Top 8 Bitcoin Myths Debunked

Bitcoin in a short span of 10 years has made its mark in the global financial ecosystem challenging some of the most powerful and…

Bitcoin in a short span of 10 years has made its mark in the global financial ecosystem challenging some of the most powerful and well-established institutions that run ‘money’.

This new form of currency has caught the eye of almost every whos who of the power world from tech leaders to economists to politicians, who have expressed mixed reactions to bitcoin.

Whether you are using it or not chances are that you must have heard of bitcoin at least once by now.

But given the fact that there are so many different things being said about bitcoin and that it is in its nascent stage, there are quite a few myths that have come to be associated with it.

Let’s debunk some of these myths!

1. Craig Wright is Satoshi Nakamoto

Craig Wright is an Australian computer scientist and businessman who publicly claims to be Satoshi Nakamoto, the mysterious inventor of Bitcoin.

In 2015, several news outlets published claims that Craig Wright is the man behind Bitcoin. Craig has openly embraced the assertion and publicly claims to be the rightful owner of bitcoin.

Since then crypto communities across the world have lit up rejecting Craig’s claim and calling him a fraud as his claims are disputed by lack of evidence.

Even Vitalik Buterin, the inventor of Ethereum came out to express his disbelief over the claim.

2. It has no intrinsic value

This argument against bitcoin is nothing new, in fact, bitcoin oppositionists have used this particular statement over and over to bring down bitcoin.

Andrew Bailey, Bank of England governor said, “If you want to buy it, fine, but understand it has no intrinsic value. It may have extrinsic value, but there is no intrinsic value.”

What's more interesting is that he is not the only high profile figure who has voiced this claim against bitcoin. Public figures such as Warren Buffet, Mark Cuban, Donald Trump have all voiced this particular sentiment towards bitcoin.

By definition, intrinsic value refers to the true, inherent, and essential value of an asset, commodity, or currency.

Bitcoin was created as a hedge against the tyrannical banks and governments who manipulate the fiat currency at their will. Plus, it was created with a set of defining rules and principles that equips it with all the characteristics that ‘money’ should have.

According to the founder of Quantum Economics Mati Greenspan;

Intrinsic value is defined as ‘an investor’s perception of the asset’s value,’

And it seems that bitcoin is perceived pretty well in the eyes of millions of its users.

3. Bitcoin is a bubble

Bitcoin has been identified as a speculative bubble by some notable Nobel prize laureates, central bank officials, investors, business executives, some of which include Paul Krugman, Warren Buffett, Jack Ma.

Bitcoin exponential rise from nothing to a $241 billion market cap in a matter of a decade is something that has baffled even the brightest economists of our time.

There have been multiple times when bitcoin was declared burst or dead but every time it has bounced back.

More than anything that is keeping bitcoin going is its underlying piece of technology that ultimately provides people with ‘sound money’. A new form of money for the digital age.

People from all over the world are realizing its potential and engaging in commerce which in turn drives its value up. It is estimated that there are about 100 million bitcoin users performing almost 350K bitcoin transactions per day.

4. Bitcoin is not Real Money

Let’s take a moment to look at what makes a currency ‘good’.

Scarcity: A limited supply of a currency gives it value. Bitcoin’s supply is limited to 21 million while fiat has no cap.

Divisibility: Dividing any currency into smaller denominations is important for its economic use. Bitcoin and fiat both possess this quality.

Transportability: The ability to easily send and receive money is an important factor in a currency’s practical application. Contrary to fiat currencies, bitcoin can be sent anywhere and to anyone in the world in a matter of minutes (for a fee).

Durability: A currency needs to be strong enough to withstand any loss of value. Thankfully bitcoin used blockchain technology to operate which is much stronger than any fiat currency that ever existed.

Acceptability: For any currency to be useful it should be accepted by the people. This should not be a problem for bitcoin thanks to its ~100 million and growing users worldwide.

Uniformity: Currency needs to stay the same despite where it is used and for what purposes, this increases trust and recognition for the currency. This cannot be more true for bitcoin as it is a digital currency, which means it is the same everywhere no matter who is using it.

5. Bitcoin is only for tech-savvy people

Private keys, Public keys, blockchain, hash rates, are some of the things you might have heard when talking about bitcoin.

And in all fairness, given the tech-oriented nature of bitcoin, there might be a smidgen of truth in this myth.

That being said, it only appears to be complicated and tech-oriented for someone on the outside looking at bitcoin. Once you get to use it, it actually is pretty simple and straightforward. Of course, there are a few things that need to be learned but well that's true for any new piece of technology that enters the market.

