Top Crypto Tax Platforms for 2022

Whether people like it to not but crypto taxes are becoming a thing, many major countries have already drafted laws that tax users for…

Whether people like it to not but crypto taxes are becoming a thing, many major countries have already drafted laws that tax users for crypto-asset, may it be trades, gifts, earnings, or even NFT sales.

But calculating these crypto taxes can be a challenge. With most people using multiple wallets, trading on numerous exchanges, and holding assets all over the place, it is no surprise that generating tax reports is not easy.

That’s where crypto tax software come in, with these platforms you can not only aggregate all your crypto assets in one place but also generate tax reports that calculate your tax liability and in some cases also help you save up some money.

With various reporting standards, diverse crypto asset classes, and required expertise, it is important to pick the right software for you. And that is what this list aims to help you with.

Here are the top crypto tax softwares for 2022…

Koinly

One of the best crypto tax software, Koinly, offers a plethora of features to its users coupled with a top-notch platform that can generate your tax reports in a matter of minutes.

Koinly easily connects with crypto exchanges, wallets, blockchains, and services and supports 17,000+ cryptocurrencies. In addition, Koinly is one of the few platforms that offer multi-country support.

As for tax reports, it supports most major filling standards including, FIFO, LIFO, HIFO, Average Cost, Share Pooling & Spec ID. You can even export reports to filing software such as TurboTax, H&R, TaxACT, etc.

It even has a dedicated portal for tax professionals who manage taxes for other clients.

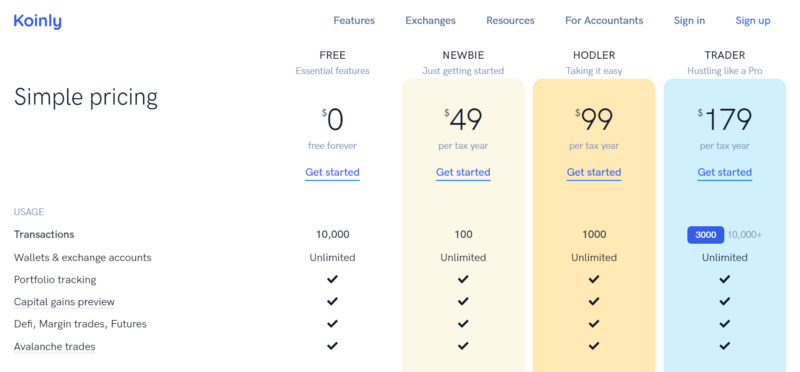

Pricing:

- Free: $0/year

- Newbie: $49/year

- Hodler: $99/year

- Trader: $179/year

Pros:

- Feature-rich

- Integrations: 350 exchanges, 50 Wallets, 11 services, 50 blockchains

- 6+ years historical data

- Error Reconciliation: Fix errors in your data

Cons:

- Downloading tax reports is paid

- Not all countries supported

Accointing

Another great tax crypto tax software, Accointing, allows users to easily generate tax reports as well as review their crypto transactions from all the sources.

With more than 300 integrations, Accointing, is well equipped to import data from most crypto-related services, may it be wallets, exchanges, mining software, and much more.

Additionally, it also offers a crypto portfolio tracker, where you can keep track of all your crypto assets and get a holistic view of your investments.

The main countries supported are USA, UK, Germany, Switzerland, Australia, and Austria.

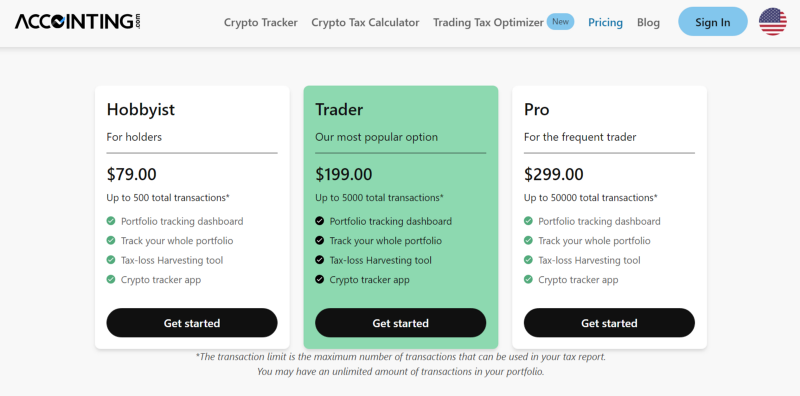

Pricing:

