Top Bitcoin Payment Processors — 2024

Explore the top Bitcoin payment processors of 2024 and streamline your cryptocurrency transactions with ease. Discover your ideal choice today!

The cryptocurrency market is seeing an influx of industries catering to the many clients who are embracing this digital revolution.

Bitcoin Payment processor is one such pivotal industry that has seen a lot of growth in the past few years especially since millions of crypto users are looking to pay for products using their digital coins, privately, and anonymously.

As a result, there have been numerous payment processors that have entered the space that offer their unique benefits to their users.

In this article, we will look at some of the top bitcoin payments gateways that are currently available to users along with some of the key parameters.

Table of Contents

- Centralized Versus Decentralized Payment Processors

- Overview of Payment Processor Versus Type of Organisation

- Top Payment Processors in 2024

- How to Choose the Right Payment Gateway

- Conclusion

Centralized Versus Decentralized Payment Processors

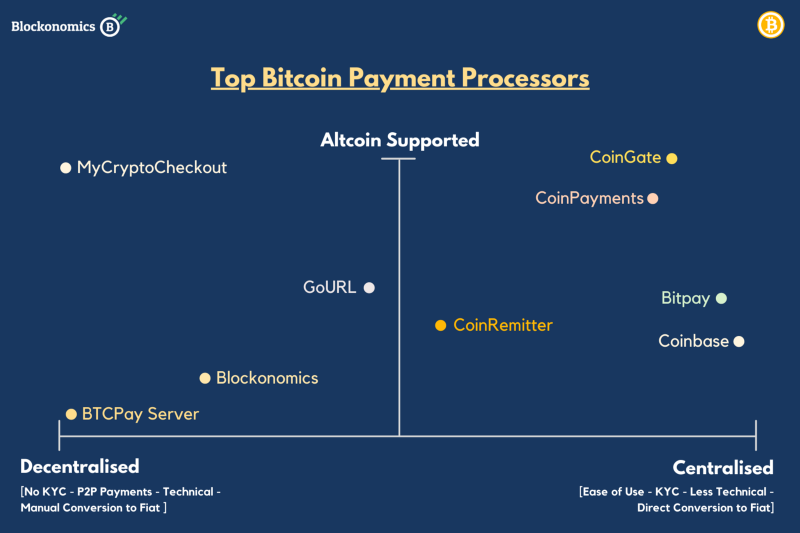

One key distinction between various payment processors is based on how decentralized they are, a characteristic that is inherent in the cryptocurrency ecosystem.

Decentralized Payment Gateways

Decentralized simply refers to the process of being free from central authoritative control. For a payment processor to be decentralized would mean:

- No identity verification — KYC/AML

- Non-custodial payments (payments are never in custody of a third party) — P2P [Peer-2-Peer]

- Slightly technical setup

- No fiat support

BTCPayServer, Blockonomics, MyCryptoCheckout fall in this category. With MyCryptocheckout offering an entirely decentralized experience along with the most altcoin support.

Centralized Payment Gateways

Centralized payment processors on the other hand offer a less technical setup but payments are usually held by third-party companies making them slightly risky.

Coinbase, BitPay, Coinpayments, Coingate, CoinRemitter are all categorized are centralized processors as they have access to user’s funds in some form or another.

