Most Used Crypto Terminology Explained - The Only Guide You'll Need

The exciting space of crypto has peaked the likes of global users and it is no surprise that it is one of the fastest-growing industries right now.

What started with just Bitcoin has now grown into a billion-dollar space with altcoins, smart contracts, tokens, NFTs and much more developing each day.

For investors, businesses, and enthusiasts it can be a compelling task to understand what all these different things mean, especially given how new this space is. Yet knowing them can be quite advantageous, especially for making sound decisions and better understanding the developments in the market.

Here is a list of the most used crypto terminology that will keep you on track with this space's jargon, slang, terms, and much more...

51% Attack

An event when a particular entity gains control of more than 50% of a blockchain's mining power.

Such control allows them to alter the blockchain giving them the power to, block incoming transactions, and reverse transactions which would allow them to double spend coins.

Even a popular sitcom series Silicon Valley featured such an attack.

Given the decentralized nature of cryptocurrency, such attacks are quite rare but not entirely impossible.

Altcoin

Any and all cryptocurrencies that are not bitcoin are referred to as Altcoins, or "Alternative Coins".

Since Bitcoin was the first cryptocurrency, all subsequent crypto coins came to be known as Altcoins.

Address

The random string of letters and/or numbers that are used to send, receive, and store cryptocurrency.

Each address is unique and somewhat similar to a bank account number of an individual but with way more privacy and security features.

Bitcoin address looks something like this: bc1qar0srrr7xfkvy5l643lydnw9re59gtzzwf5mdq

AML

AML stands for Anti Money Laundering. A series of laws and regulations that government and financial institutions enforce to stop illegal activity of converting illegally acquired money into a legitimate source.

Given the private and anonymous nature of cryptocurrency, AML policies have been a hot debate for a lot of crypto organizations.

API

API or Application Programming Interface is a specialized software interface that is used to define how two or more pieces of software are going to interact with each other.

They are specialized in their functionality and perform defined functions.

APIs are fairly common in the software world and are extensively used in crypto products as well. Some common examples include an API to get real-time crypto market data or to accept bitcoin payments on eCommerce sites.

ATH

All-Time-High or ATH is the highest price any cryptocurrency has reached to date.

ATH is a dynamic figure and can change anytime a crypto asset surpasses its previous ATH.

Bitcoin

A digital currency that uses the power of blockchain to perform transactions and gives complete ownership of funds to its users along with privacy and security.

Often touted as Digital Gold, Bitcoin's inception gave birth to a whole new industry and a more open financial era.

Blockchain

Blockchain is a distributed ledger technology that forms the basis of cryptocurrency. A set of transaction records are stored in consecutive blocks of data.

Blockchain data is distributed and immutable.

Block Height

The number of blocks preceding a given block in a blockchain is referred to as its block height.

The first block ever created is called Block 0, or genesis block, and all further blocks are numbered sequentially.

0 -> 1 -> 2 -> 3 ............ 45000 -> 45001 -> 45002

So, a block height of 45002 means that 45002 blocks have already been mined.

Block Reward

Blocks in a blockchain need to be validated [or mined] using specialized computers and software. For performing this task, miners [who undertake the act of mining], are incentivized with a reward, which is usually a particular amount of coins.

So, with every block mined, the miners are given a block reward.

Each blockchain has its own set of rules for the block reward miners get for validating a block.

As of now, the bitcoin block reward is 6.25 BTC per block.

Coin

Another name for cryptocurrency or digital asset.

Cold Storage

Wallets that are not connected to the internet are referred to as cold storage. Most Hardware and Paper wallets fall under this category.

These wallets are generally considered the safest option to store digital assets.

Confirmation

The validation of a transaction on the blockchain is known as confirmation or first confirmation. This happens when a transaction is added to a block that has been successfully mined.

The number of confirmations increases by 1 with every new block added to the blockchain after the first confirmation.

So, 6 confirmations mean that 6 blocks have been mined since the transaction was added to the blockchain.

With bitcoin, 3 - 4 confirmations are generally considered safe for most transactions, if the transaction is large then 6 is usually recommended.

