Why Blockonomics endorses DriveChains (BIP300-301)

A Brief Introduction / History of Blockonomics

Blockonomics allows anyone to track/accept Bitcoin payments. We started way back in 2014 and were built with constant help/feedback from the Bitcoin community on bitcointalk/Reddit [Wiki here].

For a long time, we only supported Bitcoin. Recently a few years back we added Bitcoin Cash to help merchants make payments when the Bitcoin network was congested.

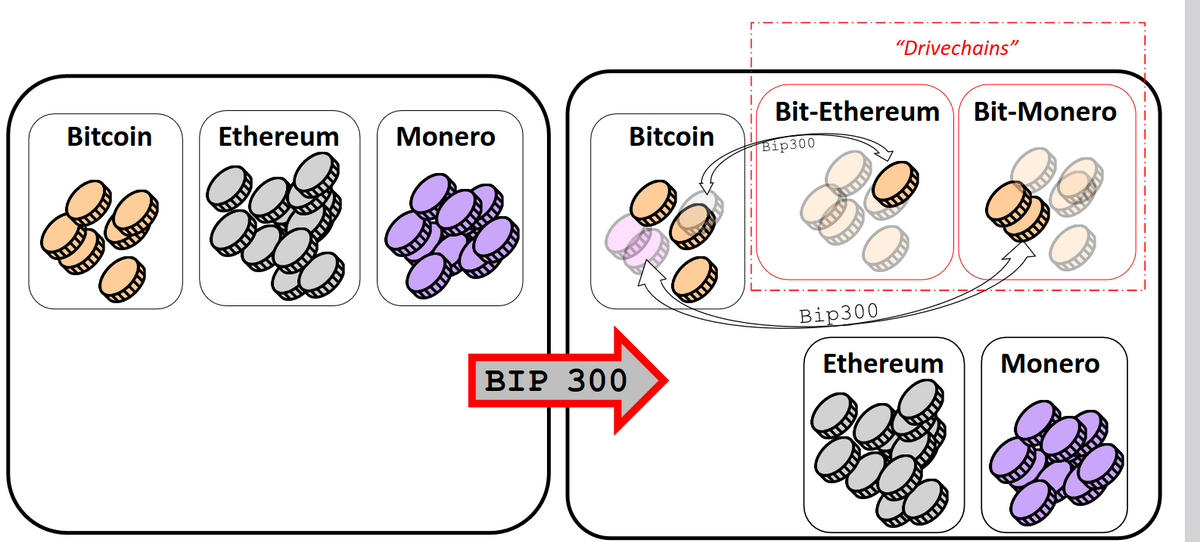

Drivechain allows Bitcoin to create, delete, send BTC to, and receive BTC from “Layer-2”s called “sidechains”. Sidechains are altcoins that lack a native “coin” – instead, pre-existing coins [from a different blockchain] must first be sent over.

There are a few reasons why we endorse drivechains:

Need for a Decentralized and Usable Payment System

- We cannot ignore users under the veil of Bitcoin maximalism

Comment

by u/Rtbrosk from discussion My transfer is not confirmed for 24h+.

in Bitcoin

- In our recent merchant survey, 59.3% of our merchants wanted more altcoin support

- Crypto E-commerce needs a payment network that is decentralized, stable, and usable. While the Bitcoin network is undoubtedly the most decentralized and stable, customers move to altcoins when it becomes congested like what happened in May 2023 when the fee skyrocketed to 30 USD, or when they need a less volatile crypto alternative [enter... stablecoins]

Need for Innovation

Everyone is aware of the technical/social/political complexities of getting anything done on the Bitcoin base layer. This definitely gives stability, however not doing any development opens the risk of Bitcoin becoming irrelevant.

Drivechain offers an alternative to our existing contentious and political process for changing Bitcoin. “Layer 1” rules never have to change, and new features are instead introduced by adding opt-in sidechains.

Future of Transaction Fee Economics

As of this writing, the block subsidy is 6.25 BTC (at around $23,600/BTC) and it will drop to 0.390625 BTC (a drop of around 94%) by 2040. We can’t expect users to be willing to pay transaction fees that are much higher than they are today, and in 2040 users are still very unlikely to pay much more than $1 or $2 (when adjusted for inflation) for a transaction.

So, to get a security budget in 2040 that is comparable to today’s security budget, either the bitcoin price will have to rise to around $350,000 (which would also make the Bitcoin network a 15-times more valuable target to attack) or the number of transactions will have to increase substantially.

Source: Nikita Chashchinskii in Bitcoin magazine

Drivchains will allow miners to collect fees from various sidechains via BIP301 without solely depending on block subsidy/mainchain transaction fee

Sidechains don’t create a new asset - SC:BTC maintains a 1:1 Rate

While even currently, users can easily convert Bitcoin to a stablecoin, this inherently comes with the risk of centralization / de-pegging.

Users can withdraw from Bitcoin to the sidechain and then back to Bitcoin without worrying that it will lose value.

Comments ()