Barriers to Bitcoin Merchant Adoption

Bitcoin has been enjoying quite a spotlight lately with major players in the business world developing a keen interest in the technology.

Bitcoin has been enjoying quite a spotlight lately with major players in the business world developing a keen interest in the technology.

Elon Musk kicked off 2021 with a 1.5 Billion USD investment in Bitcoin and a possibility to accept bitcoin as payment for Tesla, sending bitcoin on an upward price rally.

Payment processor giants such as PayPal, Mastercard recently announced that might bring in crypto support for merchants.

Such institutional interest is a major plus for the digital currency which would propel merchant use for the currency.

But despite the growing interest, there are still concerns amongst online merchants to use bitcoin as a form of payment on their webstore.

Let’s look at some of these concerns,

Regulatory Concerns

Regulations concerning cryptocurrency and bitcoin form one of the biggest reason stopping merchants from adopting them in their business.

Arnold Spencer, general counsel of bitcoin network Coinsource

The regulatory framework surrounding cryptocurrency is an ever-changing landscape with each country implementing a different set of rules.

More than anything there is an underlying uncertainty when it comes to crypto laws. Companies do not want to break any laws while operating in a country. Often times a lot of crypto companies incorporate their businesses in countries that are more crypto-friendly to escape the regulatory scrutiny of many countries.

Due to this merchants are oftentimes hesitant to accept crypto payments in their online stores.

High Fees

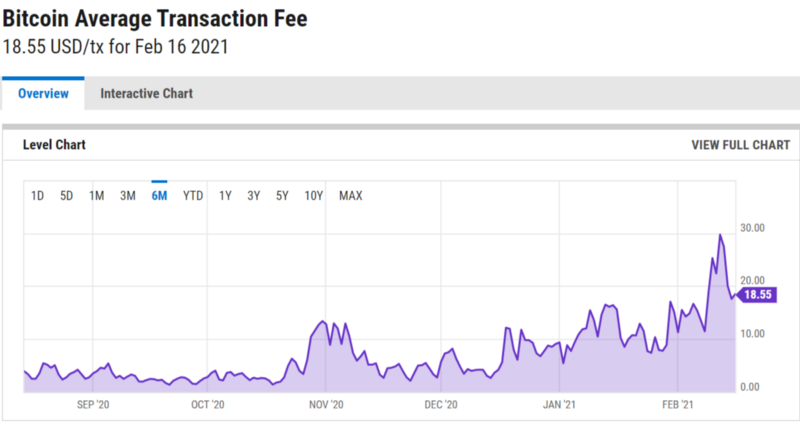

Bitcoin transaction fee has been a controversial subject for quite some time and it is one of the reasons bitcoin fails to be scalable.

For bitcoin transactions to confirm users have to pay a “small” fee to the miners. In the past few years, this fee has consistently increased making it practically unusable for daily use.

Bitcoin is mined in blocks of 1Mb every 10 minutes. If the number of transactions exceeds the 1 Mb size limit miners usually tend to pick the transactions with the highest fees, which drives the fee up.

During the bull run of 2017, the transaction fees reached as high as 55.27 USD before dropping again to reasonable levels.

The current bull run brings out the same problem, with the fee on a consistent rise [currently stands at 18.55 USD]

Long Confirmation time

Another scalable issue faced by bitcoin is its long confirmation time, closely tied with the transaction fees.

When a bitcoin transaction is broadcasted on the blockchain it needs to be confirmed by the miners. Usually, 6 confirmations are considered an ideal number to consider a transaction valid and complete. Even with a high transaction fee, this can take some time to happen.

In case one broadcasts a transaction with a low fee it is possible that the transaction is stuck for hours and even days, a challenge faced by many bitcoin users on a daily basis.

Volatility

Bitcoin’s infamous volatility has been a topic of debate for as long it has existed. Bitcoin is perhaps one of the most volatile assets in the market.

Bitcoin’s volatility index currently stands at 5.04% [60 days BTC/USD volatility], this is quite a high number for a currency. Most major currencies’ volatility hovers between a range of 0.5% — 1%.

The volatility makes it a risky asset to be used as a medium of exchange in day-to-day trading.

Technical

Bitcoin is often touted as technical and difficult to be used by people. Even J.K. Rowling went on Twitter to ask people about it.

Yes, there are some technical aspects to bitcoin that a few people find challenging but this does not in any way make it unusable.

What people seem to forget is that Bitcoin is a new technology, which typically follows an adoption curve during its lifespan.

Another point that people seem to ignore is that Bitcoin is a nascent technology and users can expect a lot of development in the future. As Bitcoin gets more mainstream, the more user-friendly it will become, just look at the internet a decade ago to what it is now.

Misinformation/Lack of Trust

Used by criminals, prone to hacks, illegal to use, too complicated, these are some of the many characteristics people often associate with Bitcoin resulting in a lack of trust in this currency.

Bitcoin has been subject to multiple rumors, controversies, misinformation in the past most of which stem from the lack of proper knowledge of the technology.

To dispel a few:

- Bitcoin has never been hacked, the exchanges and wallets that deal with bitcoin have,

- Almost every currency is used by criminals, not just bitcoin,

- Bitcoin is in a legal grey area, countries have little to no laws regarding crypto at the moment but it can change anytime,

- Bitcoin is not complicated to use, it is just going through an innovation adoption curve.

Conclusion

Bitcoin is getting popular amongst the general population and this trend is only expected to grow. Merchants around the world have a lot to benefit from this decentralized and borderless currency.

Despite its nascent nature bitcoin has managed to grow at an impressive rate disrupting an impenetrable financial sector, something thought to be impossible before.

Proper education is definitely needed to dispel the many rumors and misinformation regarding digital currencies and it is highly encouraged to do proper research before buying into such rumors.

While there are some issues that bitcoin still faces, the biggest one being scalability, developers are working towards finding solutions to such problems.

In the future, merchants can expect to see a regulatory system structured around cryptocurrency. Whether it will be positive or negative only time will tell. Merchants accepting crypto are advised to be on the lookout for any changes that might occur in their country of operation regarding cryptocurrency.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()