How to Pay with Bitcoin for Goods and Services: Step-by-Step Guide

Bitcoin is a decentralized digital currency that has gained significant popularity since its creation in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto. Bitcoin operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

One of the primary use cases of Bitcoin is as a medium of exchange, allowing individuals and businesses to make payments for goods and services. Paying with Bitcoin offers several unique advantages compared to traditional forms of payment, such as cash or credit cards. In this article, we explore the step-by-step process of making payments using Bitcoin.

Table of Contents:

- Making a Purchase with Bitcoin: Step-by-Step Guide

- Advantages of Using Bitcoin for Payments

- Tips for Smooth Bitcoin Transactions

- Conclusion

- FAQs

Making a Purchase with Bitcoin: Step-by-Step Guide

Step 1: Set Up Your Bitcoin Wallet

Before you can purchase with Bitcoin, you need to set up a Bitcoin wallet. A Bitcoin wallet allows you to store, send, and receive Bitcoin. There are various types of Bitcoin wallets, each with its own advantages and security features. The main categories of Bitcoin wallets include:

Hot Wallets

- Desktop: This is an application that you can install on your computer and use like any other software on your computer. It offers a good balance of security and convenience for on-the-go transactions. Some good desktop wallets include Exodus, Electrum, and Armory.

- Web: These are online wallets that you can access through a web browser. They are convenient but may be less secure since they are hosted on a third-party server. This means that in case of a security breach on the server, your wallet could be compromised. Freewallet and Blockchain.com are a few popular web wallets in the market.

- Mobile: These are wallets designed for use on mobile devices and are available as apps. They are very convenient for on-the-go transactions. MyCelium, Coinomi, and Trust are some of the popular mobile wallets.

Since hot wallets are connected to the internet they are usually more vulnerable to hacks and attacks, thus it is a good practice not to store large amounts of crypto in these wallets.

Only store a small amount or the amount you need for day-to-day transactions. For long-term storage, it is prudent to consider cold wallets.

Cold Wallets

- Hardware: Hardware wallets are physical devices designed specifically for storing Bitcoin securely. They resemble USB drives and are considered one of the most secure options since your private keys remain offline. Trezor and Ledger are two of the most popular wallets in this category.

- Paper: A paper wallet involves printing your Bitcoin private and public keys on a physical piece of paper. It's highly secure but needs caution to prevent it from physical damage.

Choose the wallet type that best aligns with your preferences and security requirements.

Also, given you alone are responsible for your crypto's safety consider exploring some best practices to secure your bitcoin.

Step 2: Acquire Bitcoin

Once you've set up your Bitcoin wallet, the next step is to acquire Bitcoin. There are several ways to obtain Bitcoin, depending on your preferences and location. Some common methods include:

Cryptocurrency Exchanges:

Cryptocurrency exchanges are online platforms that allow you to buy, sell, and trade various cryptocurrencies, including bitcoin. To acquire Bitcoin through an exchange, you'll need to

- Create an account,

- Complete identity verification (KYC),

- Link a payment method (e.g., bank account or credit card), and

- Place an order to purchase Bitcoin.

Popular cryptocurrency exchanges include Coinbase, Binance, and Kraken.

Peer-to-Peer (P2P) Platforms:

P2P platforms connect buyers and sellers directly, facilitating Bitcoin transactions without the need for an intermediary. Users can negotiate prices and payment methods with individual sellers on these platforms.

Paxful, and HodlHodl are two good examples of P2P exchanges.

You can even consider decentralised P2P exchanges which run on smart contracts and are not run by a central intermediary. There is no need for KYC to use these services but liquidity is usually a problem on such platforms. Bisq is one such example.

Bitcoin ATMs:

Some locations in countries such as El Salvador, USA, and Germany have Bitcoin ATMs where you can buy Bitcoin using cash or a debit/credit card. You simply follow the on-screen instructions, provide your wallet address, insert cash or use your card, and receive Bitcoin in your wallet.

With Bitcoin now in your wallet, you're ready to use it for making purchases, whether online or in physical stores.

Step 3: Discover Merchants that Accept Bitcoin Payments

After setting up your Bitcoin wallet and acquiring Bitcoin, you are not ready to pay with Bitcoin for goods and services. Your next step is to discover merchants or businesses that accept Bitcoin as a payment method. Here's how to find such merchants:

E-commerce Platforms:

Many e-commerce platforms, such as Shopify, WooCommerce, and BigCommerce, offer plugins or integrations such as Blockonomics that enable businesses to accept Bitcoin payments on their websites. When shopping online, check if the e-commerce website you're using offers Bitcoin as a payment option during the checkout process.