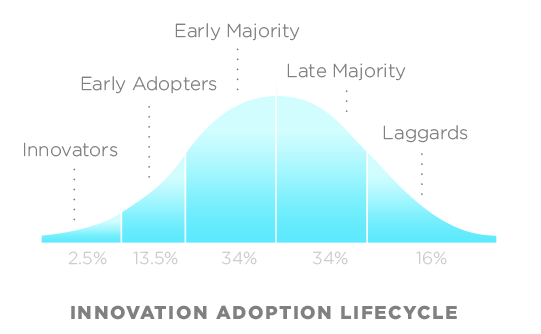

Bitcoin seems to be going through an innovation adoption ‘bell curve’, which applies to the advent of any new technology.

6. Bitcoin has been hacked

Over the past several years, there has been a lot of news on bitcoin being stolen from major cryptocurrency exchanges.

Major cryptocurrency exchanges like Mt.Gox, Bitfinex, Binance, and many more have been subject to cyber-attacks and had millions of dollars worth of bitcoin stolen.

Just recently, there was a first-of-a-kind bitcoin scam that shocked the world. Twitter accounts of some high profile figures were hacked, urging the public to make bitcoin donations.

Such news seems to have spread a belief that bitcoin is easily hackable. This is similar to saying that if a criminal steals USD from a bank then USD got hacked.

So let’s set the record straight, Bitcoin has never been hacked.

Almost all the cases of bitcoin being stolen were due to breaches in the companies that were dealing with bitcoin.

Bitcoin operates on a blockchain which is an extremely safe and reliable piece of technology.

7. It is used for criminal activity

A very common argument that you hear against bitcoin is that it is used by criminals for illegal activities.

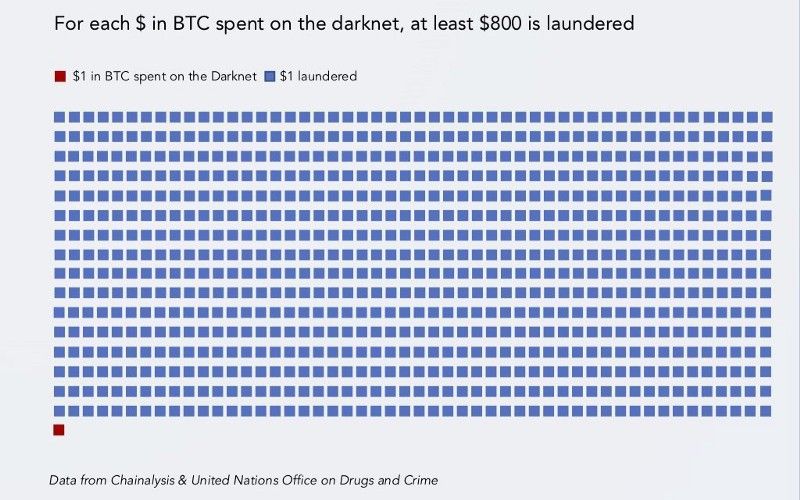

The truth in fact is that all currency including fiat and the coveted US dollar is used for illegal activities.

Even to this day, the fan-favorite for criminals is good-old paper money.

A report recently published by the United Nations Office of Drugs and Crime (UNODC) showed that for each $1 spent in BTC on the dark web, $800 in USD is laundered.

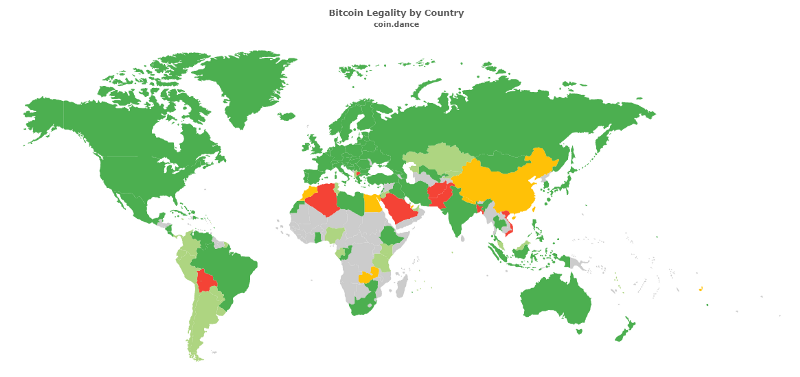

8. It is Illegal

A lot of people have been shying away from bitcoin because it is perceived as illegal.

The truth however is a little more complicated than that. In most regions, bitcoin would be classified as neither legal nor illegal.

Bitcoin and cryptocurrency is a new technology that birthed itself a decade ago. Despite its meteoric rise it is still being understood and analyzed by most governments.

This is why the legal climate surrounding bitcoin changes quite rapidly and is different for each region, as of writing this article bitcoin’s legality by country can be seen in the illustrative map below,

But, there is a counterargument to the aforementioned point, which states that legality for bitcoin is not essentially relevant as it is designed to give power back to the people.

Citizens from a country like Venezuela have been using bitcoin amid the failing Venezuelan currency. In such cases, bitcoin legality is irrelevant as it transcends beyond such regulations and empowers people in tough political climates.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()