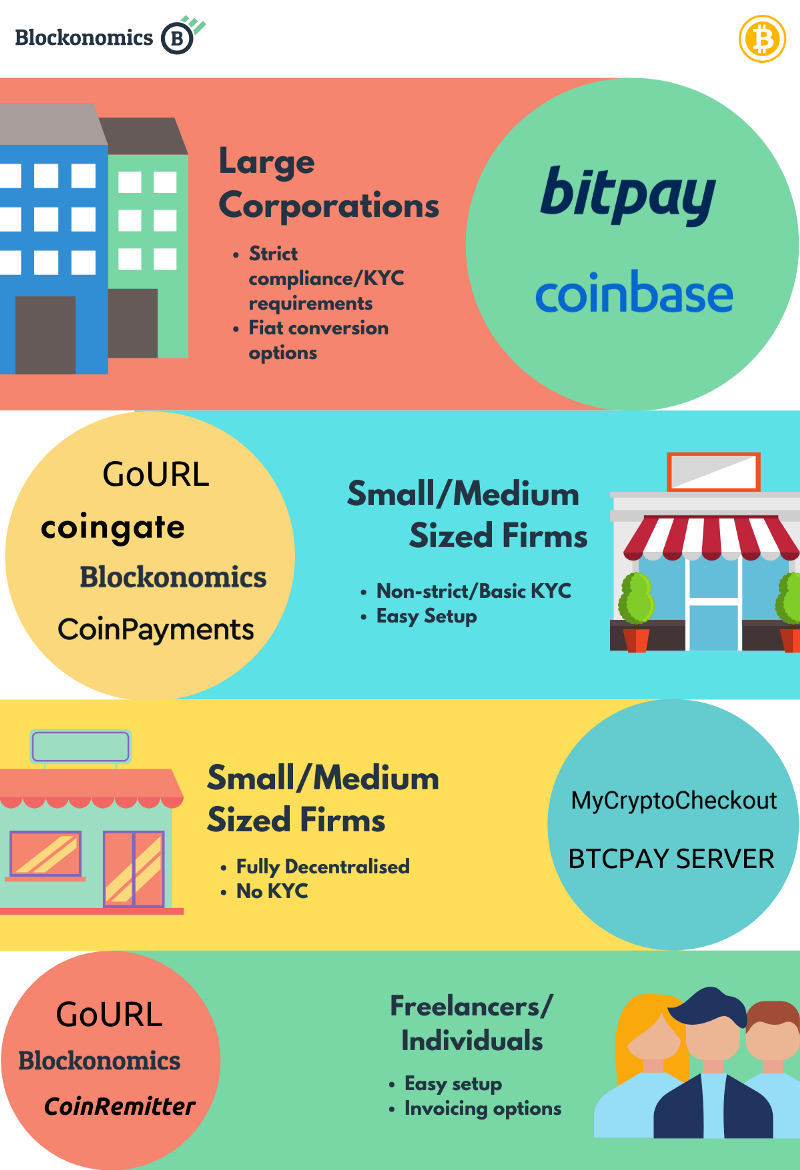

Such processors usually make for a good choice for larger corporations that need strict KYC/AML compliance to avoid any form of misuse or foul play, plus they offer direct fiat settlements to avoid crypto volatility.

Overview of Payment Processor Versus Type of Organisation

Companies that are looking for a decentralized experience with minimal account control are better suited for Blockonomics, BTCPay, GoURL, or MyCryptoCheckout.

From small/medium-sized firms that want to operate without any geopolitical restrictions to the many anonymous dealing in the dark web, all are well suited for these payment processors.

Top Payment Processors in 2024

Let’s have a look at each of these payment processors and their features individually:

GoURL

GoURL is a 100% open-source cryptocurrency payment gateway that allows merchants to accept crypto payments on their webstore.

They offer a WordPress Plugin and an API. For custom-made websites, GoURL offers API for various programming languages including PHP, JSON, C++, Java, etc.

→ KYC: No

→ Non-custodial: Yes

→ Fee: 1.5% for every transaction

Pros:

- 100% open source

- Direct-to-wallet

- Altcoin Support: BitcoinCash, BitcoinSV, Litecoin, Dash, Dogecoin, Speedcoin, Reddcoin, Potcoin, Feathercoin, Vertcoin, Peercoin, UniversalCurrency, MonetaryUnit

- Free Support

- Usage statistics

- Easy Setup

- Customizable payment gateways

Cons:

- Limited plugin options [only WordPress and API support]

