Why you cannot be your own bank

Bitcoin holds the promise of truly decentralized digital currency, where you can have a bank in your own pocket. For a few cents or even…

Bitcoin holds the promise of truly decentralized digital currency, where you can have a bank in your own pocket. For a few cents or even free you can transfer money around the world like email. This was true in the initial years of the cryptocurrency. The current reality however is a little different

A currency for the elite

The current average transaction fee on 8 March 2017 is around 92 cents. Method of calculation: Total number of tx - 297108 . Total tx fee- 234 BTC, Price - 1178 USD

92 cents is a heavy price to pay for decentralization. While people in dark markets or those that require anonymity could be ready to pay this price. Most people will happily switch back to credit cards to avoid paying 5–10%.

I also advice people writing articles championing bitcoin for the unbanked [1], [2] to take time out and do one bitcoin transaction before blindly writing such pieces. 75% of rural India get an income of around 50 cents per day [3] . To think that they would use bitcoin is really absurb.

Average payment value

People are using bitcoin for various reasons; buying goods, peer to peer payments, gambling etc. It would be good to know the average value of bitcoin being transacted.

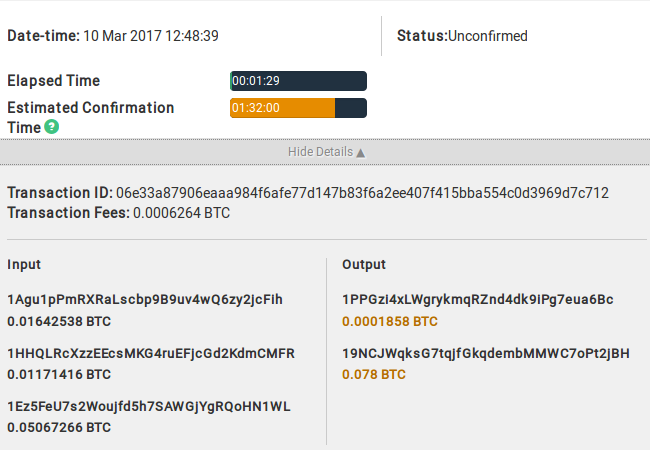

Bitcoin transactions are unlike PayPal or bank transactions where you know the exact payment value. This is because a bitcoin transaction has multiple outputs and it is difficult to know which outputs exactly correspond to the payment.

We take a simple heuristic for this. We only look at the transactions with two outputs. This is the most common bitcoin transaction. Since, we don’t know which is the change and which is the payment output, we take the value that is lower of the two outputs for calculation. This gives us a lower bound on the payment value.

For blocks 456504–456533, we get 54492 such transactions and get a lower bound of average payment value as:

0.2053 BTC ~ 243 USD

As expected, it is not the poor who are doing these transactions

True cost of decentralization

Another question to ask is what is the real world cost of confirming the bitcoin transaction. On Scaling Decentralized Blockchains [4] does a very good calculation taking into factor mining, bandwidth and storage costs.

According to their calculation in October 2015

The cost per confirmed transaction is $1.4 — $2.9

The current costs would be higher than this, due to increase in price as well as hash rate. This however, does give us an estimate why tx fee are so high. The reason why transactions fee is currently lower than this estimate is because this cost is subsidized by the block reward which is 12.5 BTC

As the block reward decreases, someone has to pay the decentralization costs and it would be reflected with an increase in transaction fee.

Banking the system

Bitcoin was developed as an alternative to banks and financial institutions. Quoting satoshi

Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.

However, gaming and controlling the bitcoin system has become very easy. If I were a bank, I would use my money to do the following:

- Buy bitcoins and pump to increase the price

- Fill up the blocks with transactions. Use the network to do high volume inter bank transactions

- Bribe or incentivize miner fractions to stop bitcoin scaling solutions

- Wait for next block halving

- Develop a centralized bitcoin wallet service that does transactions off chain

As the infighting around scaling solutions continues, the next halving would make bitcoin transactions more unaffordable. Million of users would happily use my centralized wallet service and even give their KYC/AML. The important thing is not to try to control the network too much so that it precipitates a hard fork. I can sit back and enjoy banking :D

About Us: Blockonomics has been at the forefront of developing permissionless /decentralized tools for the bitcoin space . We fully support Segwit for scaling and thank the core developers for their continued efforts.

![Top 10 Tools and Resources for Crypto Research [2021]](/content/images/size/w720/max/800/1-kDyyUnRCD656bm2ny-jHag.png)

Comments ()