Which Is The Most Decentralized Cryptocurrency?

The concept of decentralization is not a new one but is seldom heard in the financial sphere. The traditional financial institution that…

The concept of decentralization is not a new one but is seldom heard in the financial sphere. The traditional financial institution that prevails the world is known to be notoriously centralized.

In fact, it is the advent of cryptocurrency that ushered in an era of decentralized finance.

On Oct 28, 2008, a white paper was released by Satoshi Nakamoto, a figure that remains a mystery to this date. The paper outlined a peer-2-peer electronic cash system that allowed transactions between parties without a financial intermediary. This electronic cash system is none other than ‘bitcoin’.

Little did the world know that this paper would revolutionize the financial industry and birth a whole new space in a matter of a few years.

Bitcoin, like most cryptocurrencies that came after it, has decentralization as one of its defining features.

But how decentralized is bitcoin? Is there some other currency that is more decentralized than bitcoin?

What is Decentralisation?

In a financial context, decentralization refers to the ability to perform financial transactions without a third-party intermediary overlooking the transaction.

For a cryptocurrency to be decentralized it needs to have the following features:

No Central Authority

There can be no central authority governing the currency or the blockchain it operates on. Instead, the currency is maintained by a network of distributed computers, and this network is open to all.

The same goes for data, there are no central storage or data servers for a decentralized currency. The information is publicly available and stored in a distributed network, making it extremely safe and efficient.

Not only is the risk of cyber attacks eliminated, but it also adds in a layer of trust amongst its users who can easily access the information whenever they want.

Decision Making

With regards to the maintenance and future upgrades to a decentralized currency, the decision-making is based on the consensus mechanism that takes into account everyone involved in the network.

The network of stakeholders who are involved in the blockchain could include developers, miners, researchers, traders, investors, entrepreneurs, etc.

Issuance

The issuance of a decentralized currency is often dictated by the defining parameters which were drafted during its inception. The beauty of it is that it cannot be manipulated or tampered with.

This means that there is only a fixed amount of currency that will be in circulation at any given time.

Contrary to centralized fiat currency, whose issuance and value are easily manipulated by government bodies, decentralized currencies follow the protocols on which they were built.

Use

Anyone and everyone can use a decentralized currency.

There is no need for approval, ID checks, or geographical restrictions to use a decentralized currency. It is open to everyone and anyone around the globe.

And this open access is not just limited to its use of performing transactions, even the issuance of new coins is open to the public. Almost anyone can start issuing new coins for a decentralized currency as long as they are following the specified protocols designed for that currency.

What is the most decentralized currency?

To answer that question lets have a look at some of the top long-standing cryptocurrencies:

Bitcoin

Bitcoin [BTC] is widely regarded as the most decentralized blockchain although there are some arguments against it.

The majority of Bitcoin nodes use bitcoin core as their client to run the blockchain, making it highly centralized when it comes to client usage. Additionally, any updates/changes to the bitcoin network are contributed by a small handful of developers making it a centralized ecosystem.

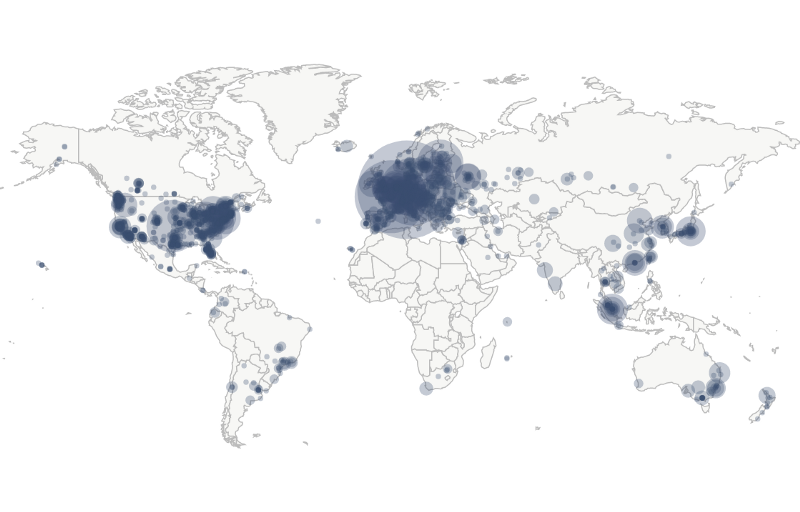

When it comes to Bitcoin nodes, although they are distributed all across the globe, there is a fairly high concentration on them in the USA and Germany accounting for almost 12% each.