- Technical knowledge needed for API integration and/or customization

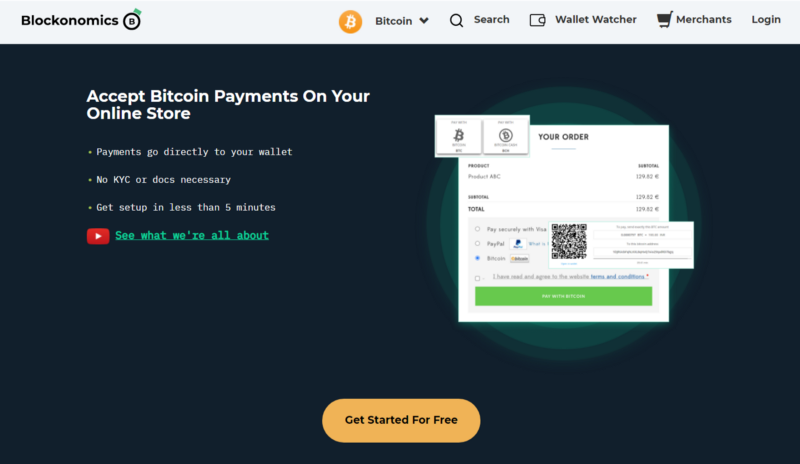

Blockonomics

Blockonomics is a cryptocurrency payment gateway that offers support for Bitcoin [BTC] and Bitcoin Cash [BCH].

For BTC payments, it offers plugin integration for WordPress, Prestashop, WHMCS, Wix, Squarespace, and a Payment API for custom implementation.

Its additional services include a blockchain explorer, BTC invoice, and a Wallet Watcher

→ KYC: No

→ Non-custodial: Yes

→ Fee: 1% for every transaction

Pros:

- Direct-to-wallet

- 24X7 customer support

- Quick and easy setup

- Embedded payment widget [No redirects — same page payment]

- Secure and Private

Cons:

- No customization for plugins

- Limited altcoin support: BCH

- Technical knowledge needed for API integration

BTCPay Server

BTCPay Server is a self-hosted, open-source cryptocurrency payment processor.

For BTC payments, it offers plugin integration for WordPress, Prestashop, Magento, Drupal, Custom Integration, and API.

→ KYC: No

→ Non-custodial: Yes

→ Fee: 0%

Pros:

- Open Source

- Direct-to-wallet

- Altcoin Support [External setup]

- 24X7 customer support

- Secure and Private

Cons:

- Personalized support is paid

- Integration is technical and requires expertise

MyCryptoCheckout

MyCryptoCheckout is a crypto payment plugin designed for WordPress. It's a Peer-2-Peer gateway that allows merchants to receive payment directly to their crypto wallets.

They support about 140+ altcoins in addition to bitcoin and boost a 0% transaction fee.

→ KYC: No

→ Non-custodial: Yes

→ Pricing:

- Free: 5 transactions per month

- Paid: $59/year — unlimited transactions

Pros:

- 140+ Altcoin support

- Easy Setup

- Fiat Autosetellments

- Embedded payment widget [No redirects — same page payment]

- Secure and Private

Cons:

- Only supports WordPress

- Limited Support

CoinRemitter

CoinRemitter is a Singapore global cryptocurrency payment processor/gateway service for online merchants who want to start accepting crypto coins as payment for their service or products.

In addition to their payment gateway, they offer a digital wallet, invoice generating, and coin swapping services.

Crypto payment plugins for eCommerce merchants are available for WordPress, Magento 2, Opencart, PrestaShop, Laravel, PHP, and REST APIs.

→ KYC: No

→ Non-custodial: No

→ Pricing:

- Free: 0.23% for crypto withdrawal

- Paid: $99.99/month + 0.23% for crypto withdrawal

Pros:

- Multiple plugin support

- Altcoin support: BCH, ETH, LTC, DOGE, TCN, DASH, USDT, BNB

- Secure and Private

Cons:

- Custodial payments

CoinPayments

One of the early names in the bitcoin payment gateway space, CoinPayments offers a cryptocurrency payment gateway and a multi-currency wallet.

They offer support for hundreds of cryptocurrencies and plugins for a variety of webstores making it one of the most comprehensive payment gateways in the market.

