How to Manage Funds During Bitcoin Bull Run

Bitcoin is still a new asset class and managing it as a currency can be quite challenging especially during one of its bull runs.

How to Manage Funds During a Bitcoin Bull Run

Bitcoin bull run is an exciting time for a lot of reasons, well the most obvious being the price increase, but there is a lot more to it than just the price, especially for merchants who have been accepting bitcoin for online products/services.

It is one thing to HODL bitcoin as a personal investment and a completely different ballgame when it is used as a currency to run a business.

Bitcoin is still a new asset class and managing it as a currency can be quite challenging for merchants especially during one of its bull runs that tend to skyrocket the price to new heights.

Let’s have a look at how businesses can manage their bitcoin funds during a bull run…

Disclaimer: This is not investment advice, but merely a piece of discussion please perform due diligence and understand the risks involved before making any financial decisions.

History has taught us…

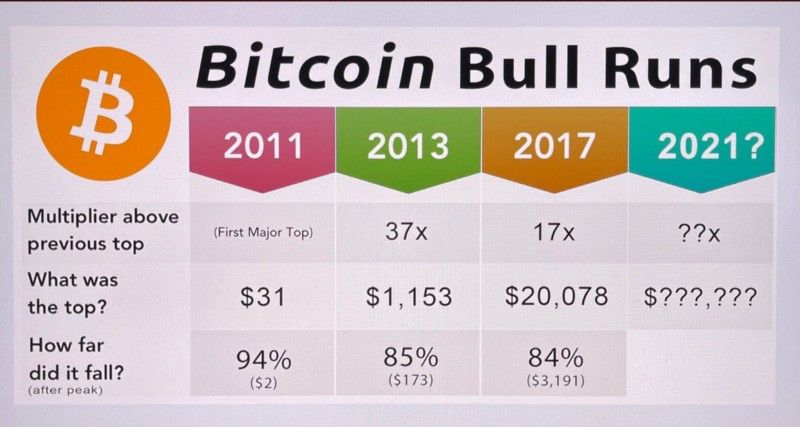

Besides the bull run we are currently witnessing, bitcoin has seen 3 other significant bull runs in the past, one in 2011, 2013, and 2017.

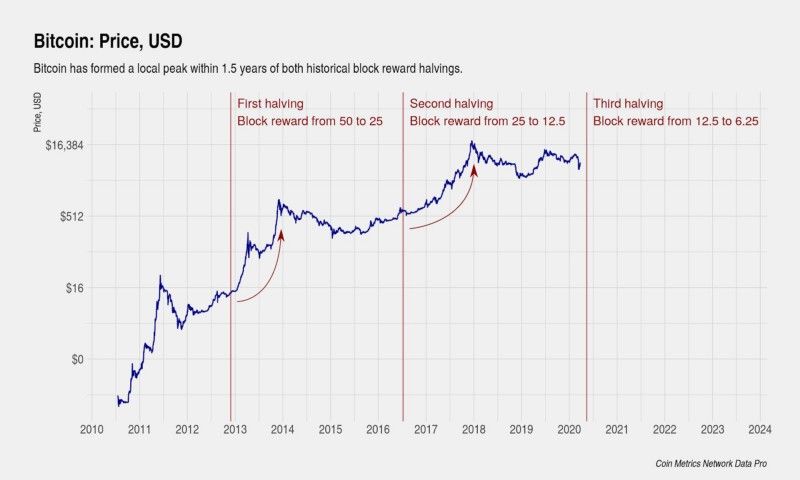

Many analysts have attributed the trigger for the bull run to be bitcoin halving that reduces the supply of bitcoin which in turn increases its value. The hypothesis does seem to hold ground as the bitcoin price peaked within 1.5 years after the last 2 halvings.

But, halving is not the only trigger for the price run, other factors do play a role in the price increase. Mainstream adoption, media, political factors all play a role in the price, in fact, the current bull run of 2021 is largely attributed to the institutional investors who are flocking to buy bitcoin before it's too “late”.

Based on the historical pattern, we can expect to see a bull run a few months from a halving, and also be prepared for the price to crash soon after.

Traditionally such a cycle lasts a few years, hence a proper strategy [a few of those we will be looking at later in the article] should be put in place by businesses that allow them to and keep/increase profits during the bull run and hedge their losses during the price crash

Get Stable…

The most common complaint amongst business owners regarding bitcoin has been its volatility. The massive price swings can make it difficult for owners to manage their business using this crypto.

Thus, it is recommended that you as a business keep a portion of your bitcoin earnings in stablecoin to avoid volatility. Ideally, this amount should be in the ballpark range of the total business expenses needed for the smooth operation of your business.

Converting some of your bitcoin into stablecoin and storing it as a reserve during a bull run has additional benefits, such as:

- It acts as a hedge against bitcoin price drop

- You get a good conversion rate

- Allows for a smooth cash flow

There are quite a few stablecoins in the market, the most popular ones being USDC, Tether, Binance USD. You can go ahead and use any of these or even convert to your desired fiat currency if that is more convenient.

Gotta pay them taxes…

Crypto laws are varied and uncertain all across the world, some countries have definite guidelines while others have nothing at all.

This can certainly pose a challenge for merchants especially when it comes to paying taxes and reporting earnings.

A bitcoin bull run is known to drive the coin price to new highs thus also driving your company's earnings to new heights. An inadvertent consequence being that you are now obligated to pay way more than you owe.

Thus, do take the time to understand the local laws regarding cryptocurrency where your business is based and make necessary arrangements to ensure you pay your fair share. This could be in the form of tax software, lawyers, or an in-house accounting team that keeps the books updated.

You can also convert and store your obligated amount into fiat/stablecoin to avoid bitcoin price volatility.

Why not get more customers?

There is no better time than a bitcoin bull run to convince your customers to start paying in bitcoin if they haven't done so already.

Crypto is still a new concept and many people are hesitant to use it. As bitcoin bull run takes on the mainstream media every time, businesses can use this as an opportunity to increase their bitcoin paying customer base.

In fact, there are quite a few creative ways you as a business can use to increase bitcoin payments on your website during a bull run.

Employees matter…

Who doesn't like rewards?

Your employees are one of the most important assets of your business so why not let them know.

As bitcoin bull run increases your company’s reserve value you can take a small percentage out and use it to provide incentives to your employees in any way that you like, it could be in the form of, bonuses, gifts, trips, prizes, or whatever resonated with your company culture.

This small gesture can go a long way in increasing employee satisfaction and motivating them to work harder and stay longer.

Bitcoin bull run is an exciting time and businesses can reap its benefits if planned properly.

Converting to stablecoins provides a hedge against the imminent bitcoin price drop plus also gives a good conversion value.

In addition, businesses can use this time to increase employee motivation by providing incentives and also acquiring more bitcoin-paying customers.

Bonus Tip: Cold Storage…

Cold storage currently is one of the safest methods to store your bitcoin and anyone holding bitcoin, whether a business or an individual should invest in one.

Regardless of the price, do invest in cold storage options for your crypto asset holdings if not already done so.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()