Cryptocurrency

Digital assets that use cryptography and blockchain to securely perform transactions.

Bitcoin and all other digital assets are different types of cryptocurrencies.

DAO

Decentralized Autonomous Organisations, or DAO, are organizations that are run on computer-defined rules with any central entity.

They are bottom-up organizations governed by blockchain-based smart contracts [pieces of code that automatically get executed when specific criteria are met]. They are collectively owned by their members and decisions are usually made through a vote of the stakeholders.

DApp

Decentralized Applications are distributed open-source software applications that run on a decentralized network and use the power of blockchain and smart contracts to operate.

Unlike traditional applications that use centralized servers and databases, DApp, uses blockchain which stores information in blocks that are distributed across the network, and smart contracts which execute the functions.

DApp needs a front-end interface to interact with users and the backend with uses blockchain and smart contracts.

DeFi

Decentralized Finance is an umbrella term for financial services and products that use blockchain and P2P networks to create a more transparent and trustless form of solutions.

A shift from the centralized and closed models that most traditional financial institutions operate it.

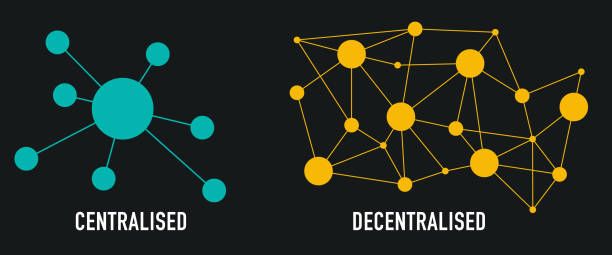

Decentralized

A system where the control and decision-making power is transferred from a centralized entity to a distributed network.

In a blockchain, the decentralized network operates on a global level with nodes interconnected with each other sharing information with each other and the public.

Difficulty

Difficulty measures how hard it is to mine a new block on the blockchain. High difficulty means that more computational power will be needed to mine a block while low difficulty means otherwise.

Blockchain usually adjusts its difficulty to maintain consistency in the number of blocks mined. So, say the number of blocks mined is increasing at a given time the difficulty in such a case is increased, making it harder to mine new blocks.

Digital Signature

A digital signature validates the authenticity of the digital data. In the crypto realm, digital signatures are used to validate transactions and are essential to the blockchain.

When transactions are sent to the blockchain, the sender sends a digital signature that contains its private and public keys, this data authenticates the fact that the data send is valid and legitimate.

Distributed Ledger

Distributed ledger is digital data that is stored and shared across a network of peers or nodes. Although these nodes are independent they are synchronized and shared with each other.

A distributed ledger does not necessarily mean its decentralized.

Double Spend

An event where a particular unit of a digital coin is spent twice. The sender typically tricks the blockchain into using a unit of cryptocurrency that belongs to the same tender more than once.

Double spending arises when there is a flaw in the blockchain network or when an attack is being made.

DYOR

Do Your Own Research [DYOR] is one of the essential principles most people getting into crypto or any financial decision must adhere to. It is aimed to encourage investors to perform due diligence before taking any financial decision.

There is a lot of misinformation that can easily circulate online regarding cryptocurrency and investing, especially with new projects, which can potentially harm uninformed investors. It is never a good idea to invest in something just because someone said so or because it's trending on social media.

It is always a good practice to perform your own research about a project/crypto, this could include the team, its roadmap, whitepaper, and developments.

Encryption

A process of encoding data so only authorized entities can access the data. Encryption plays a pivotal role in transaction validation and block creation.

Transactions sent to the blockchain are encrypted so that sensitive information is protected. In case of an attack, data leaked cannot be deciphered without the decryption key.

Encryption is a key element of blockchain security.

Exchange

A specialized platform that allows users to buy/sell cryptocurrency with fiat or other cryptocurrencies.

There are hundreds of crypto exchanges in the market, and it is always advised to properly research the exchange before using them.

Exchanges should only be used for trading crypto assets and never for storing them.

FOMO

Fear of Missing Out is a common infliction of missing out on events, actions, and experiences. In the crypto space, it is usually referred to as missing out on coins that are seeing/going to see a massive price increase, thus missing a potentially lucrative financial investment.

