Does Bitcoin Have A Scalability Issue?

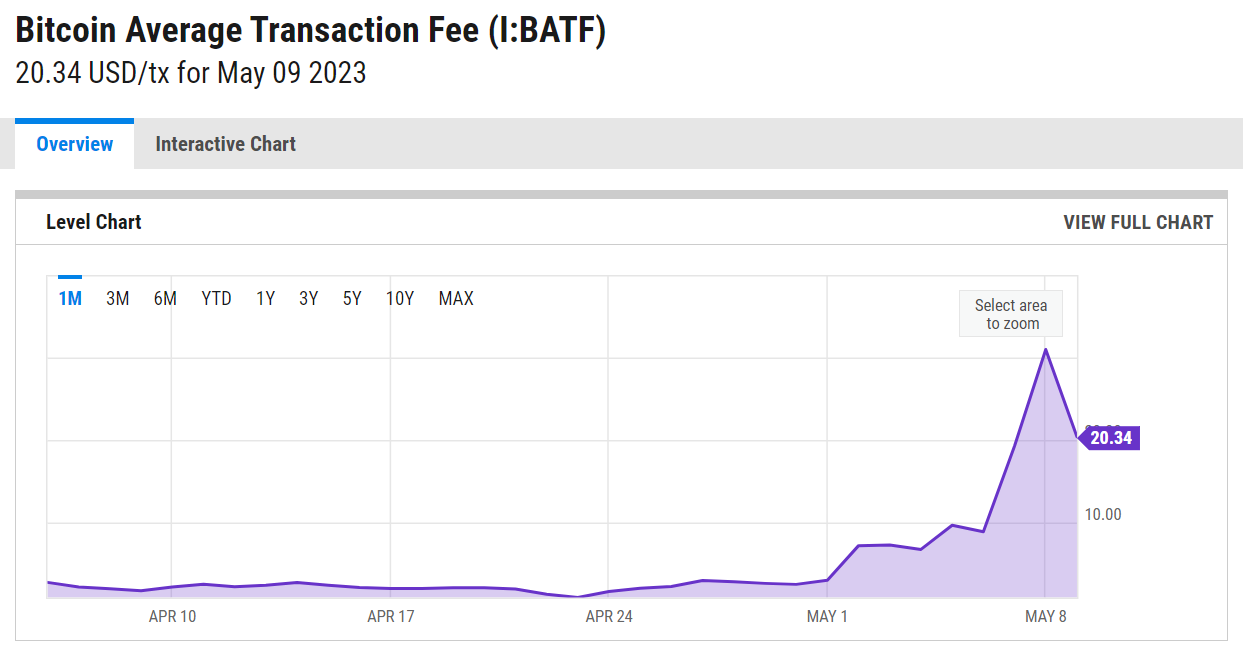

Bitcoin transaction fees in the past few days has skyrocketed from a mere few cents per transaction to up to $20 per transaction. The mempool is heavily congested with over 400K pending transactions and about 200 blocks unmined.

This congestion has caused a heavy toll on businesses and users alike who are now forced to pay insanely large fees just to get their transactions confirmed. This recent congestion points to a glaring problem within the bitcoin network which is its scalability issue.

