cards can positively impact your credit score.

Cons:

- High Fees: Credit card transactions can involve various fees, including annual fees, interest, hidden fees, and sometimes foreign transaction fees.

- Centralized System: Credit card transactions are processed through centralized entities, which some argue goes against the ethos of decentralization.

- Dependence on Infrastructure: Credit card transactions rely on a functioning banking and financial infrastructure, which might not be available in some areas.

- Less Secure: Credit Card or bank data are susceptible to hacks or breaches.

So, it really boils down to what you value more—decentralization, global accessibility, and potentially lower fees with Bitcoin, or the convenience, security features, and widespread acceptance of credit card payments.

What do you need to accept Bitcoin?

[1] The initial prerequisite for accepting Bitcoin transactions is the acquisition of a Bitcoin wallet—a secure repository designed for the initiation, reception, and safekeeping of Bitcoin assets. This digital enclave distinguishes itself through two primary classifications:

- Cold Wallets: These offline storage solutions epitomize heightened security, positioning themselves as more impervious alternatives in the market. The Cold Wallet category encompasses hardware and paper wallets, ensuring a robust safeguarding mechanism.

- Hot Wallets: In contrast, Hot Wallets maintain a constant online connection, rendering them more susceptible to potential cyber threats. Despite this vulnerability, they offer unparalleled convenience, allowing transactions at any time and from any location. Mobile, desktop, and web wallets collectively fall under the umbrella of Hot Wallets.

[2] The secondary requirement in accepting Bitcoin payments on your website is the incorporation of a Bitcoin payment checkout. Analogous to its fiat counterpart, the Bitcoin payment checkout functions in a similar manner, albeit with a slightly different checkout experience.

Upon the completion of a transaction, the Bitcoin payment checkout furnishes users with a Bitcoin receiving address and/or QR code, where the payments need to be made.

How To Accept Bitcoin Payments in 3 Steps

The processing of accepting cryptocurrencies is pretty straightforward once you understand a few basic concepts of how crypto works such as setting up bitcoin wallets and a payment checkout.

Thankfully, this process is not as complicated as you might be made to believe and doesn't require technical know-how.

Step 1: Setup a Crypto Wallet

This crypto wallet is where you will be receiving your Bitcoin transactions so it is imperative that you choose a safe and secure wallet to receive your transactions.

Once you have selected the crypto wallet you wish to use, cold or hot. Follow the setup instructions relevant to that wallet. Most wallets have a standard setup process so if you used one before this process should not be new to you.

It usually involves backing up your private key and setting up a strong password, after which you get access to your wallet, which you can now use to send, receive, and store your Bitcoin.

Prominent Crypto Wallets:

Step 2: Select a Crypto Payment Checkout

This may be the most important step to consider when receiving Bitcoin payments for your online store. There are numerous options in the market with varied features and benefits so do spend some time researching the different options and find the right fit for your business.

When it comes to choosing a top-notch Bitcoin payment plugin there are a few functionalities that you must look for:

- Complete control of the funds that you receive

- No KYC/AML requirements (if you want privacy and anonymity)

- Low Fees

- Easy integration to your website (the less technical — the better)

- Secure and Safeguarded transaction

- Excellent customer support (In case you run into trouble!)

Here is a more detailed list of things you should consider when choosing a crypto payment checkout for your business and the top payment checkouts to choose from.

Step 3: Integrate the Payment Checkout to your Website

Once you have selected your payment infrastructure and Bitcoin wallet, it's time to integrate them into your online store.

The process depends on the website CMS you used to build your website and the payment infrastructure you decided to integrate it with. Most Bitcoin payment companies offer a dedicated plugin that integrates with your website, so you simply need to follow the setup instructions provided by the checkout provider.

For example, here are the setup instructions for accepting Bitcoin payments on your Woocommerce store using Blockonomics.

Offer In-person Crypto Payments

In case you have an offline store alongside your online one, you can opt for in-store Bitcoin POS payments by your customers.

You will either need a dedicated crypto POS machine or a mobile/web app to accept payments. Depending on the provider, you would need to do a separate setup and integration with your Bitcoin Wallet.

Right now, very few crypto payment checkouts are offering both online and offline payment services so if you wish to use the same company for both your options might be limited.

BitPay and CoinGate are two popular companies that offer the option for both online and offline POS payments with crypto.

Understand Cryptocurrency Regulations

Unlike traditional physical currencies such as the U.S. dollar, cryptocurrency has not yet received universal approval. Each country has its own set of rules or oftentimes no rules at all. While some countries are quite accepting of cryptocurrencies, others are not so open to them going as far as banning them.

To run a legitimate business in a particular country requires compliance with the local regulations of that region.

It is important for businesses to make sure that such rules and regulations are followed and that the payment infrastructure they choose to integrate is compliant with such regulations as well.

However, the legality of using cryptocurrencies for business payments continues to change, so do make sure you follow all the latest developments happening around this area.