Cryptocurrency Payment Processors:

Some businesses use cryptocurrency payment processors like Blockonomics, CoinPayments, and Coinbase to accept Bitcoin payments. These payment processors offer services to merchants, making it easier for them to integrate cryptocurrency payments into their websites and physical stores. Look for merchants that mention they accept Bitcoin through these processors.

Online Directories and Websites:

Several online directories and websites are dedicated to listing businesses that accept Bitcoin. These directories can help you discover a wide range of options for making Bitcoin payments. Some popular Bitcoin merchant directories and websites include:

- SpendBitcoins: SpendBitcoins provides a directory of businesses and services that accept Bitcoin payments, sorted by category and location. You can search for local or online merchants.

- Coinmap: Coinmap is a global map that displays the locations of businesses and ATMs that accept Bitcoin. You can use this tool to find nearby physical stores and services that welcome Bitcoin payments.

- AcceptBitcoin.Cash: This website provides a list of online merchants and websites that accept Bitcoin Cash (a variant of Bitcoin). While it focuses on Bitcoin Cash, you may find some businesses that accept Bitcoin as well.

Step 4: Shop for Goods or Services

After you've set up your Bitcoin wallet, acquired Bitcoin, and discovered merchants that accept Bitcoin payments, you're ready to shop for goods or services using your cryptocurrency. Start by browsing the online store or physical shop of the merchant where you intend to make your purchase.

Add the items or services you wish to buy to your shopping cart, just as you would with any other payment method. Once you've added all your desired items to your shopping cart, proceed to the checkout page. Here, you'll typically review your order to ensure it's accurate and complete.

Step 5: Make the Payment with Bitcoin

After selecting your desired goods or services and reaching the checkout page, you'll now make the actual payment with Bitcoin. During the checkout process, you should have the option to select your preferred payment method.

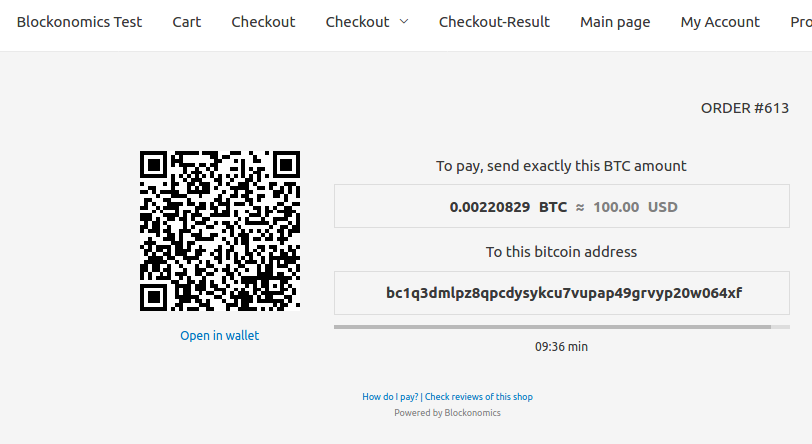

[1] Look for the Bitcoin payment option, which may be labeled as "Pay with Bitcoin", "Bitcoin Payment" or something similar. Select this option to initiate the Bitcoin payment process. You will be shown 2 things:

- A bitcoin address

- The amount to pay [in BTC and equivalent fiat]

- QR code

This Bitcoin address is where you need to send the payment to complete the transaction. Now, head on over to your Bitcoin wallet and select "Send", you can either copy the details from your checkout page [address and amount] or scan the QR code displayed for quicker entry.

[2] Review the payment details one last time to ensure accuracy. Pay close attention to the recipient's Bitcoin address and the amount in Bitcoin to be sent. Bitcoin transactions are irreversible once confirmed on the blockchain, so it's crucial to get this information right.

[3] Initiate and authorize the transaction with the appropriate network fees [the fee you pay to the Bitcoin network to confirm your transaction]. After which the Bitcoin network will process it. Bitcoin transactions are added to the blockchain in blocks, and it may take some time for your transaction to be confirmed, this typically takes anything between 10 minutes to a few hours.

[4] Once your Bitcoin transaction is confirmed on the blockchain, the merchant should provide you with confirmation of your payment. This confirmation might be in the form of an email receipt, a confirmation page on their website, or another communication method they use.

And there you go! You just made your first purchase with Bitcoin.

Advantages of Using Bitcoin for Payments

Bitcoin, as a decentralized digital currency, offers several advantages when used for payments. These advantages can make it an attractive option for both individuals and businesses. Here is an outline of some key advantages of using Bitcoin for payments:

Decentralization:

Bitcoin operates on a decentralized network of computers, known as nodes, without a central authority like a government or central bank. This decentralization means that Bitcoin is not subject to government control or manipulation. Transactions can be conducted without intermediaries, reducing the risk of censorship or interference.