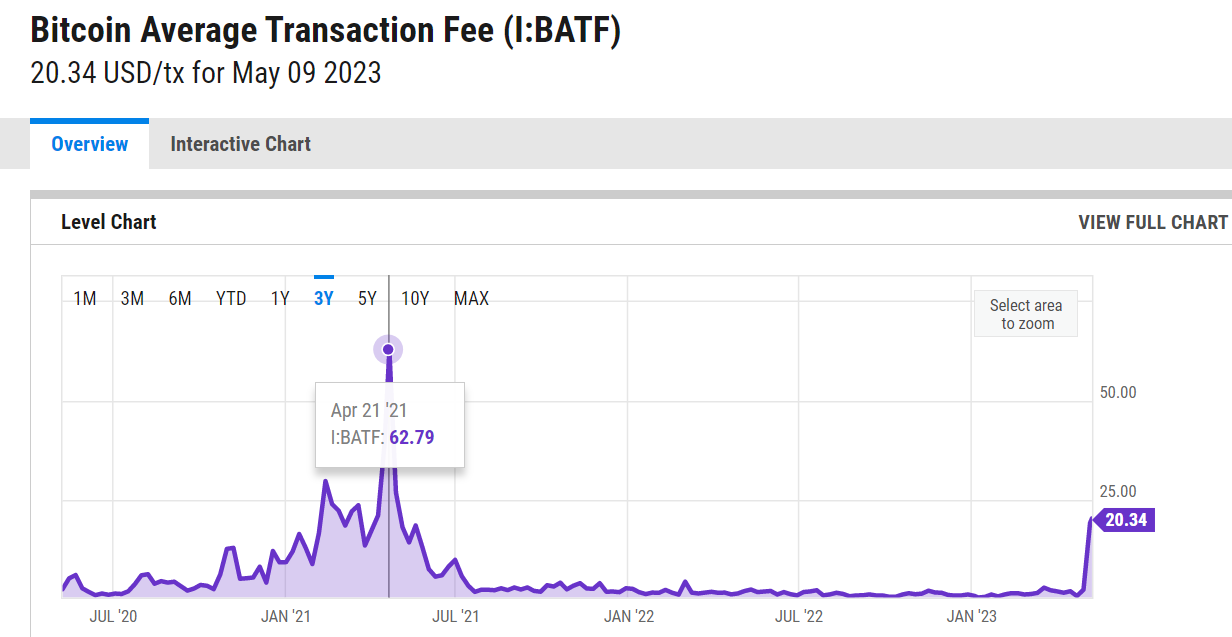

In fact, such instances of congestion are not new within the bitcoin network. Anyone who is following bitcoin for a while would vouch for the fact that every time bitcoin sees an uptick in users, the network almost always gets congested.

When the bitcoin price an all-time high of $63,000 back in 2021, the mempool saw similar congestions with transaction fees rising to a whopping $60 per transaction similar to what we are seeing now.

Although the recent congestion has little to do with price hikes and more with BRC20 tokens being mined to the Bitcoin network. The scalability issue with the network circles back making it harder for everyday users and businesses to operate.

BRC20, a recently introduced token standard allows fungible tokens to be minted via the ordinals protocol on the Bitcoin base chain. Like the ERC20 tokens that saw the influx of meme coins and NFTs in the crypto market, BRC20 is seeing a very similar trend with the majority of minted tokens belonging to meme coins PEPE and MEME.

Such is the popularity of these tokens that the market cap of BRC20 has surpassed $1 billion, which is a staggering number given that the project was launched merely 2 months ago in March 2023.

Other popular BRC-20 tokens include VMPX, MEME, BANKBRC, and PEPEBRC.

This increase in transaction volume has been a major boon for the miners who can now charge a high fee for confirming transactions given the increased demand.

So the issue that this brings up is the scalability problem that the bitcoin network is facing. Every time there is an increase in demand, whether it's price, adoption, BTC20 tokens, or anything else, the transaction fee skyrockets, making bitcoin network unusable [unless you don't mind paying exorbitant fees].

Although there is a general negative sentiment towards these BRC20 meme tokens within the bitcoin community, who see bitcoin as more of a currency than a meme token. But, it still does not mask the fact that bitcoin network has a scalability issue that is not being addressed by the bitcoin developers for some reason.

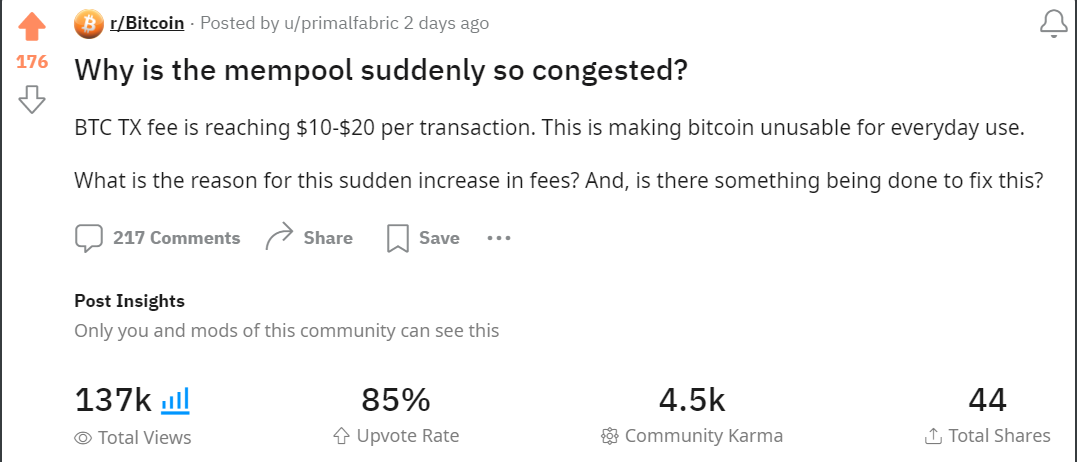

This viral discussion on Reddit a few days ago, addressed the same issue with many users commenting on using the lightning network.

But, lightning comes with its own set of drawbacks. The biggest one being its niche and limited usage, as it requires a dedicated bitcoin wallet that supports its use and both transaction parties being in the same lightning channel to transact. This is certainly not the case for most users around the world who use bitcoin's main layer to transact.

Bitcoin is a beautiful piece of technology that can truly revolutionalize the financial system yet every time there is an adoption boom, the network gives in. How will bitcoin become a global currency if a mere increase in traffic from a single project can hijack its performance?

It's something that the bitcoin community and developers need to urgently address.

Comments ()