- Hobbyist: $79/year

- Trader: $199/year

- Pro: $299/year

Pros:

- Wide selection of integrations

- Portfolio tracker

Cons:

- Expensive

- Limited global country support

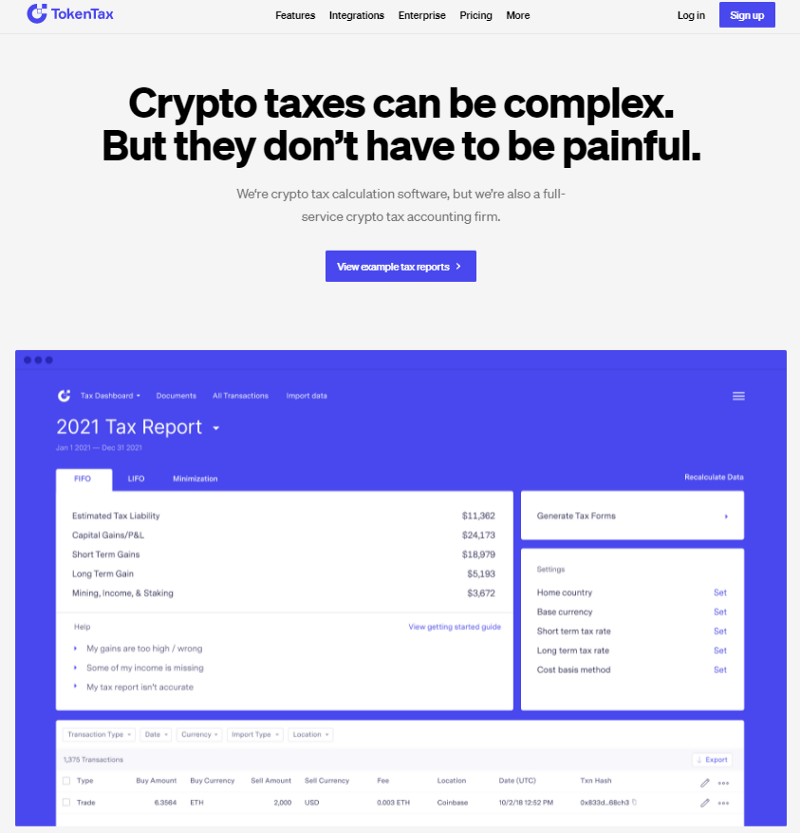

TokenTax

Launched in 2017, TokenTax, is a full crypto tax software, that takes the complexity of tax filing away from its users. It is one of the few software that offers a human touch to provide a better experience.

TokenTax, integrates with a majority of wallets and exchanges plus also allows API and CSV file imports.

In addition to generating tax reports, TokenTax, offers its VIP clients the ability to have tax experts review their reports and suggest any changes or discrepancies that might get overlooked.

Its mainly equipped for the US tax filing system but users from other countries can easily generate and export reports.

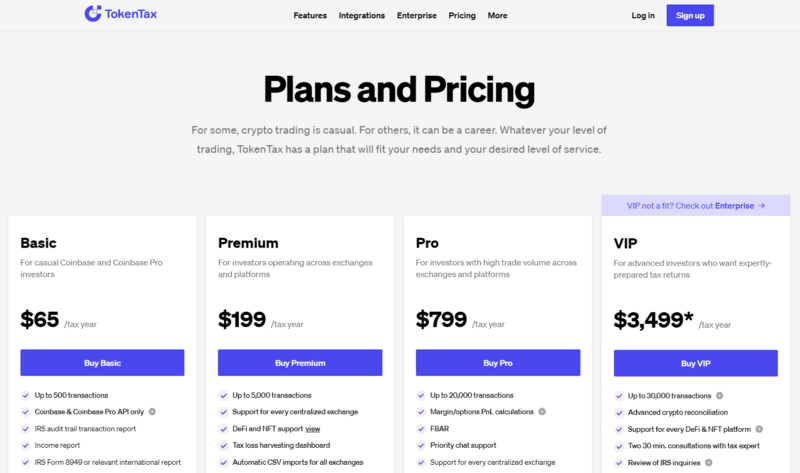

Pricing:

- Basic: $65/tax year

- Premium: $199/tax year

- Pro: $799/tax year

- VIP: $3499/tax year

Pros:

- Tax consultation options

- Good UI

Cons:

