How to File your Bitcoin Tax — Blockonomics [US Edition]

Tax season is upon us and with it comes the heavy task of calculating all your tax liabilities from various sources.

![How to File your Bitcoin Tax — Blockonomics [US Edition]](/content/images/size/w1200/max/800/1-QlQkYVr8qH1EtY5ygmBIDw.png)

Tax season is upon us and with it comes the heavy task of calculating all your tax liabilities from various sources.

One of such asset classes is cryptocurrency, which in recent times has seen quite a lot of regulatory scrutiny, especially with regards to taxes.

In the United States, cryptocurrency is taxable. The IRS considers cryptocurrency as property, which means that virtual currency is seen as assets similar to gold or stocks.

Thus, if you are trading, HODLing, earning, mining, bitcoin, or any other crypto, it is liable to tax according to the US government.

Thankfully, if you are using Blockonomics calculating these crypto taxes is easier than you might think.

Here is the guide to calculating your crypto tax using Blockonomics. The video version of this guide can be found here.

Disclaimer: For this process to work, you need to have your xpub key setup with your Blockonomics account for the entire financial year. If you haven't done so already, here is a guide to get you started.

Step 1: Setup

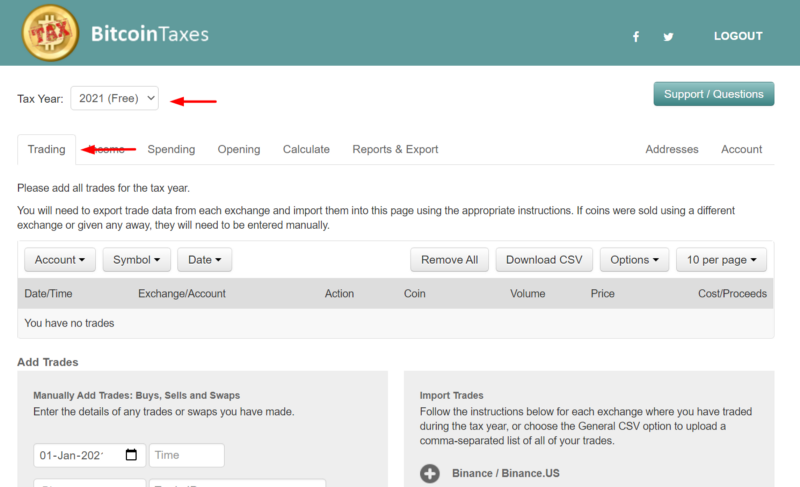

Head on over to bitcoin.tax and create an account.

After you are logged in, select your tax year, and head on over to the first tab, ‘Trading’.

Step 2: Trading

At this step, you add your crypto trading information. There are two ways to do so, manually entering each trade or importing trade data.

If you have a very limited number of trades per year then you can opt for the ‘Manual’ method. You would have to enter data for each trade made in that financial year manually.

But, if you have multiple trades across various platforms then choose the ‘Import’ method.

Almost all major crypto exchanges are mentioned here, choose the one(s) that are relevant to you, click on the + sign and follow the instructions mentioned to import the trade data.

You would need to repeat this step for each exchange you have used in that financial year.

There is even an option to upload one single CSV file with data of all your trades.