Security:

Bitcoin transactions are secured using cryptographic techniques. Each transaction is recorded on an immutable and transparent public ledger called the blockchain. The cryptographic security of Bitcoin makes it highly resistant to fraud and counterfeiting. Once a transaction is confirmed on the blockchain, it is nearly impossible to reverse or alter, providing a high level of trust in payments.

Fast and Global Transactions:

Bitcoin's global accessibility and fast transaction settlement can be advantageous for businesses that operate internationally or for individuals who need to send or receive money across borders.

Financial Inclusion:

Bitcoin can help increase financial inclusion by allowing individuals without bank accounts to participate in the global economy, receive payments, and access financial services through digital wallets.

Privacy and Pseudonymity:

Bitcoin transactions are pseudonymous, as they are linked to Bitcoin addresses rather than real-world identities. While not entirely anonymous, Bitcoin offers a degree of privacy. This privacy feature can be appealing to users who value financial privacy and wish to protect their identity when making transactions.

Ownership and Control:

Bitcoin users have full ownership and control over their funds as long as they have access to their private keys. This control eliminates the need for reliance on third parties, such as banks, and empowers individuals to manage their wealth independently.

Tips for Smooth Bitcoin Transactions

Smooth Bitcoin transactions are essential for a positive experience when using cryptocurrency for payments or investments. Here are some tips to ensure seamless Bitcoin transactions and keep your crypto assets secure:

Use Reputable Wallets:

Choose a trusted and secure Bitcoin wallet to store and manage your funds. Reputable wallets offer strong security measures, user-friendly interfaces, and timely updates to protect your Bitcoin holdings.

Backup Your Wallet:

Back up your wallet's private keys or recovery phrase. In case of wallet loss or device failure, having a backup ensures you can recover your Bitcoin funds.

Secure Your Wallet:

Set a strong and unique password for your wallet, enable two-factor authentication (2FA), and follow security best practices. Enhancing wallet security reduces the risk of unauthorized access and potential theft.

Double-Check Transaction Details:

Carefully review transaction details, including the recipient's Bitcoin address and the amount.

When possible, scan QR codes to input Bitcoin addresses, reducing the risk of manual entry errors.

Be Mindful of Fees:

Pay attention to transaction fees, which can vary based on network congestion and the transaction size. Most wallets automatically adjust your fees according to the network but if they don't make sure you send the appropriate fees to get your transaction confirmed.

Wait for Confirmation:

For larger transactions or when dealing with valuable assets, wait for multiple confirmations on the blockchain. Confirmations increase the security of the transaction by making it more challenging to reverse.

Use Wallet Software Updates:

Keep your wallet software up to date with the latest security patches and features. Updates often address vulnerabilities and improve wallet functionality.

Beware of Scams:

Be cautious of phishing websites, fraudulent schemes, and suspicious offers. Never click unsolicited crypto claims online, most often when something is too good to be true it probably is.

Conclusion

Paying with Bitcoin for goods and services is becoming increasingly accessible and user-friendly. By following the step-by-step guide outlined in this blog, you can navigate the process with confidence.

From setting up your Bitcoin wallet to making the actual payment, understanding the mechanics of these transactions empowers you to harness the benefits of this innovative digital currency.

As the cryptocurrency ecosystem continues to evolve, paying with Bitcoin offers a glimpse into the future of global commerce, where decentralization and security play a central role in how we exchange value.

Frequently Asked Questions

Is it safe to pay for goods and services with Bitcoin?

Yes. Paying for goods and services with Bitcoin can be safe if you take the necessary precautions. It's essential to use secure wallets, verify transaction details, deal with reputable merchants, and stay informed about the cryptocurrency landscape. While Bitcoin offers benefits like security and decentralization, responsible usage and adherence to safety practices are key to a safe payment experience.

How to Convert Fiat Currency to Bitcoin?

To convert fiat currency to Bitcoin, choose a reputable cryptocurrency exchange for the conversion. Deposit fiat currency into your exchange account and place a buy order for Bitcoin, specifying the amount and price. Finally, wait for the order to be executed and receive Bitcoin in your account.

Can I Use Bitcoin for International Transactions?

Yes, you can use Bitcoin for international transactions. Bitcoin offers advantages like speed, lower costs, accessibility, security, and the ability to exchange between different fiat currencies without multiple conversions.

What fees do I pay when I pay via crypto?

The fees you pay when you make a payment via cryptocurrency can vary depending on several factors, including the specific cryptocurrency you're using, the platform or service you use for the transaction, and the current network conditions.

Comments ()