- Limited integrations

- Very limited country support

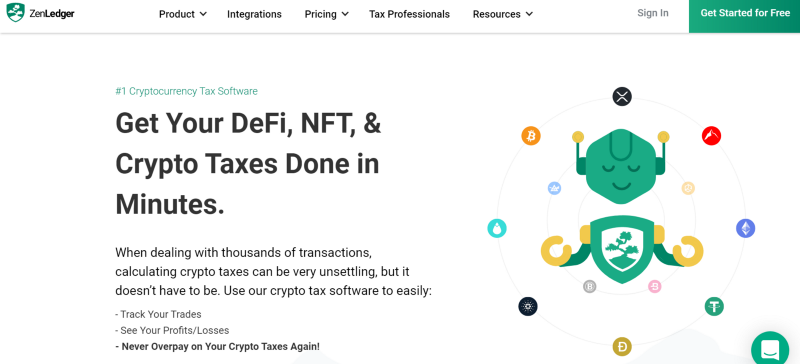

ZenLedger

One of the most feature-rich and exhaustive crypto tax software, ZenLedger, offers a multitude of integrations and reports to its users.

With 400+ integrations to various wallets, exchanges, and blockchains plus 30+ Defi protocols, ZenLedger has you covered when it comes to importing your data into the system.

It also supports almost all types of tax forms that are valid in most Western countries.

Additional features include ‘Grand Unified Accounting’, ‘Loss Harvesting tools’, and ‘consultation from tax professionals’.

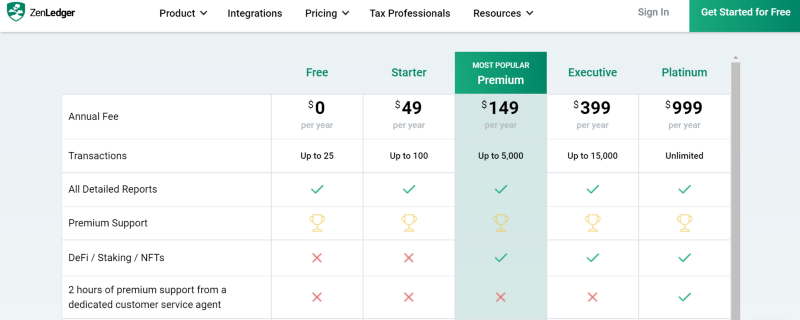

Pricing:

- Free: $0/year

- Starter: $49/year

- Premium: $149/year

- Executive: $399/year

- Platinum: $999/year

Pros:

- Very feature-rich

- 400+ integrations & 30+ Defi protocols

- Grand Unified Accounting and Loss Harvesting tools

- NFT support

Cons:

- Can get challenging for beginners

- Most additional features are available for high paying customers

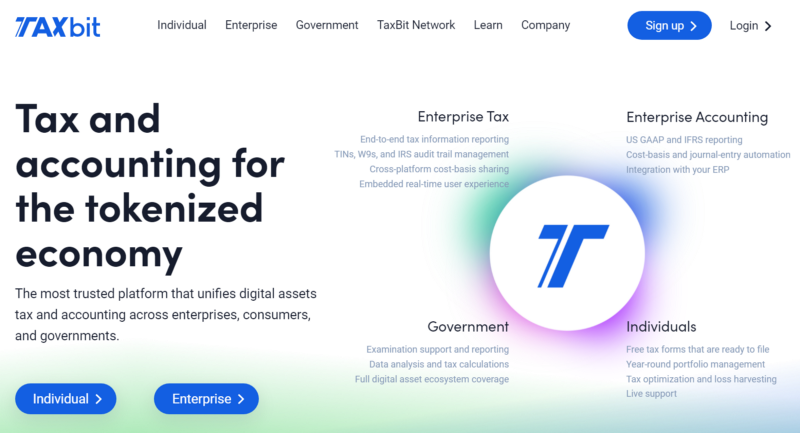

TaxBit

A unified tax and accounting software for digital assets, TaxBit, offers services that connect individuals, enterprises and governments.

While most tax softwares are geared toward individuals, TaxBit’s distinctive feature is that it can be used by large-scale corporations as well as individuals.

For individuals, it offers free tax reports that are ready to file as well as year-round portfolio management.

For Enterprises, it offers accounting and tax solutions, some of its features include:

Accounting:

- US GAAP and IFRS reporting

- Cost-basis and journal-entry automation

- Integration with your ERP

Tax:

- End-to-end tax information reporting

- TINs, W9s, and IRS audit trail management

- Cross-platform cost-basis sharing

For Government, TaxBit provides data analysis, tax calculation and examination support, and more, working with some of the largest regulatory agencies.