Best Practices For Integrating Bitcoin Payment Checkout

Incorporating a Bitcoin payment checkout demands thoughtful evaluation of several elements, encompassing security measures, transaction costs, and adherence to regulatory standards. For eCommerce enterprises, it is equally imperative to guarantee a smooth and user-friendly integration process.

Customer Instructions:

Given the potentially uncharted nature of paying with Bitcoin for a considerable portion of your customer base, delivering clear and comprehensive instructions on the intricacies of making Bitcoin payments will help your customers better understand Bitcoin and use it more.

Provide comprehensive guidance on the following aspects:

- Creating a Bitcoin wallet

- Funding the wallet

- Executing payments with Bitcoin

- Monitoring and tracking Bitcoin transactions

Integration Testing:

Prior to the official launch of your Bitcoin payment checkout, thorough testing is imperative to diagnose any potential flaws and bugs in the integration. This encompasses testing diverse scenarios, including successful, pending, and unsuccessful transactions.

A robust payment checkout should offer testing options to validate the seamless setup of your integration.

Incentivizing Bitcoin Usage:

To encourage customer adoption of Bitcoin as a payment option, consider offering various incentives.

These can include discounts, coupons, giveaways, merchandise, or other creative rewards, facilitating increased bitcoin payments and, consequently, augmented sales.

Fraud Monitoring:

While Bitcoin payments inherently boast heightened security and irreversible transactions, the risk of fraud still persists.

Monitoring transactions for suspicious activity is essential, as it can help prevent fraudulent behavior. Implementation of good fraud detection tools and regular review of transaction logs for anomalies can help.

Customer Support:

Stellar customer support plays a pivotal role in the overall success of any business, eCommerce included.

Establish a dedicated support team proficient in addressing Bitcoin-related queries who provide quick and prompt resolutions to these queries for a positive customer experience.

Additionally, supplement it with detailed documentation and tutorials for customers navigating the Bitcoin payment process.

Communicating Bitcoin Benefits:

In addition to providing clear instructions, emphasize the advantages of using Bitcoin to your customers. Highlight the decentralized nature, swift settlements, absence of chargebacks, low fees, global acceptance, and robust security that cryptocurrency payments offer.

Diversification of Payment Methods:

Broadening the spectrum of payment options enhances market accessibility. By integrating multiple payment checkouts that support various payment types, your eCommerce store not only caters to diverse customer preferences but also stands to increase overall revenue.

Try to provide fiat payment options that accept various types of cards and online payment options alongside your Bitcoin payment option.

Prominent Display of Bitcoin Option:

Actively encourage Bitcoin usage by prominently showcasing the payment option on your eCommerce website. Employ strategies such as adding a "Bitcoin accepted here" logo at the footer, signaling to potential customers that your website is bitcoin-friendly.

Staff Education:

Integrating a Bitcoin payment checkout necessitates additional training for your staff. Equip them with knowledge of Bitcoin transaction mechanics, troubleshooting procedures, and handling customer inquiries related to Bitcoin payments.

Conclusion

Embracing cryptocurrency payments for your online store can open up new avenues for financial transactions. By integrating this innovative payment method, you not only cater to a broader customer base but also position your business at the forefront of technological advancements.

The decentralized nature, security features, and global accessibility of cryptocurrencies make them a promising option for the future of e-commerce. Stay adaptable, keep abreast of industry trends, and watch as your online store evolves with the changing landscape of digital payments.

FAQs

1. Are blockchain and cryptocurrency the same?

Cryptocurrency is a form of digital currency that employs blockchain technology to operate. It actually uses a combination of cryptography and blockchain to validate and record transactions across a distributed ledger.

Blockchain is a distributed ledger that records all transactions and stores them in blocks of data each linked to each other in succession stored in a distributed network.

2. How to check Bitcoin transactions?

To check the status of a bitcoin transaction you have to use a bitcoin blockchain explorer. This can be easily done online using numerous blockchain explorers available.

Some popular ones include blockonomics, mempool, and blockchain.

Simply plug in the Bitcoin address or the transaction ID you wish to check the status of and it will show all the necessary details.

3. How long do Bitcoin transactions take to settle?

Bitcoin transactions can take on average anything from 10 minutes to a few hours to confirm. It depends on the network congestion, meaning the total number of unconfirmed transactions at any given time and the fees you pay for the transaction.

4. What is Bitcoin Fee?

Bitcoin fee is the fee you pay on top of your transaction amount to get your transaction confirmed. This fee goes to the miners who run programs to validate the transactions.

This fee is dynamic and depends on network congestion and hash rate difficulty.

5. Can I accept Bitcoin on PayPal?

Yes, with Paypal you send and receive crypto to and from eligible confirmed personal PayPal accounts in the U.S. and U.S. Territories (excluding Hawaii.) Buy, hold, and sell Crypto. Through checkout with Crypto, you can sell Crypto and use the proceeds to pay for purchases through your PayPal account.

Comments ()