How to Invest in Crypto in 2022

Albeit new, bitcoin and cryptocurrency have become one of the most desirable asset classes in a mere decade. With fantastic returns and a revolutionary technology challenging the archaic and corrupt fiat financial model, cryptocurrency is quickly becoming the new norm.

In addition to the common population, it has managed to grasp the attention of major investors, corporations, and governments. Suffice to say crypto is here to stay.

Being a new asset class, crypto operates in a different fashion compared to traditional assets making it a bit heavy for many people to get into it. Volatility, regulations, safety, and knowledge are some of the things that people have to consider before getting into this space.

But these roadblocks shouldn't stop you from exploring this exciting space. If you are a new entrant looking to invest in crypto, you are not alone.

Here is a quick guide to get you started...

How to choose the right cryptocurrency?

With thousands of cryptocurrencies and new ones coming almost every day. Crypto markets for new entrants can not only be intimidating but quite challenging.

Most projects in the crypto space don't last more than a few years, not to mention the numerous scam coins that pop up almost every day. Looking at the last 10 years of the market alone, only 2 cryptocurrencies [Bitcoin and Etherum] have managed to stay in the top 10 list by market cap. All others have either fallen to lower ranks or have faded away into nothingness.

It is quite important to do well-informed research before investing in any new crypto project. Even coins with a strong team and roadmap have not managed to survive the wild world of crypto.

Crypto market is a new space and is thus quite unpredictable so it is quite important to be well informed and most importantly be aware of the risks involved.

If you prefer to be on the "safer" side of things consider the most popular coins such as Bitcoin and Ethereum as they have the biggest market cap and have also seen wide adoption.

Is this a good time to invest in crypto?

For any new investor looking to get into crypto, one question that often gets pondered is whether it is a good or let's say the right time to invest in crypto assets.

With massive price swings and high volatility, deciding on the right time to invest can be quite challenging. Bitcoin alone has seen a 70.5% price decrease from its all-time high of $69,000 back in November 2021 to its current price of $20,500.

Such price drops can be a little intimidating for someone who is new to crypto and can for the most part keep them from investing in them.

But, one thing that most new investors should consider before investing in crypto is that such investments are long-term.