Additionally, they offer a POS interface, invoicing, and donation button.

→ KYC: Yes

→ Non-custodial: No

→ Pricing: 0.5%

Pros:

- Multiple plugin support

- 100+ altcoin support

- Secure and Private

Cons:

- Custodial payments

- Limited support options

CoinGate

CoinGate is a Lithuanian-based fintech company founded in 2014. This crypto payment gateway offers cryptocurrency payment processing services for businesses of any size.

Coingate provides support for multiple eCommerce CMS, including WooCommerce, Prestashop, Magento, WHMCS, OpenCart, and more, plus 100+ altcoin support.

They also offer merchant directory, gift cards, fiat buy/sell options.

→ KYC: Yes

→ Non-custodial: No

→ Pricing: 1%

Pros:

- Multiple plugin support

- 100+ altcoin support

- Secure and Private

- Lightning Network Support

Cons:

- Custodial payments

Tomapay

A relatively new crypto payment gateway, Tomapay allows customers to receive payments with zero fees. They offer multiple coin support and even allow stable coins such as USDT, USDC.

Tomapay offers plugin integration for WooCommerce plus API.

→ KYC: No

→ Non-custodial: Yes

→ Pricing: 0%

Pros:

- Easy Setup

- 50+ altcoin support

- Private

Cons:

- Less secure: Single BTC address used to receive payments

- Limited plugins

BitPay

One of the most popular names in the crypto payment space, Bitpay is perhaps one of the most used services when it comes to crypto payment e-commerce.

Established in 2011, Bitpay aims at providing customers with easy access to crypto with its innovative and user-friendly products.

They offer plugin support for almost every eCommerce CMS including, WordPress, Prestashop, Shopify, WHMCS, EDD, Magento, Drupal.

They have lately come under criticism for blocking certain funds resulting in the crypto community calling them a centralized organization.

→ KYC: Yes

→ Non-custodial: No

→ Pricing: 1%

Pros:

- Multiple plugin support

- Altcoin support: Bitcoin, Bitcoin Cash, Dogecoin, Ether, Gemini US Dollar, Circle USD Coin, Paxos Standard USD, Binance USD, Dai, Wrapped Bitcoin, and Ripple

- Secure and Private

- Fiat settlement support

- Lightning Network Support

Cons:

- Custodial payments

- Centralized company

- Non-anonymous

Coinbase

The biggest name in the crypto world, Coinbase has made its presence in almost every avenue, from wallets, to exchange to crypto payment gateway.

Based in Silicon Valley, Coinbase boasts millions of worldwide users and billions of dollars in revenue.

Due to its size, Coinbase has come under immense criticism for being yet another overtly centralized company and not really following cryptocurrency's vision.

Coinbase offers support for WooCommerce and Shopify and charges no fee for cryptocurrency payments.

→ KYC: Yes

→ Non-custodial: No

→ Pricing: Free

Pros:

- Altcoin support: ETH, DAI, LTC, BCH, USDC

- Secure and Private

- Fiat settlement support

- Lightning Network Support

Cons:

- Custodial payments

- Limited plugin support

- Centralized company

- Non-anonymous

How to Choose the Right Payment Gateway

Choosing the right payment processor for your company is a crucial decision that can impact your business's financial operations and customer satisfaction. It can impact your bottom line and customer satisfaction, so take the time to make an informed decision that suits your specific needs and goals. Here are the essential steps and factors to consider when making this important decision.

Identify Your Business Needs

The first step in choosing a payment processor is to identify your specific business needs. You can start by asking yourself questions like:

- What types of cryptocurrency will you accept?

- Do you need to accept international payments?

- What level of customization and branding do I need?

- What is the average transaction size and volume for your business?

- What is my budget for payment processing?

Understanding your unique requirements will help you narrow down the options and select a payment processor that aligns with your business goals.

Research Available Options

Once you have a clear understanding of your needs, it's time to research available payment processor options. Here are some ways to do that:

- Look for reputable payment processors that cater to businesses in your industry or niche.