Bitcoin uses a Proof-of-Work (POW) consensus mechanism which is notoriously energy-intensive and requires the use of specialized hardware.

The process of creating new bitcoin as well as processing transactions is known as mining. Although on paper this is an independent and open-to-all process, meaning anyone can become a miner [as long they have the necessary hardware] and start minting bitcoin, this is not the case in the real world.

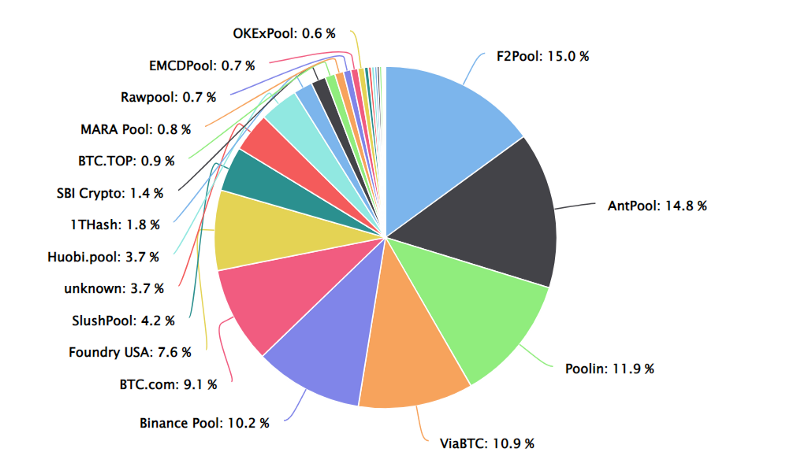

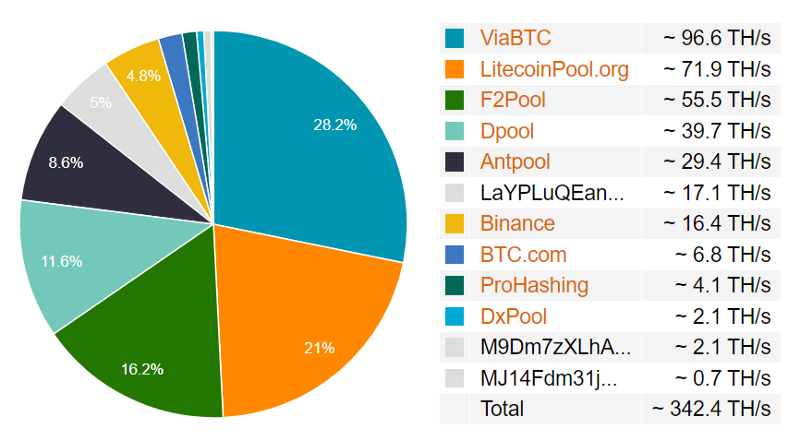

Mining is an extremely competitive process and the chances of a small miner getting selected to mine a block are rare forcing these independent miners to hand over their mining power to big mining pools.

This concentrates the mining power to a handful of mining giants who now have tremendous control over the network.

A similar incident happened in 2014 when one mining pool managed to concentrate more than 50% of bitcoin hashing power, making the network susceptible to attacks and manipulation. Thankfully nothing of such sort happened but it did raise alarms in the bitcoin community.

As of last year, no pool has managed to get more than 15% of hashing power.

There is no question over the fact that as more miners join the network the more decentralized it becomes. But the hard entry barrier does bring into question its decentralized nature.

The volume of BTC traded in exchanges stands at $34 Billion, putting it in the 2nd spot in the top cryptocurrencies traded by volume in a 24H period.