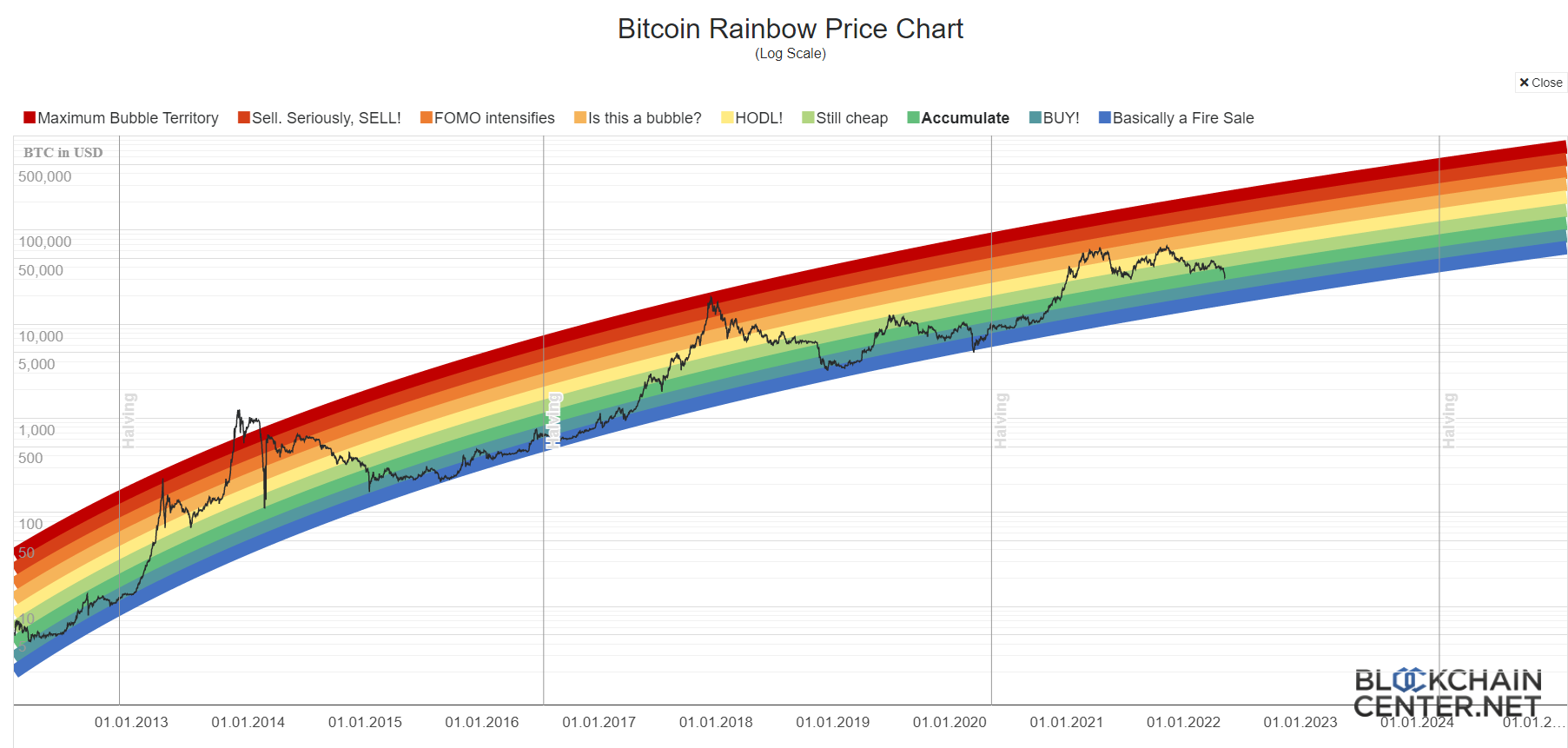

So while bitcoin saw a price drop of almost 70% in its price in the last 8 months, it also saw a mammoth increase of 151K% in the last 10 years, rising from a mere $13 in 2012 to its current price.

Whilst bitcoin is quite volatile, its long-term trajectory has seen an upward trend.

Like any other stock, crypto assets see bear and bull runs as well, so it is of course better to buy them during the bear run as you will pay a lower price.

But for newer projects, things are a bit more complicated as their price is dictated more by adoption, hype, and developments.

How to invest?

To invest in crypto the best method is to use a crypto exchange. These specialized exchanges allow you to buy/sell crypto assets either using fiat money or other cryptocurrencies. The process to sign-up is fairly straightforward and you may have to undergo KYC based on the exchange.

There are numerous exchanges that cater to most of the population worldwide, based on your location you would surely have some crypto exchange that operates in your country.

There are 3 main types of exchanges that are currently available in the market,

- Centralized exchanges: Operations are controlled by the owners of the company and they do collect information about you and your activity.

- P2P: Trades happen between two matched peers. You can call them semi-centralized.

- Decentralized exchanges: Run on Smart Contracts, these exchanges allow crypto trading without a third party involvement. They usually do not require KYC but have low liquidity and only allow crypto-to-crypto trades.

Some of the top centralized exchanges include:

- Binance

- Coinbase

- Kraken

- Crypto.com

- Gemini

Some of the top P2P exchanges include:

- LocalBitcoins

- Paxful

- HODL HODL

Some of the top decentralized exchanges include:

- UniSwap

- dYdX

- 1inch

Do check the fees, withdrawal limits, reviews, trading volume, and popularity before using an exchange. Crypto is a changing landscape and so are the exchanges that operate in this space.

How to store your crypto?

Once you have invested in crypto, the next critical step is to make sure you store your crypto safely and securely.

Despite being a critical one, this step is often overlooked by most people majorly due to a lack of knowledge and misinformation.

Unlike fiat assets which are stored in banks, crypto assets are held by their users aka you, so it goes without saying that certain security measures need to be taken to ensure their safety.

- Never store your crypto assets in exchanges: Looking back at some of the major crypto hacks and breaches, exchanges have been the prime target for most cybercriminals. Thus, it is always advised to store your crypto outside of exchanges once the trade has been completed.

- Use Hardware Wallets: There are 3 main types of crypto wallets, mobile, web, and hardware, out of which hardware is supposed to be most secure as it stores your private keys offline.

- Store your Private Keys/Wallet Seed Offline: Ownership of your wallet keys is the single most important thing to prove ownership of assets. Thus storing it safely is pivotal. Keeping them offline ensures their safety and secures them in case of cyber attacks.

For more information on how to keep your crypto safe, you can refer to this article.

Conclusion

Crypto investments may seem intimidating at first but with proper research, you can not only make informed decisions and also understand the risks involved.

With crypto assets, it is always good to have a long-term mindset and not focus so much on short-term gains. For short-term gains, you are entering more into trading territory which is a whole other ballgame.

Use exchanges to buy/sell your crypto and similar to the asset do perform research on the exchange you choose to use and understand the fee structure, limits, KYC policy, and other nitty-gritty of using one.

And last but not the least, keep your crypto safe and secure as you and you alone are responsible for its safety.

Disclaimer: This article is not intended as investment advice nor is its purpose to push people to buy crypto assets but to help them make informed decisions in case they decide to do so. Please perform your own due diligence and understand the risks involved with crypto investments. Plus, do take into consideration the legal laws (if any) pertaining to crypto in your country.

Comments ()