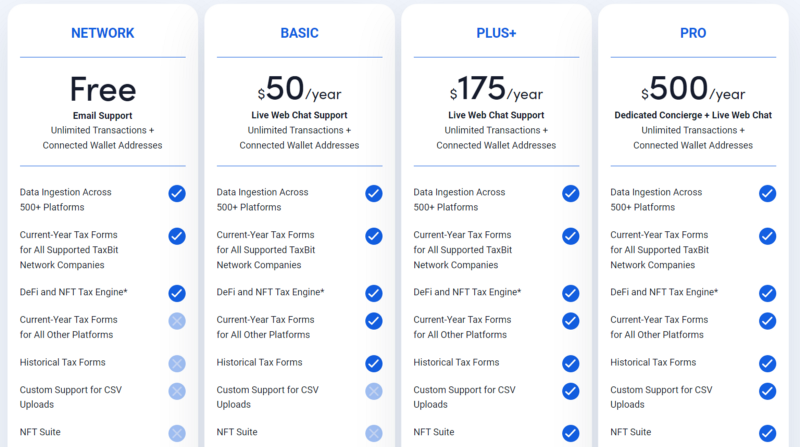

Pricing:

- Network: $0

- Basic: $50/year

- Plus+: 175/year

- Pro: $500/year

Pros:

- Highly feature-rich

- Support for Enterprise and Government

- Large network

- Good customer support

Cons:

- Only US support

- Most features are available for paid customers

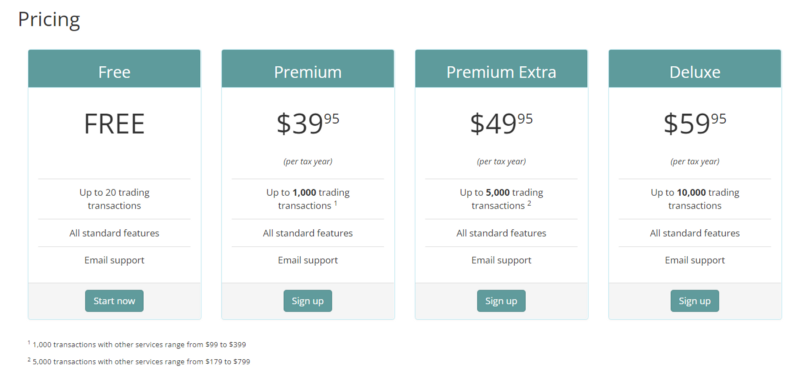

Bitcoin.tax

Perhaps one of the oldest and long-standing crypto tax software, Bitcoin Tax, was established in 2013 and has been the leader in providing bitcoin tax solutions to customers in the USA and worldwide.

Bitcoin Tax aims to provide a simple and easy way to you to file your taxes which is evident from its easy-to-use UI making it ideal for beginners or experienced crypto users.

Most popular crypto exchanges can be integrated into the platform plus it also supports CSV file imports. But compared to other crypto tax software its integration support is rather limited.

Additionally, it offers ‘Full Tax Preparation service’ as well as ‘Audit Defense Service’.

Pricing:

- Free: $0/year

- Premium: $39.95/year

- Premium Extra: $49.95/year

- Deluxe: $59.95/year

Pros:

- Easy and simple UI

- Multiple tax filing systems supported

Cons:

- Limited integrations

- Defi and NFT not supported

- Rather pricy for services offered

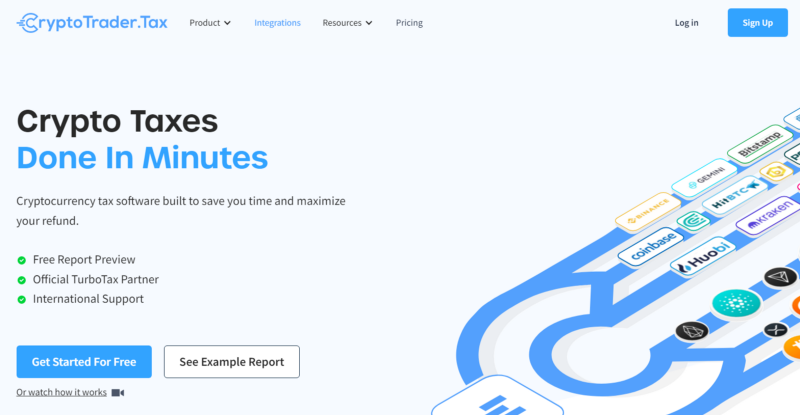

CryptoTrader.Tax

Launched in 2017, CryptoTrader.tax, aims to make crypto tax reporting easy for everyone. With a clean—modern UI, multiple integrations, and a user-friendly platform, Cryptotrader.tax makes tax filing easy.