- Ask for recommendations from industry peers, associations, or fellow business owners.

- Search online for reviews and ratings of payment processors to get an idea of their reputation and performance.

Compare Fees and Pricing Structures

Payment processing fees can vary significantly among providers. It's essential to have a clear understanding of the various fees involved, including:

- Transaction fees (percentage of each transaction or flat fee per transaction)

- Monthly fees (subscription or service fees)

- Setup fees (one-time costs for account activation)

- Chargeback fees (fees associated with disputed transactions)

- Currency conversion fees (if you deal with international payments)

Consider the pricing model that best suits your business, whether it's flat-rate pricing, or tiered pricing. Be vigilant for hidden fees or additional costs that may not be immediately apparent.

Check for Security and Compliance

Security is paramount when it comes to payment processing. Ensure that the payment processor you choose adheres to the required standards of compliance. Additionally, verify whether the processor offers robust fraud protection tools, data encryption measures, and two or multi-factor authentication.

Assess Integration Options

Your chosen payment processor should seamlessly integrate with your existing business infrastructure. Consider the following:

- Can the processor seamlessly integrate with your e-commerce platform, website, or point-of-sale system?

- Does it offer APIs or plugins for your preferred business software?

A smooth integration ensures efficient payment processing and a better overall experience for both you and your customers.

Evaluate Customer Support and Service

Excellent customer support can make a significant difference when dealing with payment processing issues or questions. Contact the provider's customer support to assess their responsiveness, helpfulness, and availability. Reading customer reviews can also provide insights into user satisfaction with the provider's support.

Review Contract Terms and Terms of Service

Before finalizing your choice, carefully review the contract terms and terms of service provided by the payment processor. Pay attention to:

- Any restrictions or limitations on your account.

- Cancellation fees if you decide to switch providers.

- The dispute resolution process in case of transaction disputes or conflicts.

Be cautious of long-term contracts that may lock you into a specific provider, especially if you're uncertain about their service.

Consider Scalability and Growth

Your business is likely to evolve and grow over time. Therefore, it's crucial to select a payment processor that can accommodate your growth without causing service disruptions. Ensure that the processor can handle increased transaction volumes and adapt to your changing needs.

Test the User Experience

Before making a final decision, set up test transactions to evaluate the user experience provided by the payment processor. Check if the checkout process is smooth, intuitive, and user-friendly. A cumbersome or confusing payment process can lead to cart abandonment and lost sales.

Negotiate Terms, if You Can

Don't be afraid to negotiate terms with the payment processor, especially if you have unique business needs or anticipate a high transaction volume. Many providers are willing to work with businesses to tailor their services to specific requirements.

Selecting the ideal payment processor for your company is a pivotal decision that can impact the efficiency and success of your financial operations. Remember that your chosen payment processor should not only meet your current requirements but also accommodate future growth and evolving payment trends.

With thorough research, careful consideration of fees and security, and a focus on providing a seamless customer experience, you'll be well-prepared to optimize your payment processing and enhance your business's financial health. Making this decision wisely can contribute to improved customer satisfaction, streamlined operations, and sustained growth in today's dynamic business landscape.

Conclusion

When it comes to choosing the right payment gateway there really isn’t a one size fits all approach, every business has its own sets of needs.

Various parameters such as centralized/decentralized, custodial/non-custodial, fiat conversion, altcoin support, pricing, plugins, all play a role in deciding the right cryptocurrency payment gateway for your company.

Top industry names include Coinbase and BitPay who have been around as long as bitcoin itself and have established a strong market presence but lack in providing a decentralized and anonymous experience to its customers.

Companies such as Coinremitter, Coingate, CoinPayments have managed to provide users with a user-friendly product with multiple plugin options and tons of altcoin support.

If you are looking for a decentralized and anonymous experience then go for BTCPay Server, Blockonomics, GoURL, or MyCryptocheckout.

If a non custodial, direct to wallet cryptocurrency payment gateway with an embedded payment widget is what you are looking for, you can get started with Blockonomics here.

Comments ()