Why Blockonomics Does Not Support More Altcoins?

One of the biggest pieces of feedback we at Blockonomics have received from our merchants time and again is the ability to accept altcoins along with bitcoin. We are aware of the benefits altcoins offer to merchants and have debated whether or not we should add them to our service.

Currently, our service supports two digital currencies, Bitcoin and Bitcoin Cash. Given the sheer volume of altcoins that are circulating in the market, this seems like a rather low number but there are quite a few considerations we as a business must look into before offering it to our customers.

We want to give our customers options that are truly decentralized, secure, and economical. This is why we vet every altcoin based on several parameters than just market cap or popularity.

Let's have a look at some of the pros and cons of accepting altcoins:

The Good...

More options

Bitcoin might be the most popular cryptocurrency, but it's not the only one. There are 1000s of altcoins currently circulating the market, each with its own unique features and most importantly a user base.

A lot of altcoins boost cheaper and faster transaction settlements making them quite appealing to a lot of users globally. And as an eCommerce merchant, you will gain access to an even bigger market as you can now sell to customers who don't just use bitcoin but also altcoins.

Stablecoins

A common complaint amongst merchants with bitcoin has been its notorious volatility. With constant price fluctuations, business owners find it challenging to manage their finance with bitcoin.

A solution to this problem exists in the crypto ecosystem in the form of stablecoins, where each coin is pegged against 1 US dollar, giving its users the benefits of blockchain along with the convenience of price stability. There are a number of stablecoins in circulation, such as Tether, USDC, and Binance USD.

Although, despite the "stability" it provides, there are some arguments against its legitimacy and the models that they operate in, as backing a digital coin against a centralized fiat currency essentially makes it centralized.

Faster & Cheaper Transactions

Bitcoin transactions typically take 10 mins to a few hours depending on the transaction fees, and this fee is likely to go up during network congestions and bull runs as the number of transactions increases.

While this is still much faster than traditional fiat systems, some altcoins can process transactions much quicker [a few seconds] for a fraction of the cost. So there is no surprise that using these altcoins is much more effective than sticking with just bitcoin.

The Bad...

Centralized

Cryptocurrency by definition is decentralized but while it is true for bitcoin and some altcoins, it does not hold ground for a majority of altcoins currently circulating the market.

Most altcoins operate on a centralized model controlling the operations of that particular blockchain. This makes these altcoins no different from fiat currencies or payment giants like Paypal or Stripe as users essentially lose control over their funds.

Most altcoins in the top 10 crypto list, currently have some form of centralization in their blockchain. Popular altcoins such as Tether, USDC, Ripple, Litecoin, Solana, Iota, NEO, and Stellar all operate with a centralized leadership where general users have little to no control over their functionality.

Recently, Tether, one of the most popular stablecoin, blocked a transaction on its blockchain without any prior notice because it was deemed suspicious. This is the 5th account they have blocked in 2023 alone. Such an event is impossible with bitcoin.

Transaction fees

Transaction fee in cryptocurrency is a very dynamic topic and varies with each blockchain. While some blockchains allow minuscule fees ranging between a few cents others have seen reach as high as thousands of dollars.

This is particularly true for Ethereum, the most popular altcoin in existence, which once saw a transaction fee of around half a million dollars for a single high-value transaction. Even for normal transactions users can expect to pay anything between $5-$40 [current transaction fee stands at $15], and the fees go up with the value of the transaction. This makes it essentially useless for commercial use as a currency.

