Blockonomics steps up where PayPal and Stripe have failed

For any business, online or offline, payment processing forms an integral part of their business, after all any company irrespective of…

For any business, online or offline, payment processing forms an integral part of their business, after all any company irrespective of size needs to set up processes to successfully manage transactions. This is where payment processing systems come into the picture.

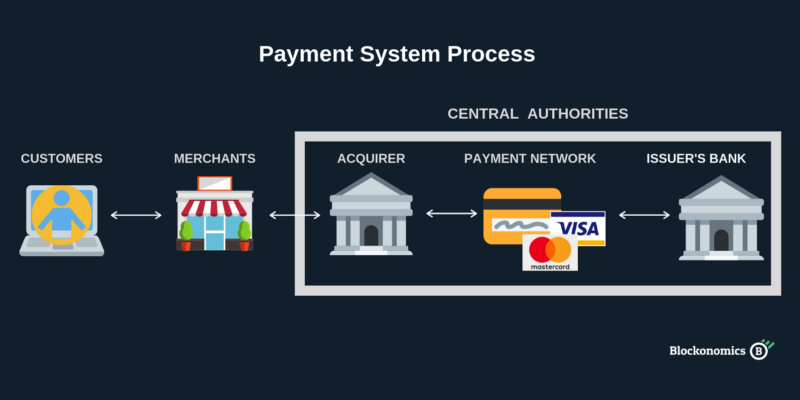

For merchant transactions, the space has long been dominated by institutions such as Visa and MasterCard which make for the majority of the payment processing landscape we see today. Majority of the payment cards (credit, debit cards) that banks issue to its customers operate using either of the two services. There institutions are not banks but an intermediary between conventional banking institutions, merchants and customers who oversee, verify and transmit the transaction information by acting as a point of communication between all the stakeholders involved.

For a simple transaction to occur between two individuals, two central authorities participate in the process, and as a result, collect high processing fees & private user data, which is often times a pressing issue for merchants and customers alike. For a single transaction credit card fees can range from anywhere between 0.5% — 5%, plus additional service fees based on the card provider. While doing cross border payments the traditional banking system is even more archaic leading to delayed transactions, even higher fees & security issues.

In the past decade, the financial sector has seen some innovation in the payment processing systems, with companies such as PayPal and Stripe entering the picture. There companies provided easy solutions for merchants & customers with online payment solutions for sending, spending or receiving money from (almost) anywhere in the world. And they have been top choices for business online as a payment processing system. But as revolutionary as it seemed, these companies did not seem to solve the problem the traditional payment processing systems had, in-fact they are ending up to be just like them. A merchant or a customer can easily receive or spend money online using these services and the speed and cost is almost negligible for same currency/country transactions. The problem starts to occur while doing cross border payments which see high fees + delayed transaction time + high currency conversion rates + security breaches. There have been multiple instances where transactions are getting blocked or accounts frozen without any warning for people who have been long-term clients of these companies.

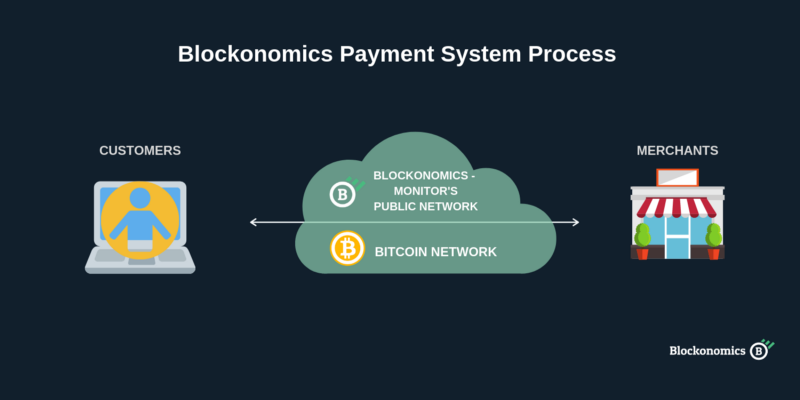

From a simplified economic perspective these companies are providing us with a service and in return charge a fee for that service. But, analyzing the current market landscape the question that cannot be ignored is that is it fair for the customers/merchants to keep bearing this brunt without getting quality service. This is where Bitcoin enters and seems to solve some of the most pressing issues we see in the fintech space. The two biggest advantages being low processing fees and quick & anonymous transaction between 2 parties without central authority(s) acting as middle men. For online stores and merchants this is a huge upside as they no longer have to incur heavy fees, wait for days for the payment to come through and worry about security breaches that can happen doing the transactions.

Using bitcoin, online stores can receive money directly from the customer making it is completely P2P (Peer to Peer) transaction. There is no requirement to set up a bank account, divulge any personal information to a central authority or pay high set-up fees. Anyone irrespective of where they are in the world can receive or send money as long as they have a bitcoin wallet.

Online merchants can easily set up bitcoin as payment option in there checkout page using bitcoin payment solutions such as Blockonomics, which offer plugin that easily integrates bitcoin payment option into an online store’s checkout page. Just like bitcoin, which does not require complex setup, fees or documentation, Blockonomics is just as easy to integrate.

In the ever changing landscape of financial technology, bitcoin seems to be a clear alternative to the traditional payment systems when it comes to features, technological capabilities, overall versatility. Online merchants are realizing its potential and making the switch.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()