Economics of Bitcoin merchant adoption

Merchants accepting bitcoin have a disproportionate effect on the price due to the large of entities they interact with daily. A normal…

Merchants accepting bitcoin have a disproportionate effect on the price due to the large number of entities they interact with daily. A normal user would maybe do only few P2P BTC transactions a month. Its is surprising to keep hearing stories of new merchants adopting bitcoin, yet the price of BTC keeps tumbling down. Let us investigate this by looking at what kinds of entities are adding real value to the bitcoin ecosystem

HODLers— Speculative Value

HODLers hoard bitcoin and don’t believe in spending it. This increases its speculative value. A system having only HODLers is a bubble that would eventually burst. HODlers do help to amplify something that already has an intrinsic value.

Spenders — Network Value

Entities spending BTC and using it for P2P transactions create network value. Number of users in the network gives an indication of the inherent value in the network. Turns out that according to Metcalfe’s Law, it is proportional to N exponent of 1.69 (Ref). It is no coincidence that the price of bitcoin surged when large number of users were using it and blocks were full in early 2018.

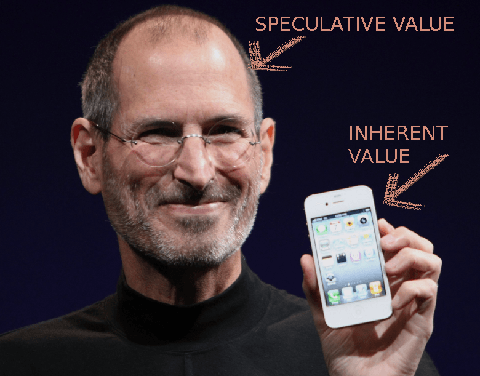

One analogy we can think of this is how Steve Jobs hypes up the sales of iPhone. iPhone has an inherent value which is similar to network value in case of bitcoin. However, the charisma and hype acts as a multiplier to the price of iPhone. Similarly HODLers hype up the price of BTC, though they may not have the charisma of Jobs !

Bitcoin Merchants — Who is the Robin Hood ?

We classify merchants accepting bitcoin/crypto in an attempt to find out which ones are helping to drive the price up and helping the ecosystem to grow:

- Merchants who only accept Bitcoin

Network Value: High

Speculative Value: High

These are the real heroes of the bitcoin ecosystem. First of all they force new users to buy bitcoin to be able to transact with them. This increases the number of users in the network, exponentially driving the price up. Second, they mostly keep the BTC or spend it directly on salaries/other services. This helps to keep the monetary value locked in crypto and increase the speculative value. - Merchants who accept multiple payment methods but don’t convert to fiat

Network Value: Low

Speculative Value: High

These merchants create low network value because they bring in very few new users from the fiat world into the BTC network. People already owning fiat would choose to directly pay in fiat instead of going to painful process of conversion, except in case of international/privacy conscious users who chose this route.

These merchants do help to lock in the people already owning BTC in the network. This creates speculative value and promotes customer to hold BTC to buy goods or pay bills. - Merchants who accept multiple payment methods but convert to fiat

Network Value: Low

Speculative Value: Zero

They create positive speculative value by accepting bitcoin via their customers who keep BTC. However, this is negated by the fact that they dump the bitcoin. Huge amount of BTC is converted to fiat, creating a negative impact on the price.

As you would have guessed, merchants converting to fiat aren’t really helping the ecosystem much.

What is the percentage of merchants converting BTC to fiat?

While an exact figure is not known, there are stats from back in 2014 by Bitpay. Coupled with our interaction with merchants through Blockonomics, approximate one in every three BTC merchants would be converting to fiat

In summary, BTC ecosystem needs a increase in number of active users to improve its intrinsic value. Merchants can help by keeping more of BTC and narrowing down the payment methods. Merchants convert to fiat; particularly in a bearish market, to avoid losses. However, merchants need not convert to fiat and can convert to stablecoin or use abra like non custodial wallet to keep BTC locked in fiat value.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()