While the total BTC addresses currently stand at 918K, with a rather flat curve over the last 3 years indicating not much change.

Ethereum

Ethereum [ETH], the second-largest cryptocurrency by market cap, has been around for almost 7 years now and has a very active developer community more so than bitcoin.

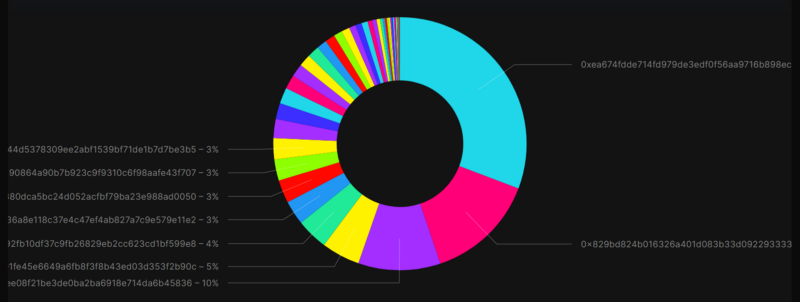

But, its development is highly centralized following the vision of its creator Vitalik Buterin, who can steer the project to his liking. In addition, there is no consensus mechanism to approve any changes to the protocol which makes this coin highly centralized in the development aspect.

Additionally, Ethereum uses a geth codebase to run its blockchain, which means any compromise or vulnerability to this codebase could put the whole blockchain in danger.

Ethereum nodes are also fairly centralized in their global distribution, with the USA having 41% of the nodes followed by Germany with 15%.

Ethereum is a proof-of-work (POW) coin that operates in a similar fashion as bitcoin making the process centralized by fostering large mining pools that control significant hash power.

But, Ethereum is set to transition to a proof-of-stake (POS) algorithm sometime in 2022 with its launch of Ethereum 2.0, making the blockchain significantly more decentralized as it does not require people to participate in mining pools or invest in heavy equipment.

However to become a full validator node, one must stake at least 32 ETH, a significant investment at the current market price of ETH.

But apart from the initial investment, the process to become a full node validator is open to all making the entry barrier significantly lower than before and making the network more decentralized.

As for the volume of ETH traded in exchanges, looking at the past 24H data, the volume stands at $17 Billion, putting it in the top 3 cryptocurrencies traded by volume in a 24H period.

While the total ETH addresses currently stand at 821K, with a constant increase since ’17. Although the 20% of ETH is concentrated in only 10 ETH addresses.

Monero

Monero[XMR] is yet another long-standing cryptocurrency that has been around as long as Ethereum. It is known for its anonymity and privacy.

Monero is one of the few cryptocurrencies where every user is anonymous and no details about the transactions are publicly available. The sender, receiver, and amount of every single transaction are hidden through the use of three important technologies: Stealth Addresses, Ring Signatures, and RingCT.

As for its decentralized nature, Monero’s developer community is rather concentrated compared to Bitcoin or Ethereum and while changes in the code do involve a community consensus, the development of the code is definitely more centralized.

To run a Monero node one must connect to a client called deamon, which connects your node to the blockchain. There is really no other option to run a Monero node otherwise.

While Monero nodes are globally distributed but similar to BTC and ETH the top 2 countries that hold the most nodes are USA and Germany.