It offers integrations with crypto wallets, exchanges, and even Defi protocols so you can manage taxes for all your crypto assets.

The distinctive feature of this software is that it has a Tax Professional suite which can be used by tax professionals to manage taxes of their clients.

Additionally, it offers ‘tax-loss harvesting’ solutions as well as ‘TurboTax integrations’.

Pricing:

- Hobbyist: $49/tax year

- Day Trader: $99/tax year

- High Volume: $199/tax year

- Extreme: $299/tax year

Pros:

- Multiple crypto income sources supported

- Most major tax reports are supported

- Tax-loss harvesting

Cons:

- No real-time tax professional support

- Mainly for US customers but can be used internationally to generate reports

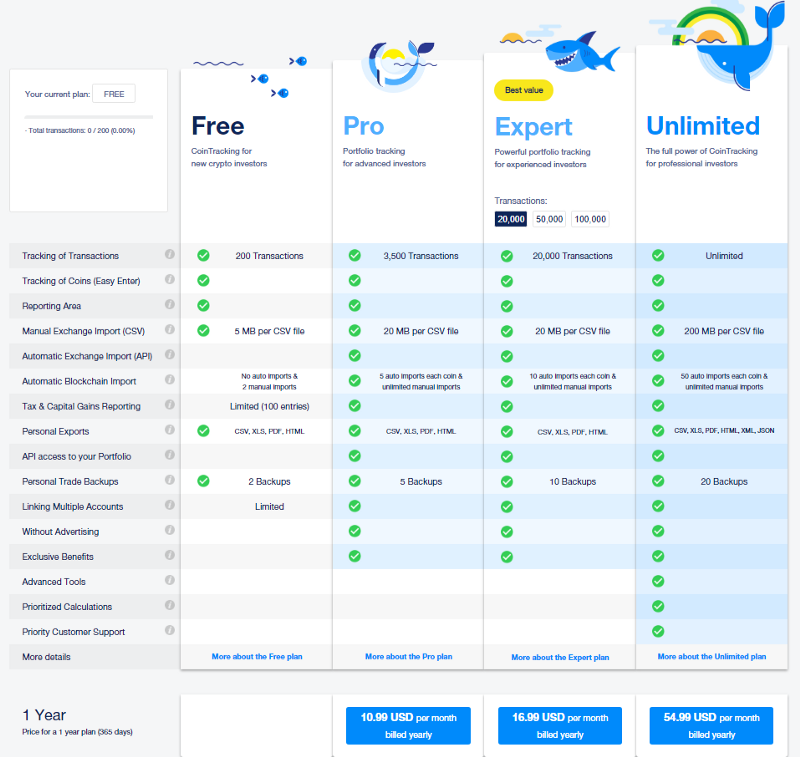

CoinTracking

A crypto tracking and tax report software, CoinTracking, has been around since 2013 and was the world’s first cryptocurrency tax reporting tool and portfolio manager.

With robust features and 100’s of integrations, CoinTracking, makes generating tax reports easier than ever. It even supports historical data for up to 13 years for its users.

Additional services include tax consultation with professionals and an exhaustive help section with videos and blogs.

Pricing (billed annually):

- Free

- Pro: $10.99/month

- Expert: 16.99/month

- Unlimited: $54.99/month

Pros:

- Multiple Integrations

- Crypto Portfolio Tracker

- Tax Professionals Support

Cons:

- Dashboard can be overwhelming for new users

- No ICO or Defi support

- Expensive

Conclusion

With multiple options in the market choosing the right tax software can be a daunting task, but once you know the features and offering that these softwares provide, it is much easier to pick the right one for you.

Before choosing any software do take into consideration if your country or tax filing standard is supported.

Koinly and Accointing are the most popular choices and offer lots of features with multiple country support and numerous reporting standards.

ZenLedger is perhaps one of the most feature-rich software available in the market and if you have the need for it then definitely this way.

If you are a tax professional then using Cryptotrader.tax or Koinly is the way to go as it offers a dedicated suite to manage clients.

For Enterprises or Governmental organizations, Taxbit would make for a good choice as it is one of the few ones that cater to them.

For a simpler experience, you can choose TokenTax, Bitcoin.tax, or Cointracking.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()