Investing made Easy, or How I Learned to Stop Worrying and Love Cryptocurrencies

Bitcoin and other cryptocurrencies, called altcoins, are increasingly becoming a popular investment. With the huge price increase over the…

Bitcoin and other cryptocurrencies, called altcoins, are increasingly becoming a popular investment. With the huge price increase over the past few months, many people have seen large returns on their investments. But the question remains whether Bitcoin and altcoins are safe investments now, or if the bubble will burst. This article will look into just how much money people have made, as well as looking into whether cryptocurrencies are currently a good investment. To assist, I’ll be looking at a number of graphs created on CryptoCurrencyChart: I’d suggest checking out their website to do your own fiddling.

Investing in Bitcoin

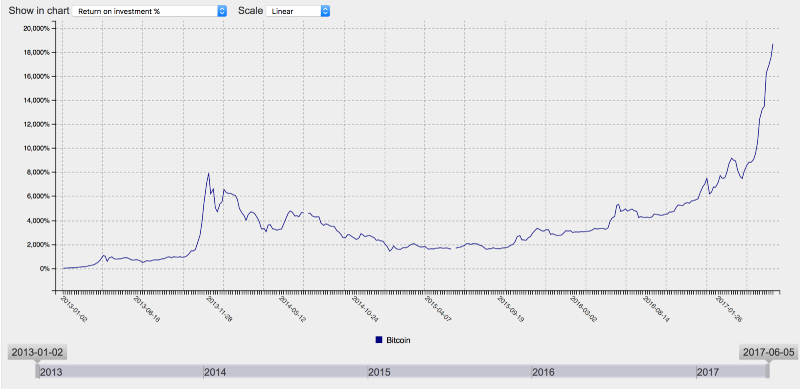

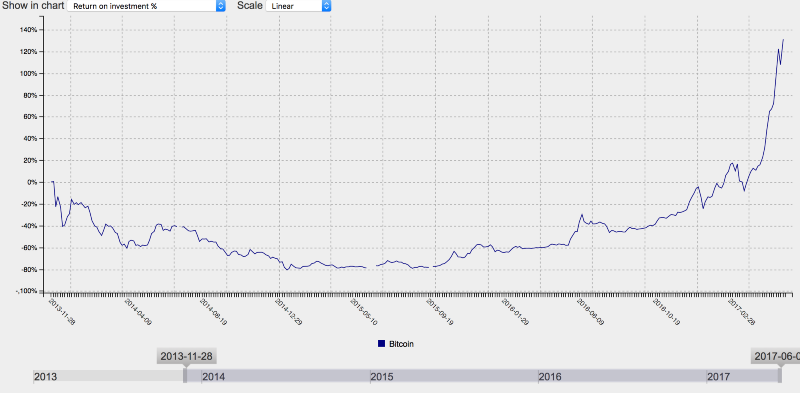

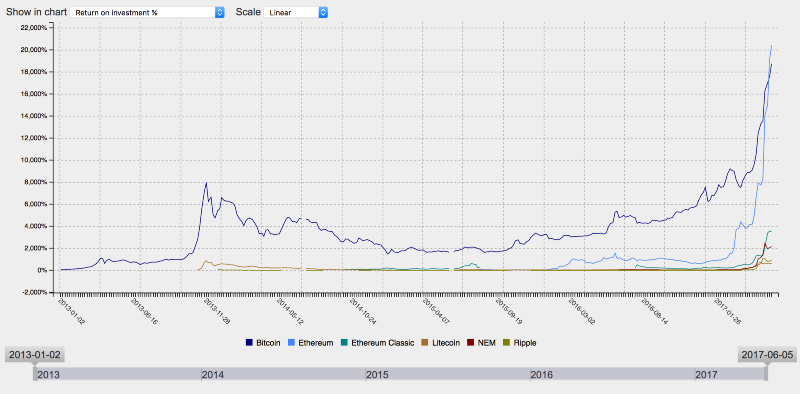

First, let’s take a look at the money one could have potentially earned over the past. Taking a look at the above Bitcoin graph, you can see that if I had invested 1 dollar in 2013, today I would have a 19000% return! That’s quite a bunch of change! Compare that 19,000% with the average investment return of the stock market which is about 7%. Even if I had invested a dollar at the height of the Bitcoin bubble in late 2013, I would have increased that by 130%, shown in the graph below.

Let’s go back to the chart back to the beginning 2013. Bitcoin has seen a huge long term investment. As with most stocks, if you’re investing its probably a good idea to ride it out for the long term. If you sold your Bitcoin in November of 2013 you may 8000% return, however, if you had held on to it until today you would have 19000% return. Its a tricky question whether to cash out though. Because Bitcoin is so new it and because no one can tell what Bitcoins true value is, although some say it is inflated value right now, long term investment has its own risks. It is possible that Bitcoin will never reach a similar height again, instead plateauing out at a lower rate. Nevertheless, there were people saying Bitcoin would never reach the height it did in late 2013, but now it has completely surpassed it. There are those that even say Bitcoin could reach 100000 dollars in the next 10 years. Investment is always tricky.