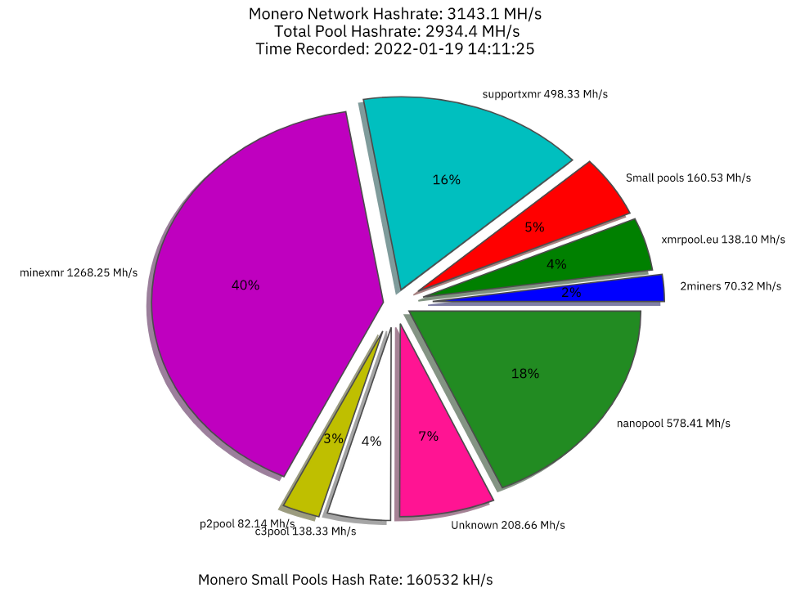

Monero is a Proof of Work (POW) coin like BTC and ETH so it does require mining to validate transactions and create new ones.

Mining Monero does not highly specialized equipment and can be done using regular computers significantly reducing the barrier to entry.

That being said, mining is highly competitive, and independent miners have less chance of minting a new block than large mining pools, which is why it is recommended for independent miners to join the mining pools if they wish to generate a steady income. This makes the mining process highly centralized.

In fact, about 74% of Monero's hash rate is controlled by only 3 mining pools, making it more centralized than Bitcoin and even Ethereum.

As for the volume of XMR traded in exchanges, the volume stands at $185 Million, putting it at #44 of the top cryptocurrencies traded by volume in a 24H period.

Litecoin

Also known as Digital Silver, Litecoin [LTC] is one of the oldest cryptocurrencies in existence. Launched in 2011 by Charlie Lee Litecoin is similar to bitcoin in functionality and use.

Litecoin is Proof-of-Work (POW) coin and just like the rest of the coins we discussed earlier requires mining to validate transactions and mint new coins.

The development ecosystem of Litecoin is centralized with Charlie Lee spearheading the direction. Since he is the creator of the coin and still very much involved in its development, its direction can be easily influenced by his vision. This is in stark contrast to how all other cryptos function and makes bitcoin centralized when it comes to its development.

There is but one client used to run the majority of LTC nodes, called Litecoin Core, making its client distribution highly decentralized.

With a globally distributed node network, Litecoin is fairly decentralized compared to its other peers, but its biggest chunk of nodes still reside in the USA followed by Russia.

As for mining Litecoin, it suffers from the same problem most POW coins do, which is the centralization of mining pools. As it is no longer profitable for independent miners to mine Litecoin, they have to join pools to generate an income.

As of 2022, 65% of the hash rate is controlled by 3 mining pools making mining to be highly centralized.

The volume of LTC traded in exchanges stands at $1.5 billion, putting it at #20 of the top cryptocurrencies traded by volume in a 24H period.

While the total LTC addresses currently stand at 0.2 Million, with a fairly distributed coin network.

Conclusion:

While all cryptocurrencies are designed to be decentralized, there are always some aspects that often get centralized with the passage of time and its use by the people.

When it comes to development structure, Bitcoin leads the charts with the distributed developer network and anonymous creator, Satoshi Nakamoto. followed by Monero, Litecoin, and finally Ethereum. Almost all of them use the centralized client to run their blockchain.

As for client distribution, Bitcoin, Litecoin, Ethereum, Monero all have a centralized structure but one client used to run most of the nodes.

When it comes to trade volume, BTC leads the charts, followed by ETH, LTC, and finally XMR.

Similarly, BTC leads the charts when it comes to active addresses but its ETH which has seen a steady rise in its addresses over the past 3 years making it more decentralized than BTC.

But things change when we look at the mining structure and the entry barrier to enter the blockchain network. Ethereum leads with the chart with its POS upgrade and launch of Eth 2.0, making the coin more decentralized than before. After ETH comes BTC, LTC, and finally Monero.

Looking at the overall picture, Bitcoin appears to be the most decentralized coin balancing out the development as well as the mining network to provide more easy and open access to users.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()