High Risk

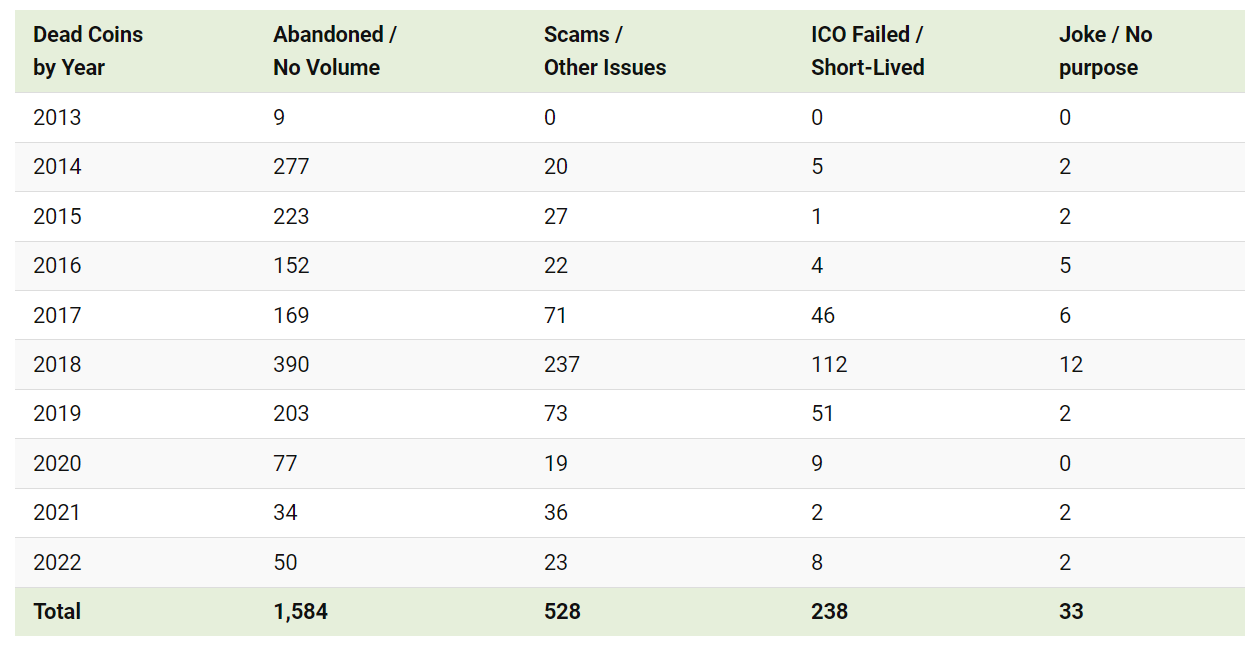

Perhaps one of the biggest disadvantages of altcoins is the risk they carry. With 1000s of altcoins flooding the market, a lot of altcoins often fail after a few years of existence.

Crypto coins need powerful algorithms, real-world applications, and a strong user base to succeed and that has not been the case for a lot of altcoins launched in the past decade.

Almost all coins listed in the top 10 cryptocurrencies a few years ago, no longer exist or have reduced in market cap hinting there is little to no real-world application for such coins. Accepting altcoins would just increase the risk of the merchants.

Mismanagement

Accepting multiple coins for your business can cause major bookkeeping and accounting difficulties. Each blockchain is separate from the other and needs its own dedicated wallet. This means that you as a business are now required to set up and manage each altcoin separately,

Keeping track of all these coins can be a major pain for your business and things get even more complicated if you accept fiat along with crypto.

Sticking with just one or two coins is one of your best bets to run smooth operations for your business.

Blockonomics' & Altcoins

Blockonomics has decided not to support more altcoins at this time because we believe that the drawbacks of supporting additional altcoins outweigh the potential benefits they offer. Bitcoin and Bitcoin Cash are the most popular cryptocurrencies, and they offer a high level of security and stability along with a decentralized model. They are also widely accepted by merchants, which makes it easy for customers to use them to pay for goods and services.

In case the transaction fee for BTC is an issue we suggest our merchants use BCH as it offers a much lower fee and is relatively price stable.

Blockonomics is always looking for ways to improve its service, and it may consider supporting altcoins in the future. However, at this time, Blockonomics believes that the risks of supporting altcoins are too high.

Conclusion

The decision of whether or not to accept altcoins is a complex one, and there is no easy answer. There are both pros and cons to consider, and each merchant must weigh the risks and rewards before making a decision. Blockonomics has decided not to support altcoins at this time, but it may reconsider its decision in the future.

Additional considerations

In addition to the pros and cons listed above, there are a few other factors that you as a merchant should consider before accepting altcoins. These include:

- The team behind the altcoin: It is important to research the team behind the altcoin. Are they experienced in the cryptocurrency industry? Do they have a good track record?

- The altcoin's roadmap: How long has the coin been in the market? What are the altcoin's plans for the future? Do they have a clear roadmap for development?

- The altcoin's community: How strong is the altcoin's community? Is there a lot of support for the altcoin?

Comments ()