Investing in Altcoins

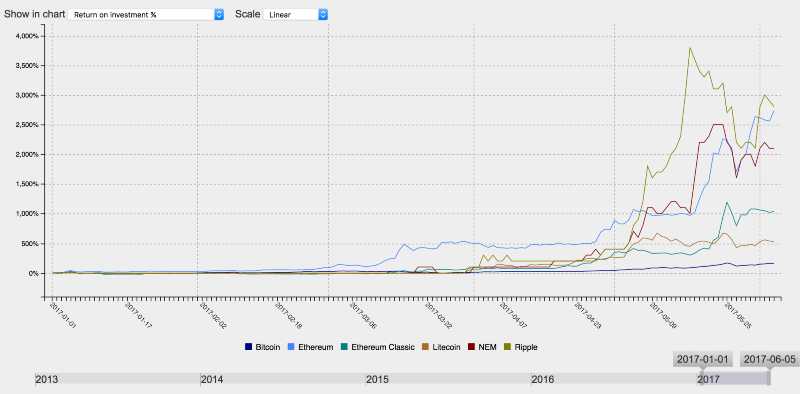

Altcoins also join in on the fun, though much more recently. Let’s look at the graph.

If I had 1 dollar on January 1st of this year, and I had wanted to invest in a cryptocurrency, where would I go? In fact, Bitcoin would have given me the least return, although its no chump change:

- Bitcoin would have gotten me about 161 return.

- Litcoin gives me a modest 500 return.

- Ripple nets me about 2700 return

- Ethereum gains 2600 return

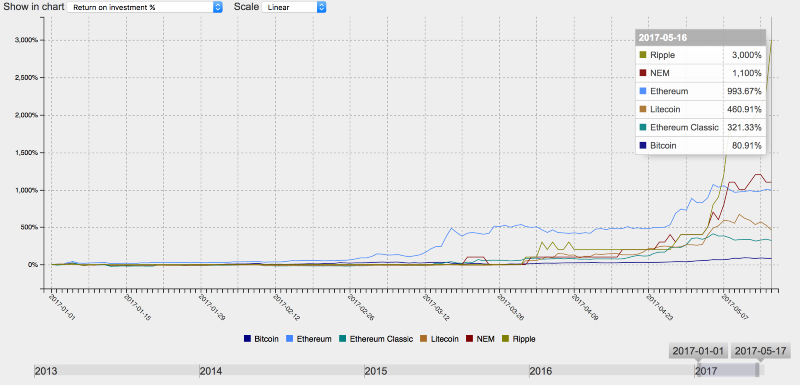

Let’s look if I cashed that 1 dollar earlier in May though:

- Bitcoin would have gotten me about 81 return.

- Litcoin gives me 460 return.

- NEM gains me 1100 return.

- Ethereum only 993 return.

- Meanwhile Ripple gains me 3000 return!

This shows one of the major problems in investing in cryptocurrency, they are very volatile. Ripple saw over a thousand percent drop in investment return just in 2 weeks. It also shows that one should be careful when investing when riding a wave, that wave could peak quickly and crash and you lose a lot of money. Just ask anyone who invested in a house in 2007, or in Dutch tulips during the tulip bubble.

Now let’s look at a graph going back to 2013. Keep in mind that these altcoins were created after the start date, so their investment return is from their creation date. Altcoins are especially tricky for long term investment. They have much less foundation than Bitcoin, so are even more volatile. Hold onto one long term may prove to be a money loser. Yet, its very possible that they establish themselves as Bitcoin alternatives. Ethereum has seen a larger investment return since its creation than Bitcoin has since 2013, but its existence has been short so its hard to look at a long term look. Nevertheless, Ethereum and Litecoin seem like the best altcoin long term investments because they seem to have the most foundation. You can view my examination of altcoins here.

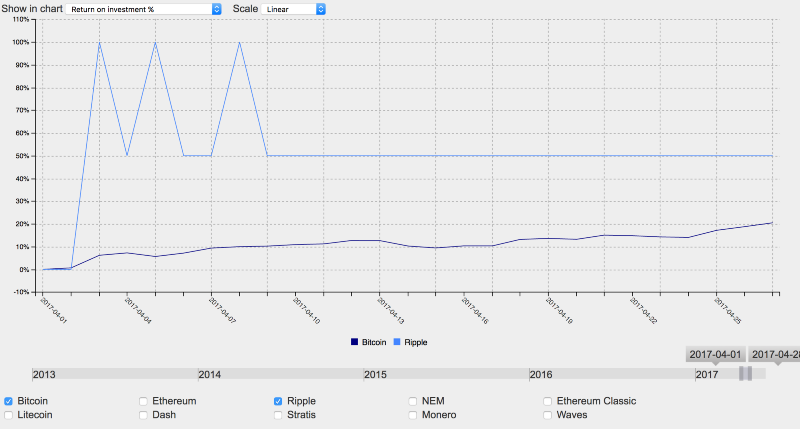

There is also the possibility of investing Bitcoin into altcoins to try to increase my Bitcoin wealth. The idea is that if I invest in Ripple with my Bitcoin, I want Ripple to grow at a faster rate than the Bitcoin. So let’s say I invested 1 Bitcoin in Ripple on April 1, and convert back to Bitcoin on April 28. Because Ripple had a higher return rate, 50% versus 20%, I’ve effectively increased my Bitcoins, as seen below.

Final Thoughts

If you choose to invest there is a number of things you should keep in mind. First you need to choose which coin you’ll invest in. Lots of research needs to be done. Bitcoin seems the safest, but others may appeal to you. Check out this article from Mic and this article on Medium for some good advice on cryptocurrency investment.

One of my biggest regrets is that I didn’t get in on Bitcoin back in the early days. If I had, I’d have some good money in my pocket. Yet, there is still chance to make a pretty penny on cryptocurrencies, if predictions come true on the growth, and a bubble doesn’t burst. Nevertheless, I’ll be treating Bitcoin as the stock market, expecting to see a long term growth that will net me a good return, but it will go through ups and downs in the process.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()