FUD

Fear, Uncertainty, and Doubt is an act of creating panic and chaos in the community by spreading misinformation. This can happen in the form of sensational media and/or news posts that cause inexperienced market participants to take rash decisions such as panic selling.

Hash

A fixed length value generated by a mathematical function that input data of arbitrary and varied sizes.

In a blockchain, transactions are put through this hashing algorithm which generates a fixed-length output, called the hash.

Hash adds security, speed, and reliability to the blockchain.

Halving

The event where the blockchain mining incentive/reward gets cut in half. Cryptocurrencies such as bitcoin incentivize miners by a certain amount of new bitcoin for every new block created. This reward is cut in half periodically.

Halving is a measure to reduce inflation by cutting down the supply and as a result pushing the price upward.

Hardware Wallet

A type of cold storage that stores private crypto information offline. Hardware wallets are specialized hardware designed to store digital assets in a safe and secure manner.

One of the key features of hardware wallets is that the private keys are stored in specialized hardware which is not connected to vulnerable devices such as smartphones or laptops.

HODL

A misspelling for the term HOLD, HODL is the most commonly used acronym in the crypto space, telling crypto holders to not sell but hold their crypto assets.

It was coined back in 2013 when one Redditor in all of the excitement misspelled "holding" to "hodling" and since then it has become the slang term for "buy and hold indefinitely".

Hot Wallet

A crypto wallet connected to the internet is called a hot wallet. All smartphone, desktop, and web wallets are classified as hot wallets.

These wallets are more vulnerable to cyber-attack as they are always connected to the internet.

Immutability

Immutability is the characteristic of a decentralized network that makes it immune to manipulation. The data in the blockchain is permanent and unalterable.

ICO

Initial Coin Offering is the investment generation practice that involves new crypto projects offering tokens/coins to the public in an effort to raise funds for their projects.

Crypto projects usually release a whitepaper, roadmap, and team structure, to gain public confidence in the project.

KYC

Know Your Customer is fraud prevention and AML policy to help curb illicit and illegal activities by collecting user information.

KYC usually involves customers providing ID documents and photographs to prove their legitimacy.

Liquidity

Liquidity is the effectiveness with which a digital asset can be converted into another digital asset or cash without much effect on its market price.

Liquidity is an important factor in trading and determines the ease with which assets can be brought and sold at a given price. The more liquid the market the easier it is to get the asking price for an asset.

A highly liquid market is usually a sign of a healthy market.

Market Cap

Market Capitalisation of any crypto asset is the total dollar value of the outstanding coins. It is calculated by taking the product of the total circulating supply and the real-time price value of that asset.

Market Capitalization = (Total Circulating Supply) X (Real-Time Price Value)

So essentially it is the total value of the available stock of any crypto coin. Do take note that it is the circulating supply and not the total supply that is being used to calculate the cap.

Market Cap provides a rough estimate of how well a cryptocurrency is doing. Generally, the bigger the market cap the safer the coin. This allows investors to gauge the performance of all the crypto assets and assess which currency is doing well over others.

Mining

The process of validating transactions and adding new blocks to the blockchain. This is also how new coins are created.

Mining is a sophisticated and energy-intensive process that requires solving complex mathematical problems using specialized computer hardware.

MultiSig

MultiSignature is a digital signature scheme that requires more than one signature to sign a single transaction most often from different sources.

This is a security measure that was implemented to ensure the safety of a user's funds. So, in an event of an attack where a wallet or private key is compromised, the funds still remain safe and cannot be withdrawn as multiple private keys are needed to sign the transaction.

Many wallets and blockchains are now offering this service to ensure user funds' safety.

Node

A node is a singular point connected to a decentralized network. In cryptocurrency, nodes, maintain the network by verifying and relaying the data. They store the entire ledger and constantly update it with upcoming transactions.

Nodes constantly monitor the network and keep it running. The more nodes a decentralized network has the more secure it becomes.

NFT

Non Fungible Tokens are unique digital identifiers recorded on the blockchain and provide proof of ownership and authenticity.

NFTs cannot be divided, copied, or substituted and thus are non-fungible, unlike other cryptocurrencies.