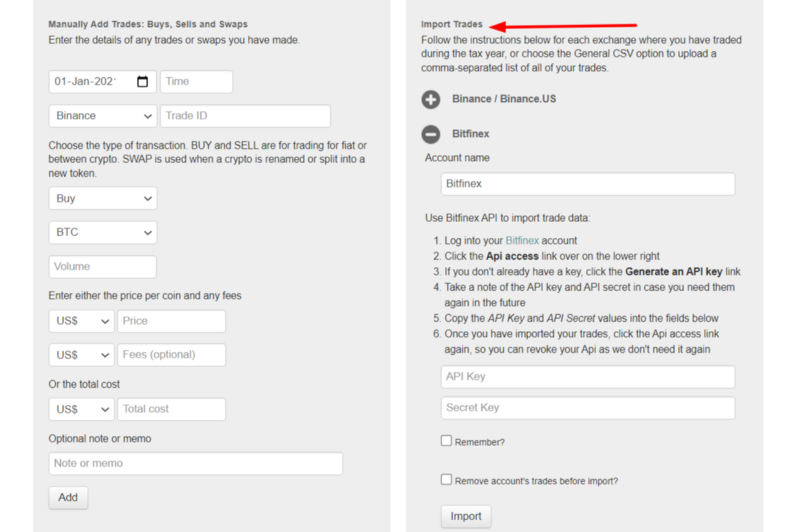

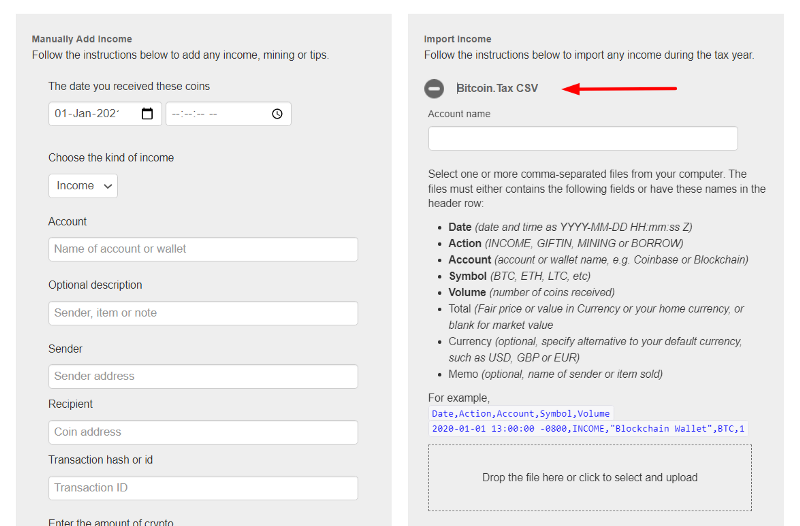

Step 3: Income

Once your trade data is successfully inputted, head on over to the ‘Income’ tab. In this tab, you add information about any income you may have earned in the form of crypto, be it through mining, salary, or tips.

Similar to the Trading tab, there are 2 options to add your information, ‘Manual’ and ‘Import’. You can choose either based on the amount of data.

In the import option, you have options to import data for mining, wallets, and of course sales.

If you have been using Blockonomics you can download your expenses data in the form of CSV and upload it here.

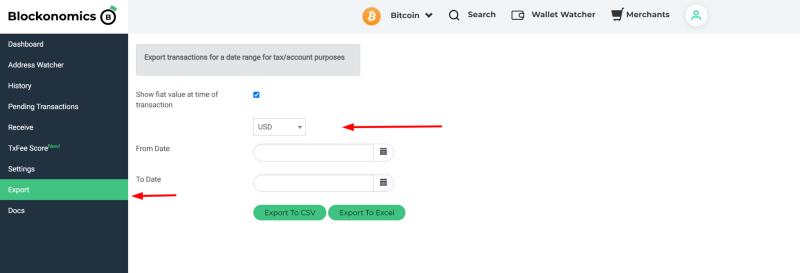

Import data from Blockonomics

Head on over to Blockonomics, login to your account, and go to Wallet Watcher -> Export

Enter the desired currency and the financial year and click ‘Export to CSV’.

In the downloaded file, you will have information about all your bitcoin transactions.

