Rise of the Altcoins

Altcoins, so called because they are presented as an alternative to Bitcoin, are increasingly entering the cryptocurrency market. In the…

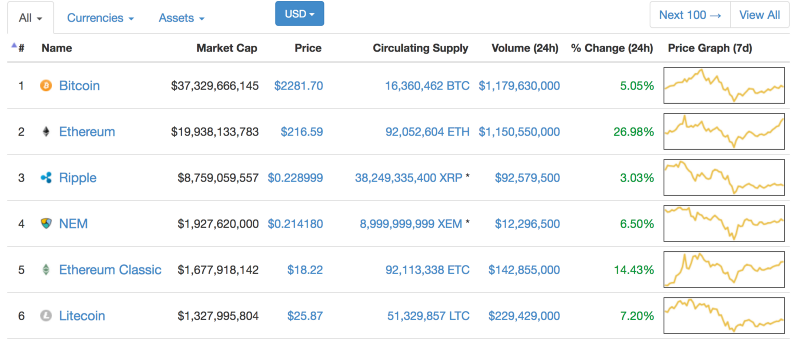

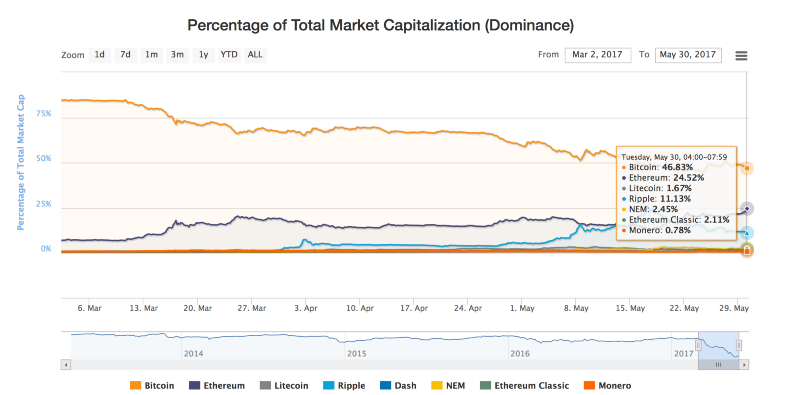

Altcoins, so called because they are presented as an alternative to Bitcoin, are increasingly entering the cryptocurrency market. In the recent boom (and possible bust) as I mentioned in my last article, Altcoins have also participated, being strong players in addition to Bitcoin. Just recently Bitcoin was over 80% of the digital cryptocurrency market, now it’s under half. Just what are these altcoins, what do they hope to achieve, and why have they become so popular? In addition, I will, with the assistant of the charts, show that Bitcoin is still the market leader. When Bitcoin goes up, altcoins follow. Likewise for when it falls. In view of this, I’m looking at Market Capitalization (Market Caps), which is the coins mined multiplied by the price. This post will help to explore that.

Altcoins often try to fill in a gap that some feel Bitcoin does not fill. For example, the first altcoin, created about two years after Bitcoin, was called Namecoin, and sought to, “decentralize domain-name registration, which makes internet censorship much more difficult.” Altcoins often address simple or singular issues of bitcoins, such as transaction speed, or the distribution method. As pointed out in the Cryptocoinnews article linked, most don’t last long. Yet there are some that have stood the test of time such as Litecoin or Ethereum.

Litecoin was one of the early cryptocurrencies, started soon after Namecoin, coining itself (if you’ll excuse the pun) as the “silver to Bitcoin’s gold,” it sought to decrease the time for transactions, using 2.5 minutes to process a block versus Bitcoin’s 10, which is claimed to allow for faster transactions. It also has four times the amount of coins as Bitcoin, or 84 million coins. It grew quickly in the early days, and has occupied a top 5 position in cryptocurrencies for most of its life, spending a large amount of time in the number 2 spot. Currently it sits at 6, because of recent successes of other altcoins and the forking of Ethereum, however its position still remains strong.

This month, Litecoin released a roadmap for its near and distant future, capitalizing on its recent activation of SegWit, a new scaling solution, it hopes to adopt new technology such as Lightning Network, but also adapt it to allow for cross-chain swaps, thus allowing one to use Bitcoin, Ethereum, Litecoin, etc, together seamlessly. Litecoin’s future looks bright, but it is doubtful it will breakout of being the underdog of the underdogs. Nevertheless, it is an altcoin to keep your eyes on.

Bitcoin was founded, in large part, on decentralization. It aims to decentralize online banking and websites like PayPal with Bitcoin and blockchain, allowing for easier and more private monetary transactions. Ethereum takes blockchain to a different level, hoping to decentralize more of the internet by using blockchain to keep the online data of people safer, instead of in the hands of large corporations. Ethereum allows for transactions and digital products to be exchanged using blockchain and the Ether coin. Instead of acting like Bitcoin, which wants to replace other currencies, Ether is used as a tool to make the transactions easier. This can make Ether very volatile, and a possible risky investment when other altcoins might be better. Nevertheless, it is available on major exchanges, and currently sits at number 2, just behind Bitcoin. In 2016 it forked, creating Ethereum Classic which currently holds the 5th spot. Ethereum has garnered a strong following, which is warranted to an extent, because it has different goals when compared to Bitcoin.

Ripple and NEM currently occupy spots 3 and 4, both riding off the recent Bitcoin and cryptocurrency boom. Ripple launched in 2012, though it had its base in the form of Ripplepay from as far back as 2005 although it wasn’t based on blockchain technology. Ripple’s position is interesting because the company itself own 61 percent of its currency, XRP. Because of the recent exponential growth of XRP, Ripple has billions of dollars all of the sudden. This has created concerns that Ripple may release them, flooding the market with billions of dollars worth of coins. However, Ripple has tried to alleviate these fears, by releasing a plan on the entrance of the coins, about a billion per month. Ripple also has the added benefit that a number of companies and banks are starting pilot programs to allow the use of XRP. Time will tell for Ripple though, regarding its 61% of coins in its “coffers.” NEM provides a different approach. With concerns that Bitcoin has gone “mainstream,” NEM, standing for New Economic Movemnet, hopes to fill in the void. NEM’s coin, XEM, can thank much of its growth to Japanese investors due to its Japanese founding roots in 2014. Its future depends on how much Bitcoin and Ripple will replace it though, thanks to recent changes in Japanese regulation of Bitcoin and Ripple’s agreement with the Japanese central bank. However, with NEM’s strong want for decentralization it is certain to continue picking up disgruntled Bitcoin users to supplement its Japanese base.

One common concern with Bitcoin is the limited capacity. This in particular has lead to many of the altcoins on the market to gain popularity and push Bitcoin’s lead down. Since Bitcoin’s conception, people have been looking for fixes to their own issues they have with Bitcoin. Its not decentralized enough, transactions take too long, fees are too high, etc. Nevertheless, Bitcoin still remains in the top spot, and its unlikely it will fall. Much of the altcoin rise over the past few months has been driven along by Bitcoin’s rise. When Bitcoin fell over the last few days, the altcoins fell as well. Altcoins and Bitcoins are linked, they were formed because of Bitcoin, and so they shall forever remain linked. However, altcoins will still provide an alternative to Bitcoin in attempt to fix the issues Bitcoin has, and as long as these alternatives exist, Bitcoin can’t let its guard down.

Next post will look at Bitcoin, altcoins and investment. Hence, consider this article a Part 1 of 2.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()