Any digital file can be converted to an NFT.

P2P

Peer 2 Peer is the decentralized system that connects two involved parties in a distributed network directly with each other without the need for middlemen.

In the crypto space, P2P exchanges, marketplaces, lendings & trading platforms are quite common.

Private Key

A private key is a digital code that is generated using asymmetric encryption used to validate transactions on the blockchain and prove ownership of funds.

Private keys are generally a string of numbers and letters that is used to decrypt, or "unlock" the transaction data and validate its authenticity.

Private Keys are a crucial part of digital asset ownership and should never be shared with anyone. Whoever owns the private keys owns the digital assets associated with those keys.

Proof of Stake

A consensus mechanism that is used to validate transactions and create new blocks in the blockchain using validators.

POS validators verify transactions and activity, maintain records and add new blocks. In return, these validators are rewarded with new coins. To become a validator, one must "stake" a specific amount of the said cryptocurrency.

PoS requires significantly less energy and processing power and is thus more environmentally friendly.

Proof of Work

The original decentralized consensus mechanism that is used to validate transactions and create new blocks in the blockchain using computational power.

POW uses high-processing machines which run complex algorithms to verify and authenticate transactions by generating a hash. This process is also referred to as mining and the people who do it are called miners.

Public Key

A public key is a digital code that is generated using asymmetric encryption used to receive/send cryptocurrency.

Blockchain uses asymmetric encryption [or public key cryptogrpahy], where two related keys are used, a public and a private key. A public key is generated from a private key and is used to encrypt transaction data.

Public keys can be freely shared with anyone.

Satoshi

The smallest unit of bitcoin.

1 satoshi = 0.00000001 BTC or 1 BTC = 100 Million Satoshi

Satoshi is also the name of the pseudonymous name of the creator of bitcoin.

Signature

A cryptographic message which proves the authenticity of the blockchain transaction.

When a transaction is broadcasted to the blockchain, the digital signature is sent along with other transaction data. This signature provides proof that the transaction is authentic.

Smart Contracts

Smart contracts are "contracts" which are hosted on the blockchain network and are self-executed when specific conditions are met.

They are computer codes with predefined conditions, which when met execute an outcome. Smart contracts allow for a decentralized ecosystem that is tamper-proof and accurate.

Several blockchains allow the functionality of smart contracts, but the first and most popular one is Ethereum.

Stable Coin

A cryptocurrency whose price is pegged to a "fixed" asset, usually a fiat currency such as USD, Euro, etc.

The most popular stable coins include Tether, and USD Coin. Stablecoins provide users the power of blockchain but with the stability of price.

To The Moon

A popular phrase used by investors and crypto holders to indicate the big increase in the value of the crypto asset, synonymous with the price reaching as high as the moon.

Token

Tokens are digital assets that are built on top of an existing blockchain. Unlike coins, tokens don't have their own native blockchain and use other blockchains as a foundation.

The ability to issue tokens was first introduced by Ethereum which allowed external projects to build on top of it using smart contracts.

Transaction Fee

The fee that users have to pay to validate their transaction on the blockchain. This fee and dynamic and changes with time and blockchain.

Transaction fee ensures that the blockchain is safe from malicious users and also incentives the miners for the work.

A particular blockchain can have a different fee at different times which is determined by market supply and demand. If the number of transactions is high [also known as network congesion] at a given time the fee goes up and vice versa.

The transaction fee also varies with blockchain, with each one having its own fee structure.

Wallet

The storehouse for your digital assets, wallets allow you to safely place and access your crypto assets. They store the private and public keys of the crypto transactions and also provide you with an interface to access them.

Wallets can be hardware, software, or even paper.

Web3

The next iteration of the World Wide Web, Web3 is a new form of internet that incorporates the concepts of decentralization, cryptocurrency, blockchain, and tokenomics.

Web3 is still in the concept stage with no current widespread use case or adoption.

Whale

A user/entity with a significantly large portion of crypto assets. Crypto Whales activity is usually monitored by the community due to the power they hold.

Whales can affect liquidity, price, and market trend of the crypto space.

Comments ()