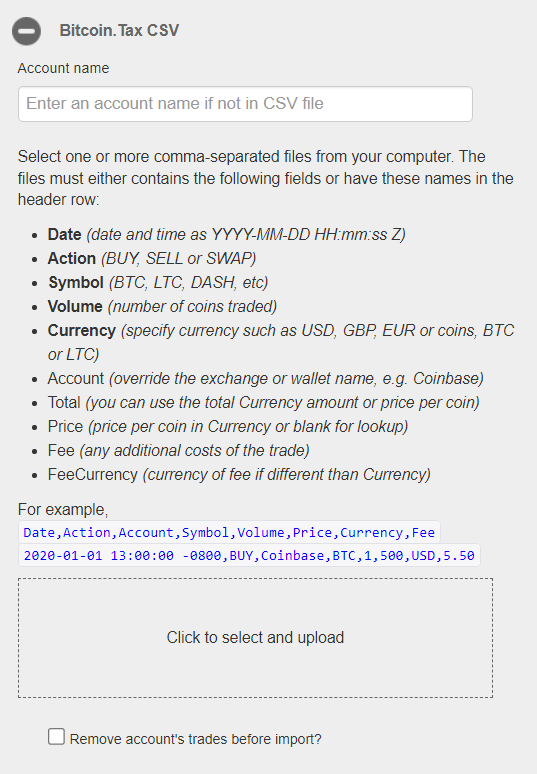

Now here is a tricky part, the CSV file downloaded has a different format to the one accepted on bitcoin.tax, so some tweaking is needed.

The instructions for the accepted fields are mentioned under ‘Bitcoin.Tax CSV’

Change the fields according to the instructions provided here AND cut any and all the fields that are related to spending (withdrawals) and paste them into a separate/new CSV sheet.

Once all the changes are done, you can upload this sheet on bitcoin.tax [the spending(s) sheet will be used in the next step]

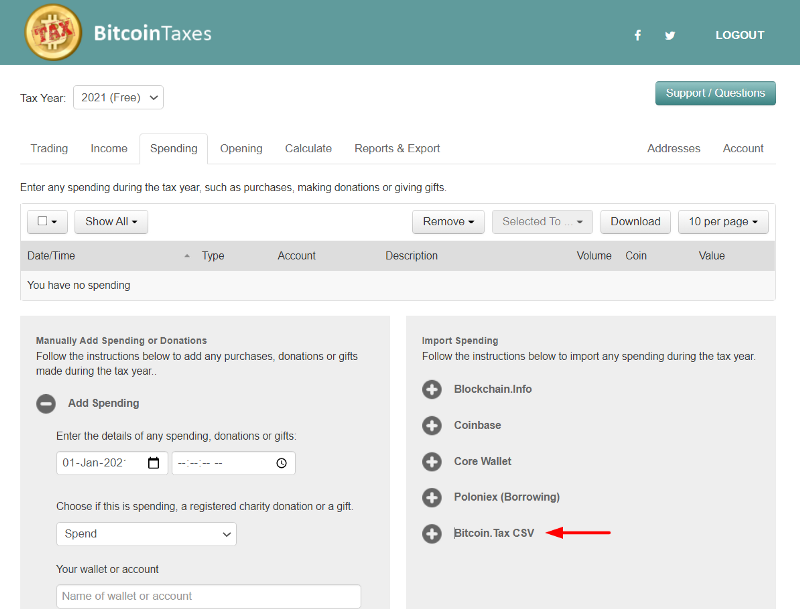

Step 4: Spending

A very similar step to the previous one, the only difference is that you add all your bitcoin spending(s) here.

The sheet that you created in step 3 for the spending(s) will be uploaded here.

