Benefits of Accepting Bitcoin Cash [BCH] for a Business

Born out of a fork of Bitcoin, Bitcoin Cash [BCH] came into existence to process a high number of transactions per second and keep the…

![Benefits of Accepting Bitcoin Cash [BCH] for a Business](/content/images/size/w1200/max/800/1-jwOAyc4-2NUBOnM61Ip1lg.png)

Born out of a fork of Bitcoin, Bitcoin Cash [BCH] came into existence to process a high number of transactions per second and keep the transaction costs low.

BCH is a great way for merchants to accept crypto payments on their eCommerce store and offer a majority of benefits to both you as a merchant and your customers.

With transactions that take a few seconds to process to minuscule transaction fees, BCH makes for a great choice for anyone looking to enjoy the benefits of blockchain and cryptocurrency.

Let’s have a look at some of the benefits you can enjoy by accepting BCH as a mode of payment.

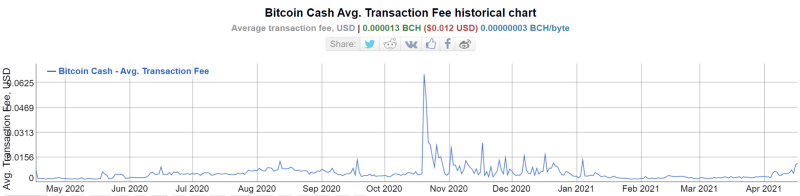

Low Transaction Fee

The biggest benefit of Bitcoin Cash for your business is the low transaction fee it offers. Currently, BCH transactions cost $0.012 which is about a cent, a minuscule amount compared to traditional card payments which take about 3% in transaction fees.

A much popular and widely accepted cryptocurrency, bitcoin, is currently seeing an average transaction fee of a whopping $40.56 [as of Apr 17, 2021] making it quite unusable for everyday transactions.

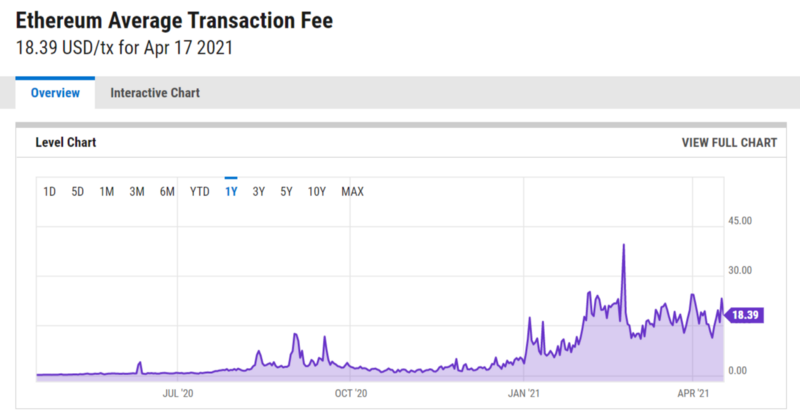

A similar trend can be seen by Ethereum, whose average transaction fee stands at $18.39 [as of Apr 17, 2021]

Near Instantaneous Transactions

Bitcoin Cash transactions typically take a few seconds to confirm making them a much ideal choice of payment when compared to its counterpart Bitcoin.

Due to the higher block size, BCH can accommodate much more transactions per block than BTC.

While BTC’s block size remains at 1MB, BCH was created with an 8MB block size which in 2018 was increased to 32MB to accommodate a higher number of transactions.

This is why BCH is able to transaction much quicker and at a much cheaper price compared to BTC.

No Chargebacks

Bitcoin Cash transactions like any other cryptocurrency happen over the blockchain which means that the transactions are irreversible, so, you do not have to worry about payments going back to the customers.

If a payment reversible is needed a new transaction must be sent by you to your customer.

Security

Blockchain is by far one of the most secure forms of money transfer. Using cryptography, decentralization, and shared consensus it is near impossible to manipulate or alter the transaction data.

Traditional payment methods including credit cards have been prone to cyber theft and fraud causing customers as well merchants to lose large sums of money.

Additionally, fiat payments require users to divulge their personal information in order to use its services, which adds another layer of potential risk that users face. In an instance of a data breach, cybercriminals can access the sensitive personal information of the users.

With cryptocurrency, such risks are largely mitigated, as transactions are anonymous and private. If proper measures are taken, crypto can be a fairly secure way to perform everyday transactions.

Future Ready

Cryptocurrency and blockchain are the next evolution of money and payments.

Millions of customers are opening up to cryptocurrency as using it as a mode of payment. By accepting BCH you as a merchant are opening up to a much wider customer base.

Cryptocurrencies are seeing widespread adoption from companies, governments, and people alike and developments are happening at an exponential pace in this field.

Despite being merely a decade old, cryptocurrency and blockchain have seen widespread mainstream adoption.

Conclusion

BCH offers its users a lot of benefits the biggest ones being its low transaction fee and near-instant payments, making it an ideal choice for everyday payments.

With a growing customer base, BCH can be a good choice for merchants to add as a payment currency reaching a wider audience, which is not restricted by borders thanks to the borderless transactions that BCH offers.

If you are looking to accept BCH for your business there are a couple of payment processors you can use that are quick to set up and do not require KYC.

Comments ()