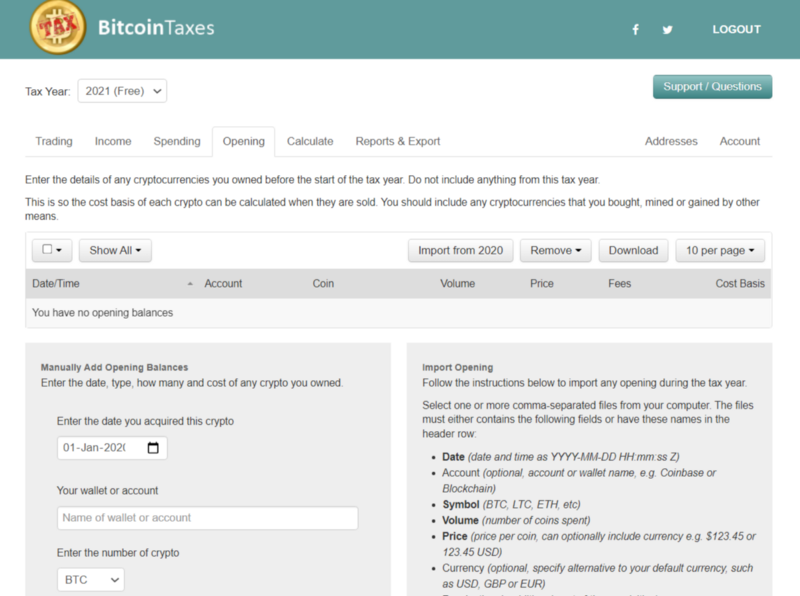

Step 5: Opening

In this tab, you need to add details of any cryptocurrencies you owned before the start of the tax year.

Similar to the previous tabs you have two options, manual and import, and you can choose accordingly based on your preference.

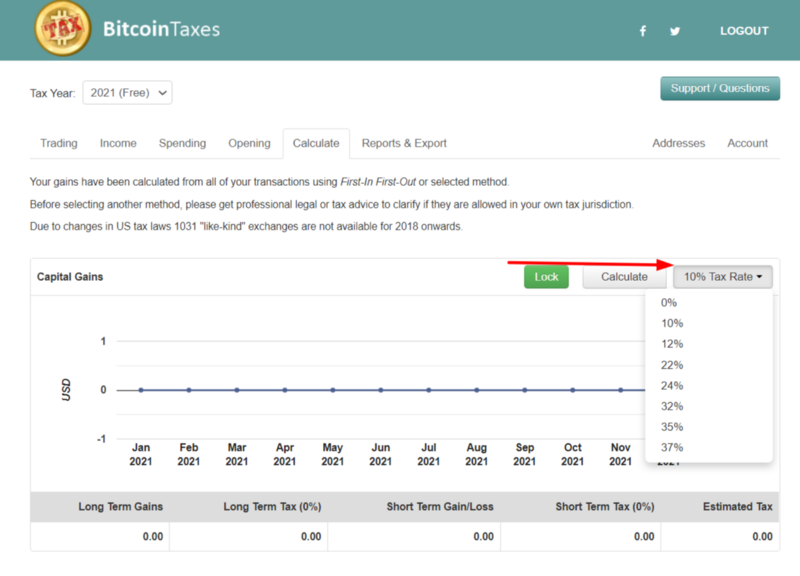

Step 6: Calculate & Export

In this tab, you can calculate your tax liabilities by selecting the appropriate tax rate from the drop-down menu.

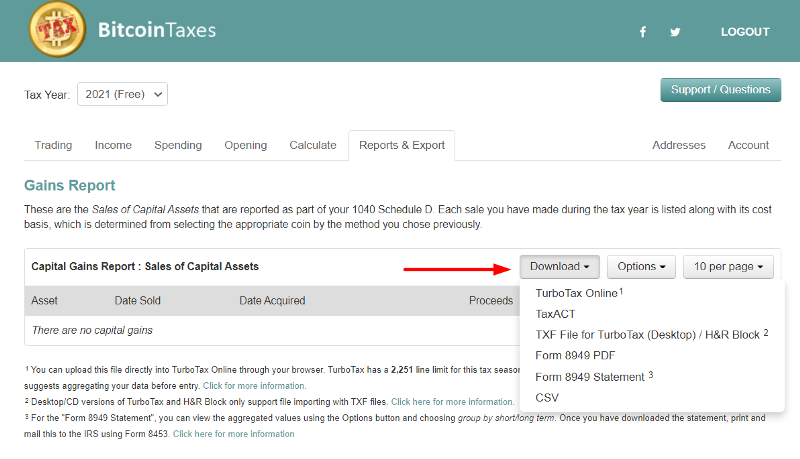

Finally, once the taxes are calculated, you can go ahead to the next tab ‘Report & Export’, and download the tax report based on your desired format.

You can then upload it to whichever tax filing software you are using.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()